My go-to resource for investment ideas

3 reasons why you should be using the Good Judgement Open website

As someone who loves learning about all things investing, I am constantly reading articles, combing financial statements, watching documentaries, and talking to experts in various fields.

My friends are often curious about where I discover information.

When it comes to finding good investment ideas, I have a handful of go-to resources.

One of my favorite lesser-known resources is the Good Judgement Open Website.

For years I’ve spent hundreds of hours on the site creating a formalized process to make investment decisions.

We have found the site to be accurate, reliable, and consistently relative to our work.

About GJ Open

GJ Open is a crowd forecasting site where people can hone their forecasting skills, learn about the world, and engage with other forecasters. On GJ Open, people can make forecasts about the likelihood of future events and learn how accurate they were and how their accuracy compares with the crowd.

The best part is, you don’t even have to be great at forecasting to extract tremendous amounts of insights yourself.

Wisdom of the Crowd

GJ Open taps into the Wisdom of the Crowd.

The wisdom of the crowd is the collective opinion of a diverse independent group of individuals rather than that of a single expert.

People on the site come from a variety of backgrounds and expertise— from aerospace defense consultants to librarians.

The diversify of backgrounds means you get a diversify of thought. Unlike most prediction markets and other forecasting sites, this is not just for day traders or financial professionals.

3 ways you can get the most out of GJ Open

All of this is meaningless, unless you leverage what is available on the site to your advantage.

An investor can get the most out of the site by: following the top leaderboards, reading forecasting commentary and analyzing the questions themselves.

Follow the top forecaster leaderboards

As someone who wants to stay ahead of the game, it's always great to follow the top forecasters on GJ Open. Not only do they have a proven track record of success, but they often share their rationale on any particular question.

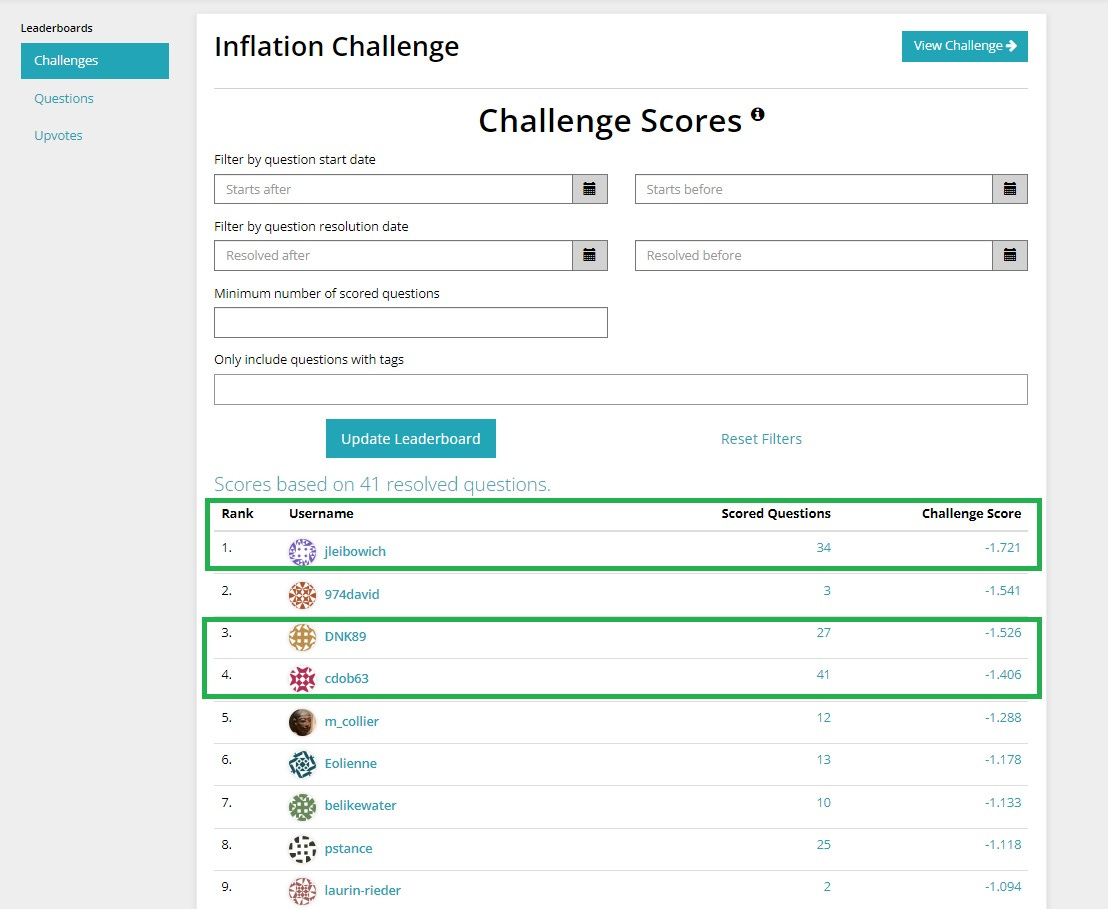

Here’s an example of the Inflation Challenge leaderboard.

You can filter the leaderboard to find a robust set of answered and scored questions.

I focus on the the lowest “Challenge Score” brier scores. (Lower is better)

A brier score is a way to verify the accuracy of a probability forecast. I believe if more people on TV were quantitatively measured, I would probably start tuning in again.

For those interested, here is how a standard brier score is calculated:

The GJ Open uses a modified Brier score methodology which has evolved over time and can apply to a range of outcomes instead of just binary outcomes.

I like the newest version because:

the score rewards accurate forecasters vs. the median consensus forecaster

the score emphasis how early a correct prediction is made (and allows multiple forecasts to be updated over time)

The people at the top of the leaderboard are really good at what they do.

Over the years, I have gone out of my way to engage with these people, following them on social media or meeting them in a setting outside of GJ Open.

It’s a way for me to get to know these people better and understand where they are coming from.

The best ones on the leaderboard usually get recruited to join The Swift Centre which is an organization that includes the top performing superforecasters from the US Government IARPA Good Judgment Project, elite performers from Metaculus, and Foretell.

Read the most upvoted commentary and research links

People sometimes share their reasoning along with their forecasts.

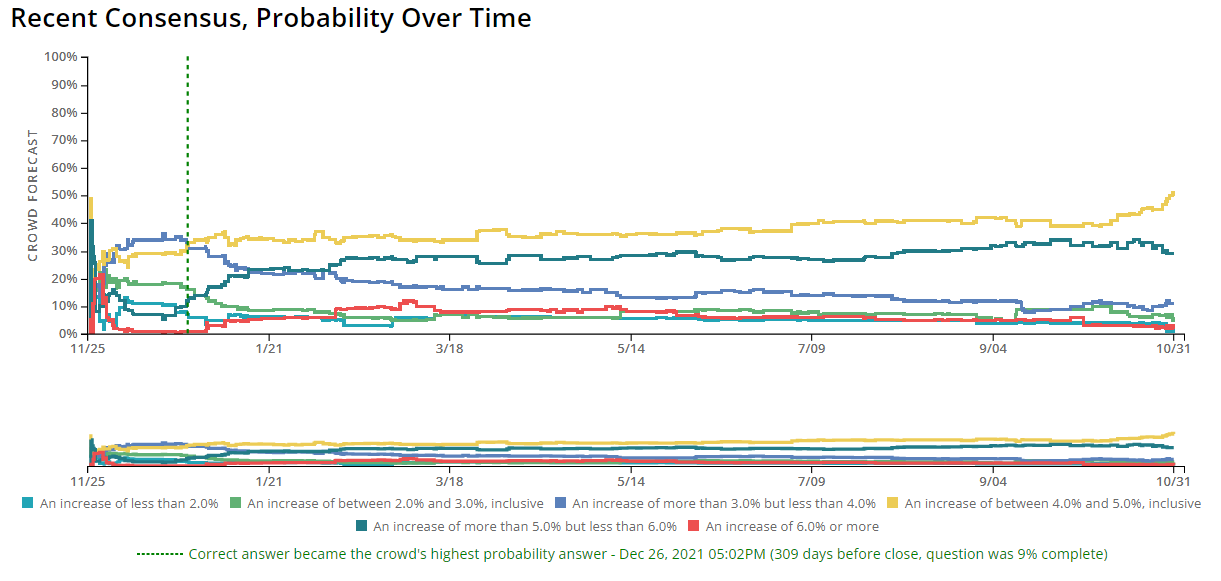

Here is an example of one forecast with above average rationale related to an average hourly earnings forecasts made in December 2021:

In the example above, you get an inside view on how this forecaster thinks and what information they consider relevant.

The baseline estimate is given along with a quality analysis on the reasons why that baseline estimate could be wrong in plain language.

This approach is straightforward and easier to read for me compared to most sell side research.

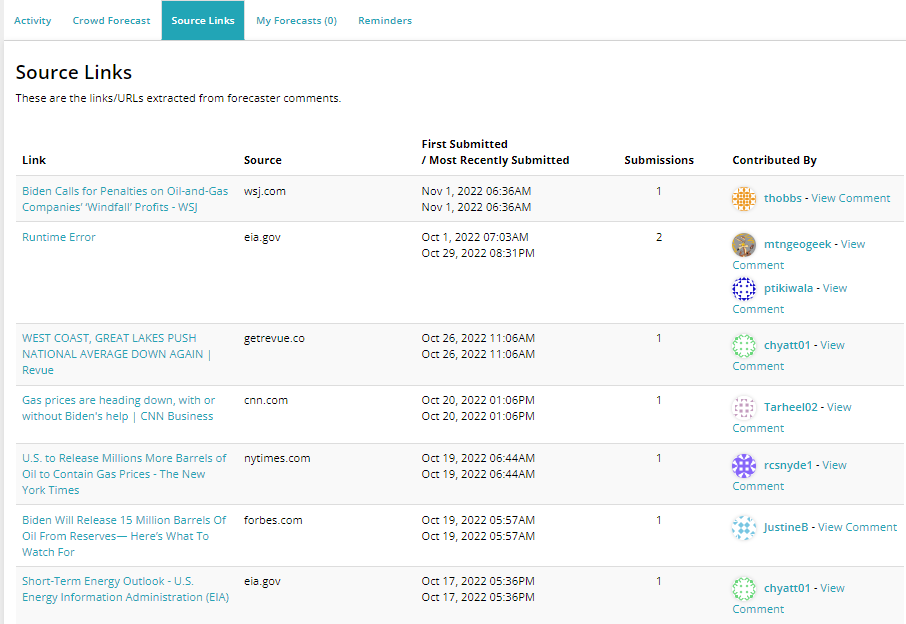

Another really helpful tool is the source link section.

This section lists all of the URLs extracted from other forecaster comments. This is a great way to find quality research articles especially when you don’t know where to start.

The Question is the Answer

Have you ever noticed that the way a question is phrased can give you insight into what the asker is thinking?

For example, take the question "Will there be a railroad union strike in the US in 2022?" This could suggest that railroad companies could be in trouble or have a negative perception of current labor conditions. Not only do you get the question but also a best educated guess at any point in time. What if this type of risk was not even considered on the radar for the average industrial stock analysts?

Questions can also reveal bias or assumptions, such as asking "Will the UK or EU trigger Article 16 of the Northern Ireland Protocol before 1 December 2022?". I can honestly say I have no idea what they are talking about, but now there is something that is worth taking a closer look at. The geopolitical framework of a specific event can often be triggered by legislation discussed above.

Being aware of how questions are worded can help us better understand others' perspectives and challenge any harmful beliefs or attitudes.

The next time someone asks you a question, pay attention to their wording – it may tell you more than just their words themselves.

Final Word

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Vision, Courage and Patience leads to successful investing.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn or Instagram.

Check out the website or some other work here.

Best,

Darin Tuttle, CFA

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.

Interesting-looking resource, thank you!

Very cool. Thanks for sharing Darin!