Until the Last Money Printer Runs Out

Taking a look at Japan’s market impact and Hotter for Longer

Welcome to +24 new subscribers over the last 30 days.

If you are looking for unique investment ideas backed by interesting research, you have come to the right place.

I highly encourage newcomers to go back and read through our past 100+ newsletters since we launched Tuttle Ventures.

Packed with:

Our Most Popular Macro Views: Bonds Never Lie, Our Landmark Inflation Call

Investment Positioning: Investing Playbook, My Go to resource for ideas

Private Investments: SpaceX, Socket Security, Midtown National Group (MNG)

All available — in the archive for our subscribers.

Newsletter Rundown:

Stocks and Their Summer Retreat

Why Japan’s Actions Matter

The Bank of Japan's Dance with Inflation

Final Word

Stocks and Their Summer Retreat

Equity markets have retraced their steps, giving up the gains made over the summer.

This is bringing new meaning to the season of Fall.

In historical context, the selloff in the bond market was the leading story.

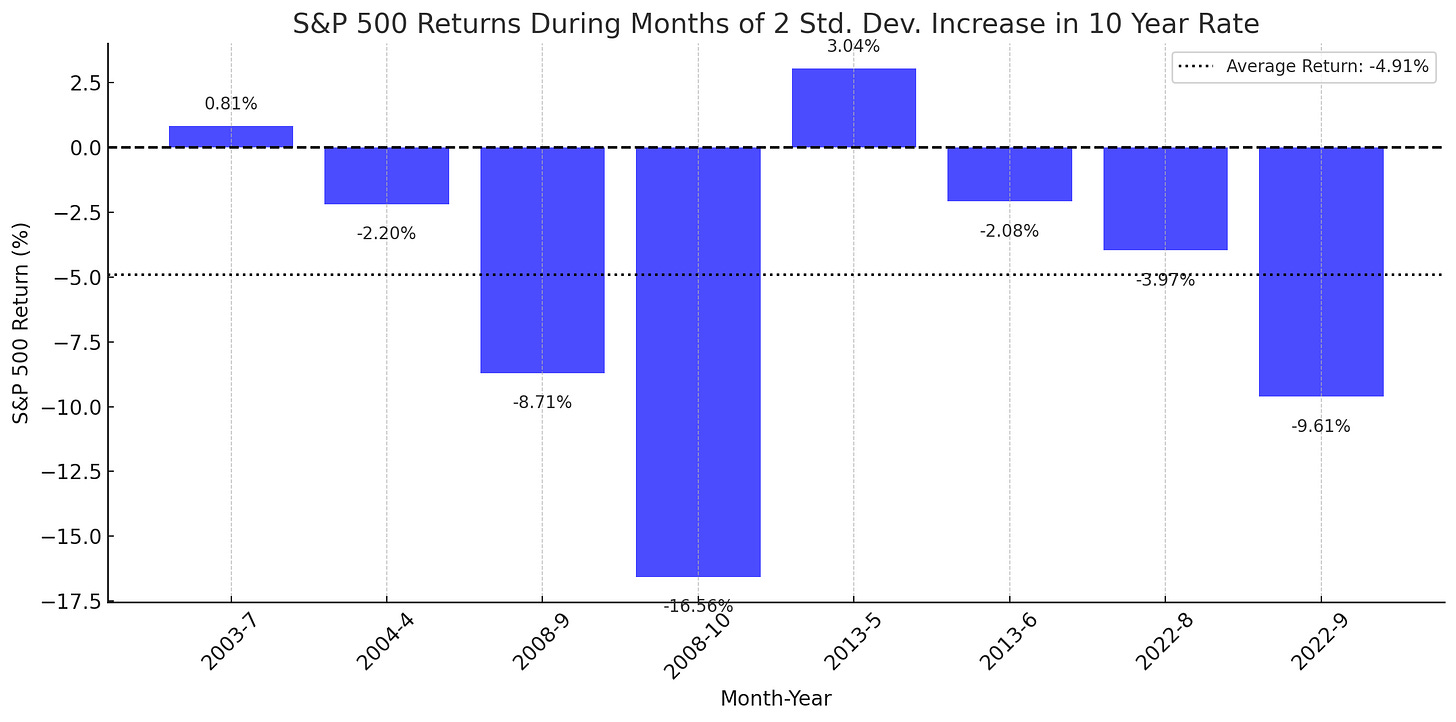

The S&P 500 typically registers a 4% dip when Treasury yields surge by 2 standard deviations within a month.

During periods of significant, abrupt increases in the 10-Year Real Treasury Rate (more than 2 standard deviations), the S&P 500 has generally experienced negative returns, with some months seeing substantial declines.

From the chart, we can observe that there have been three instances (September and October 2008, May and June 2013, and August and September 2022) where there were back-to-back months of large yield increases.

Thus, it's relatively common (75% of the time over the last 20 years) for large yield increases to happen in back-to-back months.

To stack the odds in our favor in November, we are holding off on buying bonds in the near term.

This is short term pain, but long term (income) gains as rates increase.

For equities, we are short term bullish, at least until the last money printer (Japan) runs out.

Let me explain.

Why Japan's Actions Matter

Japan's actions hold significant sway in global markets due to their substantial economic footprint and unique monetary policies.

The Bank of Japan is the worlds money printer.

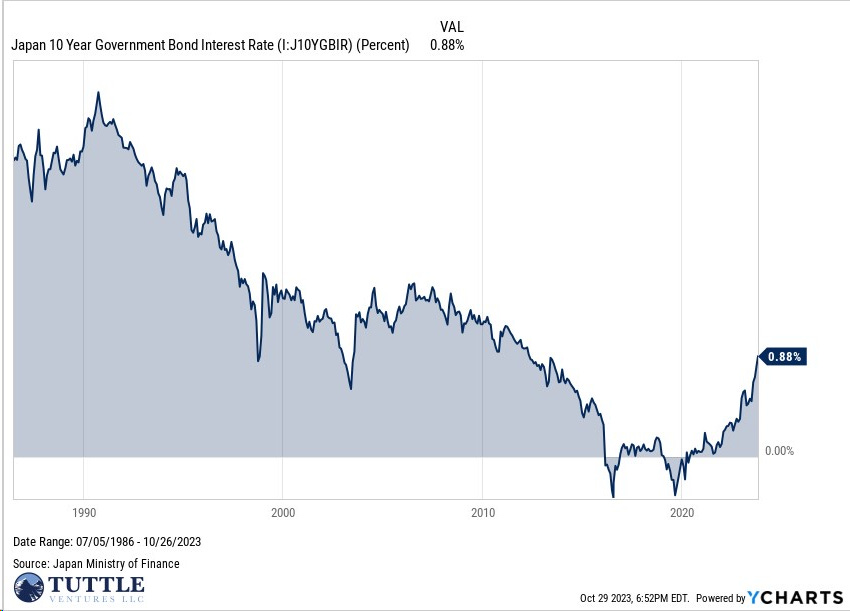

This is because Japan has experienced ultra-low interest rates for decades.

In the 2010s and early 2020s, the U.S. Federal Reserve and the Bank of Japan adopted diverging monetary policies. While the U.S. began tightening monetary policy and raising interest rates (albeit slowly) after the financial crisis, the Bank of Japan pursued aggressive monetary easing, including negative interest rates.

We don’t really know what the limit is for the money printing machine.

I wrote about this back in May 2023 in my post: Navigating Inflation and Yield Curve Control: Implications for U.S. and Japanese Equities.

In the 1990s, in response to the burst of the asset price bubble and ensuing economic challenges, the BoJ cut its policy interest rates to near-zero levels.

These low rates have persisted for years and allow speculators to borrow money cheaply.

In the US, we have allowed inflation to run above target as part of the Flexible Average Inflation Targeting (FAIT) policy under Powell, which seeks to achieve inflation that averages 2% over time and allows inflation to overshoot after a period of undershooting, more firmly anchoring inflation at a 2% objective.

Now that interest rates have risen in the US, is it time for Japan to follow?

With the USD/JPY breaking 150, we could be nearing the limit on the money printing machine.

As you can see in the chart below, 150 is forming a double top…

Changes in interest rates influence currency exchange rates.

A weaker yen makes US assets more expensive for Japanese investors, potentially affecting the flow of Japanese investment into the US stock market.

While in the long term we think Japan is reaching its upper limit, we think the policy will hold until December as Japan’s desire for the US stock market has not been as pronounced compared to past years.

This would fall in line with the flexible target that the US has used in the past.

The Bank of Japan's Dance with Inflation

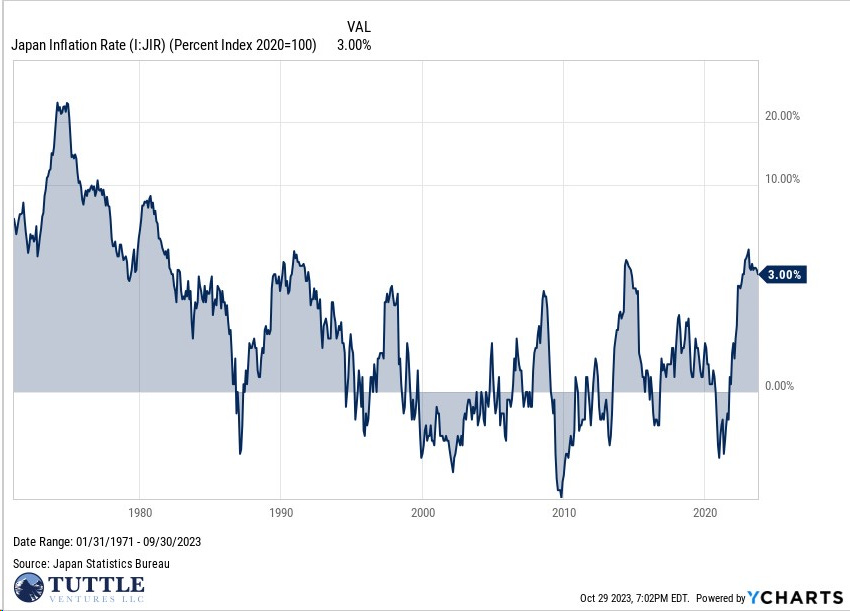

Historically, the Bank of Japan (BoJ) hasn't shied away from revising its inflation target.

This could keep the money printer going.

Today Japan’s inflation target is 2%, while inflation is running hot than expected at 3%…

Do we think it’s possible that the BOJ allows for inflation to stay above their target for an extended period of time?

Yes.

A prominent example of this is January 2013.

After nearly two decades of wrestling with deflation, the BoJ, in collaboration with the Japanese government, set a new ambitious inflation target: a 2% inflation target.

This move was a pillar of "Abenomics", a tri-pronged strategy named after Prime Minister Shinzo Abe, aiming to invigorate the Japanese economy.

Despite the aggressive stance, it has taken 10 years to reach the 2% target.

Even with a proactive and forceful policy approach, a decade is a long time to wait.

Economies, by nature, possess inertia. This means they tend to resist rapid changes, and once set on a particular course, they often maintain that trajectory due to various entrenched factors like labor, exports, and seasonal cycles.

Now that we are at this level, we believe a hotter than expected inflation will need to be persistently high before a change in policy is warranted.

(Hotter for Longer)

Final Word

Thank you for reading and I am grateful and humbled to be able to learn, grow, and invest alongside you at Tuttle Ventures.

Vision, Courage, and Patience leads to successful investing.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn, or Instagram.

Check out the website or some other work here.

Best,

Darin Tuttle, CFA

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.

Hotter for longer. I'll take it!