What happens when the RRP hits 0 next year?

Higher Taxes and Rate Cuts heading into the new year.

Welcome to the +21 new subscribers who joined us over the last 30 days.

If you are looking for unique investment ideas backed by interesting research, you have come to the right place.

I encourage newcomers to go back and read through our past 100+ newsletters.

Packed with:

Our Most Popular Macro Views: Bonds Never Lie, Our Landmark Inflation Call

Investment Positioning: Investing Playbook, My Go to resource for ideas

All available — in the archive for subscribers.

Newsletter Rundown:

Markets to Grind Higher

What happens when the RRP hits 0 next year?

Final Word

Our latest model suggests that the market will grind higher.

This is based on the continued drawdown in Reverse Repo which is scheduled to deplete by April of next year.

The major objective of the repo market is to provide consistent liquidity to financial players on a daily basis.

After the banking crisis in March, market participants have transferred overnight funding released by the Federal Reserve into leveraged long duration stock market purchases.

The ample supply of treasury bills has allowed this to continue on schedule.

This analysis would conservatively suggest a range of 480 to 490 for the $SPY closing level by the end of April.

Factors that might shift these optimistic (bullish) assumptions to pessimistic (bearish) include:

Larger than expected buildup in the Treasury General Account

Sharp drop in available treasury issuance

Forced deleveraging by a major market speculator

Restrictive shift in policy from the Bank of Japan to combat inflation

We believe the likelihood of one of these happening over the next few months is low.

During Powell's recent press conference, it became evident that his focus on price stability pertains to the rise in stock market prices, rather than controlling inflation in goods and services.

What happens when the RRP hits 0 next year?

I have no real idea what options are on the table.

Given that it's an election year, I believe the central bank might resort to unprecedented, extreme measures, without limitations, to maintain accommodative financial conditions.

A key factor could be tax receipts in April.

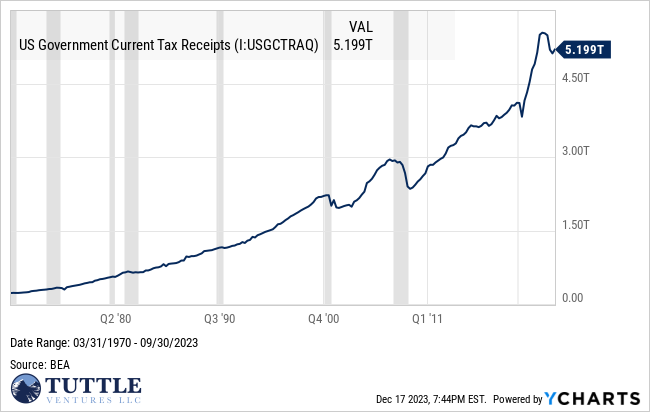

Every instance of a decrease in U.S. current tax receipts has been accompanied by a recession (indicated by grey shading).

A report from the White House, released back in October and titled “Federal Revenues After the 2017 Tax Cuts,” attributes the deficit to the last round of tax cuts.

“…estimates from the Congressional Budget Office suggest that a decline in major tax revenues was the largest driver of the increase in the deficit from 2022 to 2023.”

Could the solution to government deficits simply be higher taxes and interest rate cuts?

Logically it would justify why the market could price in cuts without a known major crisis.

Obviously, it's not that simple.

The relationship between tax receipts and interest rate cuts is a complex one and involves various economic factors and policy decisions.

That being said, a decline in tax receipts would provide Powell with the political justification to lower interest rates, regardless of the level of inflation or unemployment.

My guess is if tax receipts are lower than anticipated, it might lead to a 0.25% reduction in interest rates. On the other hand, if the receipts exceed expectations, interest rates are likely to remain the same.

The anticipation of lower tax receipts potentially leading to a modest rate cut seems like the most likely outcome to continue to be accommodative.

As we navigate these evolving conditions, it's crucial to stay informed and agile while balancing long term investing goals.

Final Word

Thank you for reading and I am grateful and humbled to be able to learn, grow, and invest alongside you at Tuttle Ventures.

Vision, Courage, and Patience lead to successful investing.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn, or Instagram.

Check out the website or some other work here.

Best,

Darin Tuttle, CFA

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.