Up to $50m in FDIC Insured Deposits?

Actionable Market Insights from Tuttle Ventures

Welcome to +305 new subscribers over the last 90 days!

If you are looking for unique investment ideas backed by interesting research, you have come to the right place.

Newsletter rundown:

Silicon Valley Bank

Safety, Liquidity, Yield

Final Word

Silicon Valley Bank

Silicon Valley Bank had $42B in withdrawals in under 24 hours.

On Friday, California regulators closed the Bank and sent it into receivership.

This means bank accounts are now frozen and the FDIC will start the process of paying out funds to cover FDIC insured deposits.

As a fiduciary for our clients, we have been prepared for this type of event to occur.

I highly encourage everyone to go back and read Safety, Liquidity, and Yield, which I wrote back in December 2022.

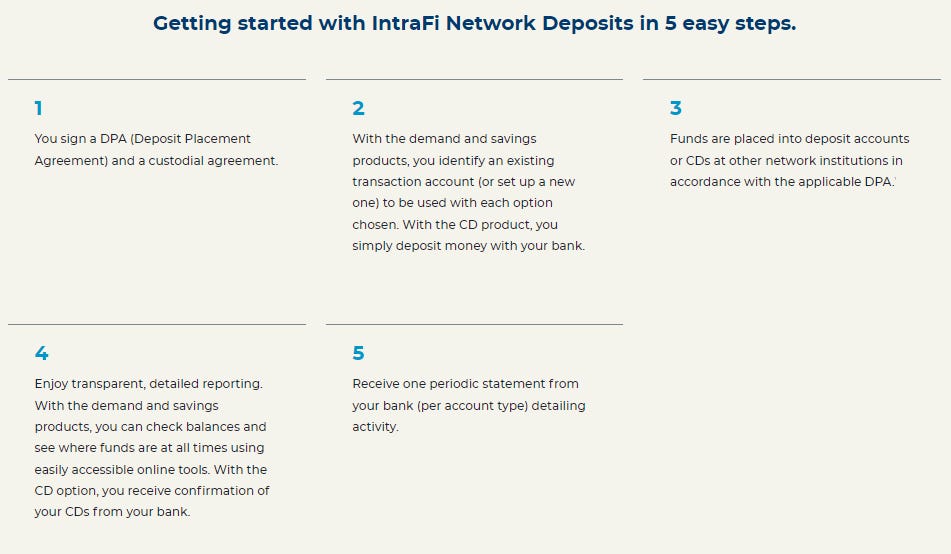

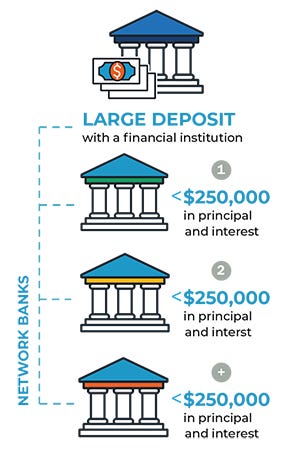

In the post, I clearly outline the importance of FDIC cash insured deposits and a cash secured strategy that allows a joint account holder up to $50MM in FDIC cash insured deposits beyond the $250k limit through the IntraFi network.

In the post I explain:

According to the FDIC’s own website, no depositor “has ever lost a penny of insured deposits since the FDIC was created”.

FDIC insurance is available above the standard $250,000 limit for investors who deposit with banks on the IntraFi network and sign a Deposit Placement Agreement.

The IntraFi network ensures deposits are maintained in different categories of legal ownership at the same bank — each separately insured.

-Tuttle Ventures Newsletter: Safety, Liquidity, Yield December 2022

At the time, some readers told me the post felt out of the place to my usual posts and “out of touch”.

As more news comes out about Silicon Valley Bank, I want you to pay attention to the difference between insured deposits and uninsured deposits.

Some investors will have to painfully learn what we already know.

The reason I spent the time back in December to find a secure cash strategy was because it was a big issue for one of clients.

I had a client who had money held at traditional bank, above the $250k FDIC limit, did not want to hold cash across multiple banks, and wanted yields comparable to U.S. treasuries.

Customers who use IntraFi Deposits are able to keep an account at one local bank (rather than at many banks across the network).

You can access multi-million-dollar FDIC protection through a single bank relationship.

Again from December’s post:

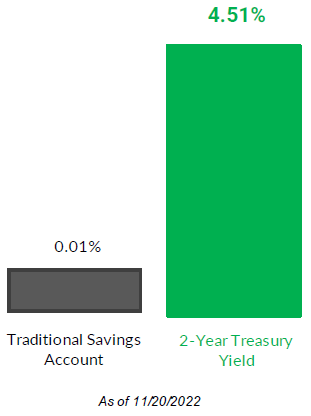

As an investor, you have to be your own advocate on cash because the banks will not guarantee you get a competitive yield on your deposits.

A conservative investor who takes the time to find competitive yield options can find 3.50% to 4.50% available in the market based on current interest rate levels.

With costs rising much faster, it might be time to rethink your cash strategy.

-Tuttle Ventures Newsletter: Safety, Liquidity, Yield December 2022

I put in hours of research to find a suitable alternative with the best team available.

Mark Jacobsen, founder of IntraFi, is a former chief of staff of the FDIC and inventor of 13 patents related to IntraFi's FDIC-insured deposit placement services.

I’m proud to say that I am a preferred advisor partner on the IntraFi network for those looking for safety, liquidity and yield.

In a matter of minutes, my clients can get the peace of mind knowing their deposits above $250k are safe.

If you’re interested in learning more about how you can get up to $50MM in FDIC insured cash deposits, I recommend scheduling a conversation.

Book a meeting with Darin Tuttle

Safety, Liquidity, Yield

The FDIC will also facilitate the sale of the bank, through an auction process, to a new owner.

Its important to understand that the process of dealing with insured deposits, uninsured deposits, and the sale of the bank holding company are all three distinct processes.

Each follows their own completely different set of rules.

During the sale, the FDIC has discretion to pay on uninsured deposits above the traditional cap limit. This exemption is given in the law for insured depository institutions that are in default.

There is no “bailout” for insured depositors. The rules for dealing with insured cash deposits is clearly outlined over the last 90 years. These deposits will be paid in full in a relatively short amount of time in cash. (Most likely in the next days or weeks)

My bet is you will hear a lot in the news about uninsured deposits.

Uninsured deposits do not have the same FDIC guarantee and will be at the discretion of the government on whether they will be paid out.

This uncertainty could place a strain on markets in the short term.

We are unsure if recent developments will cause the Fed to no longer hike interest rates. (That is the million dollar question).

Longer term, we do not believe Silicon Valley Bank is a systemic risk and continue to invest in capital markets with secure cash solutions for our clients.

Final Word

I was on The Long Game Podcast.

In this episode we talk about:

the current state of the market

whether international should be a portfolio or not

tax location and asset allocation

how to view long term investing

Checkout the link below >

Your Investing Questions Answered with Darin Tuttle

I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Vision, Courage and Patience leads to successful investing.

Best,

Darin Tuttle, CFA

This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.

Haha, I would be delighted if I needed up to 50mm in deposit protection! 😆

Re: safety and yield, my advisor turned me onto USFR to capture yield from raising rates. I guess it's not quite as good as the backwards-looking short term treasury strategies once the Fed does finally reverse course, but I tend to think the market has been and continues to be overly optimistic on taming inflation and the Fed's willingness to reverse course with stocks and the labor market doing so well. 🤷