[Part 2] Is there anything that could slow down the Nvidia momentum?

New all-time highs. China goes "all in" on Nvidia.

Welcome to the +70 new subscribers who signed up over the last 30 days.

If you are looking for unique investment ideas backed by interesting research, you have come to the right place.

All the focus has been on NVDA 0.00%↑ .

Last month, I was on Schwab network explaining why I believed the stock could go higher despite already high valuations.

You can rewatch the segment here:

I distinctly recall questioning my sanity amidst the segment, given the staggering price levels. The initial $600 price target has been nothing but a speedbump on the road to $778.

I mentioned inventory levels were the key figure to watch, since I believed Nvidia was deliberately keeping supply low and prices high due to high demand.

I was wrong.

According to the latest earnings report, inventory levels are not what is driving the stock higher.

So what’s really going on here?

There are two driving forces: geopolitical and fundamental.

Geopolitical

The national security interests of artificial intelligence are at a critical point.

Information asymmetry and social media require artificial intelligence to play in the forefront of innovation and progress.

Since Nvidia is clearly the leader of the GPU architecture, China has a vested interest to invest.

The problem is China can’t order the chips themselves, but they can bid up the stock.

As I wrote in Part 1:

It’s my opinion that CEO Jen-Hsun "Jensen" Huang is the best avenue for China investment into the US chips market.

The funding of the CHIPS act comes with geographical restrictions, prohibiting recipients from expanding semiconductor manufacturing in China or countries posing a threat to U.S. national security.

This unconventional approach highlights China's determination to circumvent exclusions, effectively 'buying the house' to gain entry.

Index providers initially provided an open door for this investment.

As I wrote in: A New Era in Global Investing: National Security, there is a conflict of interest inherent with global asset gathers.

For the last few months, as China’s stock market has faced issues, the temperature has been turned up.

Now it’s the only game in town.

China is “all-in”.

When investing in stocks, it's essential to be aware of the risks involved. (Market, Liquidity, Systemic, Company-Specific and various others).

Goldman's risk control team is likely in turmoil.

Taking a far and balanced approach by investing in this company is difficult given the unpredictable nature of the stock price.

At this point, I believe the market will not reprice Nvidia lower.

The greatest risk is regulatory.

The original strategy to limit China's access to chips is failing.

One option is if the U.S. Government considers new restrictions.

If the US government came out and said that China could no longer invest in Nvidia it would not only be illegal but financial market suicide.

I believe one option to consider is to take the same approach to the chips arms war as the soviet nuclear war of old and simply outspend our adversaries.

Manufacturing is so costly that Sam Altman of OpenAI estimates it would take $7 trillion dollars to build and maintain global manufacturing capabilities.

Initially, the $7 trillion figure seems absurd, but it appears Sam is deliberately trolling.

This amount matches exactly what the U.S. printed during the 2020 COVID-19 shutdown.

If the U.S. can allocate $7 trillion for vaccines and safety measures, why hesitate to invest equally in artificial intelligence?

According to the National Bureau of Economic Research, the COVID-19 induced economic shutdown was $7 trillion, or about $15,000 per household, per quarter. Source.

If the U.S. can allocate $7 trillion for vaccines and safety measures, why hesitate to invest equally in artificial intelligence?

The stakes are high, and with China's aggressive tactics and the potential for regulatory intervention, the U.S. faces a critical juncture.

Investing heavily, akin to the strategy during the Cold War, may well be the necessary course to outpace our adversaries and secure a technological edge.

Fundamental

As I outlined in Part 1, there is a fundamental winning business model in Nvidia.

Historically asset-light semiconductor companies, outperform asset-intensive ones.

Advanced semiconductor chips involve a series of highly sophisticated and precise steps, combining state-of-the-art technology, materials science, and engineering expertise.

Inferencing, in the context of artificial intelligence (AI) refers to the process of using a trained model to make predictions or decisions based on new, unseen data.

Inferencing used to be all CPUs/TPUs.

Now its big API-as-a Service on GPUs.

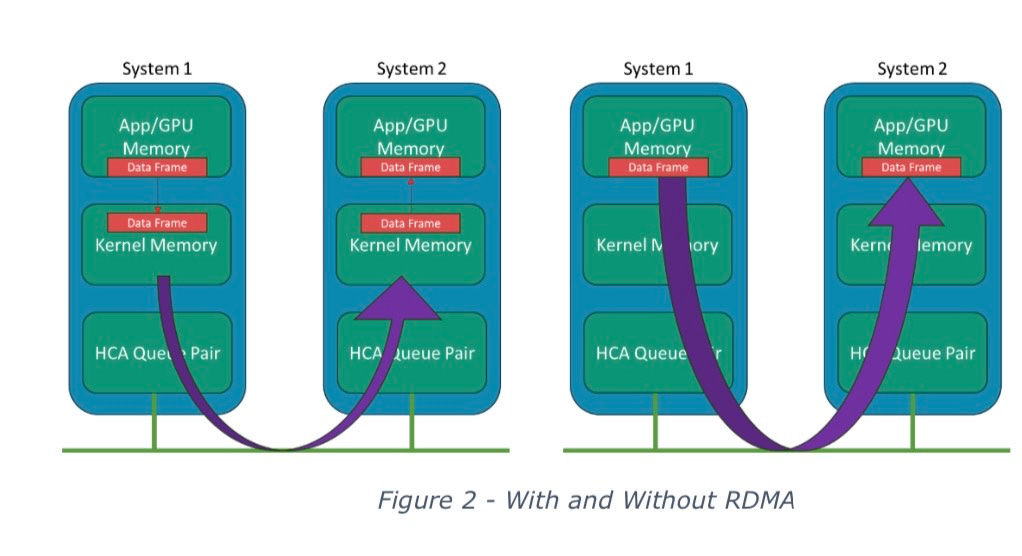

This is based on the Remote Direct Memory Access (RDMA) that can bypass kernel data structures. In modern AI systems, the “application” points to the GPU systems’ memory space, bypassing kernel memory. This creates a system with many GPU’s.

Microsoft has publicly stated that all Azure AI workloads are basically inference.

The key issue is whether the model and architecture can keep up with advancements in hardware and manufacturing.

This is something we will continue to monitor for our readers.

Best,

Darin Tuttle, CFA

This is not investment advice. Do your own due diligence. Investors are encouraged to perform due diligence, consider their risk tolerance, investment goals, and consult with financial advisors before making investment decisions. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.

Hi Darin...Sorry for the noob questions. Can you please explain this again?

How is China investing in NVDA? How is China "buying the house"? What role do indexes or ETFs play in this?

Thanks

"It’s my opinion that CEO Jen-Hsun "Jensen" Huang is the best avenue for China investment into the US chips market.

This unconventional approach highlights China's determination to circumvent exclusions, effectively 'buying the house' to gain entry.

Index providers initially provided an open door for this investment."