Navigating Inflation and Yield Curve Control: Implications for U.S. and Japanese Equities

Actionable market Insights from Darin Tuttle

Welcome to +55 new subscribers over the last month.

This week I got the chance to work from Sofi Stadium with David Meltzer. 🏟️

We swapped stories on sports, business and investing.

Dave’s ⚡️energy and 🧠 positive mindset is contagious —we are excited about upcoming ventures deals coming down the pipeline — stay tuned!

This week we hosted a private event for paying subscribers. Erik Sexton and Powell Chee shared their insights on the commercial real estate market.

You can catch the audio replay here:

Newsletter rundown:

Transmitting Inflation to Japan via the U.S. Dollar

Ok, So what?

Final Word

Transmitting Inflation to Japan via the U.S. Dollar

Rates and inflation can completely change the investing backdrop in ways that are not always predictable.

Letting history be our guide, I continue to be obsessed with Japan (both past and present) as the most relevant playbook for what the US is experiencing today.

Here’s one of our many twitter threads on the subject.

The BOJ (Bank of Japan) through its manipulation of interest rates, led to the creation of an economic bubble in the late 1980s. When the bubble burst, it resulted in a prolonged period of economic stagnation known as the "Lost Decade."

But that’s not all.

Current BOJ policy correlates with the likelihood of the US successfully navigating a soft landing.

Let me explain.

"Princes of the Yen" is a book written by economist and professor Richard Werner.

In it, Werner explains the BOJ's practice of "window guidance," a system through which the central bank indirectly controlled the lending activities of commercial banks. This allowed the BOJ to manipulate credit creation and direct funds to preferred sectors, fueling economic growth.

This sounds like the same song and dance the Fed is currently singing, requiring banks to tighten credit conditions…. or else.

In a balance sheet recession, GDP declines by the amount of debt repayment and un-borrowed individual savings, leaving government stimulus spending as the primary remedy.

I liked it best when banks used to actually lend money and the Fed was the lender of last resort.

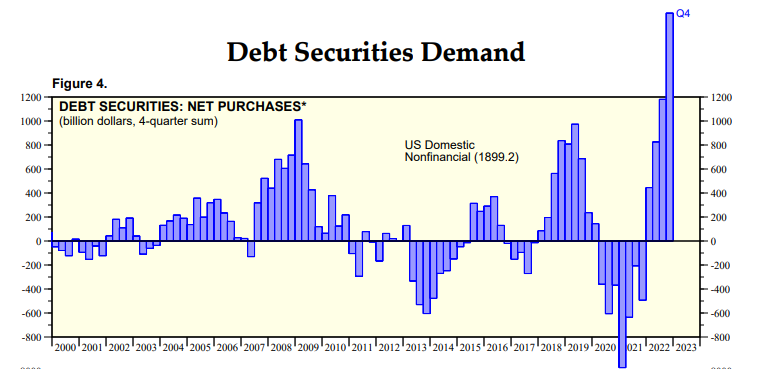

US Banks are quickly becoming treasury holding zombie companies just like Japan.

Full twitter thread here.

How can US banks grow out of zombie status when they are stuffed full of US Treasuries?

Eventually, many of these failing firms become unsustainable, and a wave of consolidation takes place.

Only the strongest banks will survive.

Ok, so what?

This isn’t macrobabble.

Even under an ‘ample reserve’ regime, watch the action on the US dollar.

The crux of the matter lies in watching the U.S. dollar and the weakening yen.

A weakening yen relative to the US dollar will be bullish for both US and Japan equities. (RBC agrees too)

We believe as long as Japan has the capacity to attract foreign investment and execute Yield Curve Control (YCC), a soft landing in the US is possible.

Buffett also knows this, which is why it was one of main points he made in Omaha this week. (Warren Buffett says 'we're not done' investing in Japan)

However, if the BOJ's policy changes, it could lead to a hard landing in the U.S., rising global yields, and a surging yen. The pressure is on, and we will be closely monitoring bond yields and BOJ policies.

Final Word

We're grateful for the opportunity to learn, grow, and invest alongside you at Tuttle Ventures.

If you'd like to discuss your portfolio, please schedule a time below:

Book a meeting with Darin Tuttle

Best regards,

This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.