Safety, Liquidity, Yield

Today is all about returns on cash at Tuttle Ventures

Welcome to +95 new subscribers this week & +369 over the last 90 days!

If you are looking for unique investment ideas backed by interesting research, you have come to the right place.

I highly encourage newcomers to go back and read through the past 60+ newsletters since we launched Tuttle Ventures.

Packed with:

Our Most Popular Macro Views: Bonds Never Lie, Our Landmark Inflation Call

Investment Positioning: Investing Playbook, Portfolio Updates

Private Equity: Boxabl, Midtown National Group (MNG)

All available — in the archive for our subscribers.

It was a busy week, so I’ll keep this short.

If you want to:

Watch the TV rebroadcast on Morning Trade Live

See our notes from Singular Research's 17th Annual Best of the Uncovered Investor Conference

Review our Research project in collaboration with the Richmond Federal Reserve

Keep up with Portfolio Updates

I’ll save those for separate posts.

Today is all about returns on cash

Safety, Liquidity, Yield.

Cash has been the 3rd best performing asset class year to date, just behind Commodities (+23%) and Global Infrastructure (+8%) according to Russell Investments Asset Class Dashboard (11/30/2022)

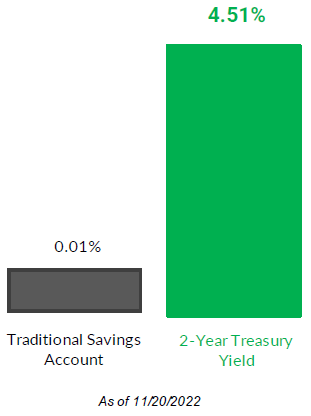

A rise in interest rates allows income to be earned on cash not seen in over a decade.

Safety

The Federal Deposit Insurance Corporation (FDIC) is a United States government agency that was created in 1933 during the Great Depression to insure deposits in member banks.

The FDIC does not insure annuities, life insurance policies, municipal bonds, ETFs, or securities held by broker-dealers or their customers.

According to the FDIC’s own website, no depositor “has ever lost a penny of insured deposits since the FDIC was created”.

FDIC insurance is available above the standard $250,000 limit for investors who deposit with banks on the IntraFi network.

The IntraFi network ensures deposits are maintained in different categories of legal ownership at the same bank — each are separately insured.

Therefore, it is possible to have deposits of more than $250,000 at one insured bank and still be fully covered.

You no longer need to hold your cash across multiple bank accounts.

Liquidity

Liquidity refers to the ability to quickly convert investments into cash.

In cash markets, next day liquidity is expected.

If you invest in a CD or some other type of annuity product, you may have penalties or contracts that restrict your ability to get your cash out the next day, or even longer.

Yield

Yield is the return received on an investment.

6 months ago, Charles Schwab agreed to pay $187 million to settle an SEC investigation based on their cash practices.

The agency alleged Schwab didn’t disclose a “cash drag” on client portfolios, which enriched the firm but caused investors to make less money for the same amount of risk in most market conditions.

Schwab neither admitted nor denied the claims.

As an investor, you have to be your own advocate on cash because the banks will not guarantee you get a competitive yield on your deposits.

A conservative investor who takes the time to find competitive yield options can find 3.50% to 4.50% in the market based on current interest rate levels.

With costs rising much faster, it might be time to rethink your cash strategy.

Final Word

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Vision, Courage and Patience leads to successful investing.

Best,

Darin Tuttle, CFA

This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.