The Repo Market Revealed: The Chart Driving Wall Street

Actionable Market Insights from Tuttle Ventures

Welcome to +64 new subscribers over the last 30 days.

If you are looking for unique investment ideas backed by interesting research, you have come to the right place.

I highly encourage newcomers to go back and read through our past 100+ newsletters since we launched Tuttle Ventures.

Packed with:

Our Most Popular Macro Views: Bonds Never Lie, Our Landmark Inflation Call

Investment Positioning: Investing Playbook

Private Investments: SpaceX, Midtown National Group (MNG)

All available — in the archive for our subscribers.

Newsletter rundown:

The most important chart right now?

Longer Maturities/Capacity to Borrow

So, what does all this mean?

Final Word

Sometimes it pays to pay attention to the financial plumbing of the markets. While liquidity and "plumbing" issues are routinely overemphasized, today is not one of those days.

As I discussed in "$2 Trillion stuffed under the mattress," I used to reconcile the cash and collateral accounts for the Tri-Party Repo market for a major Wall Street Bank. This gave me an understanding of the day-to-day operations.

A repurchase agreement (repo) is a short-term secured loan: one party sells securities to another and agrees to repurchase those securities.

You can think of a repo transaction sort of like borrowing bowling shoes at the bowling alley; you know you’ll return your shoes at the end of the night.

Now, imagine if you didn’t have to return that money overnight and instead you got to hold onto those funds for a longer timeframe. That is what is happening right now.

The most important chart right now?

The Reverse Repo (RRP) has dropped from $2,309B to $1,716B over the last 90 days - a difference of $592B.

So, where did the $592B go?

We believe these deposits have shifted into Money Market Funds (MMFs) to buy Treasury Bills (or TBills for short).

The flow of funds from RRP into MMFs is beneficial for risk assets like the stock market for two reasons:

1. Longer time to maturity

2. Capacity for margin (borrowing)

1. Longer time to maturity

The RRP has an overnight sweep, which means the funds have to be settled at the end of each day. Now, MMFs can hold TBills with maturities out to 30, 45, 90 days, and so on.

As Warren Pies of @3F_Research points out, “There has been a distinct change in the maturity of treasuries issued since the Oct lows.”

While Warren is focused on why these shorter maturities are bad for a shrinking balance sheet, I’m more interested in what this means for the largest trading desks on Wall Street.

Essentially, longer maturities equal a longer leash from risk management. Instead of settling overnight, traders now have days or weeks to execute a trade. Traders have a longer timeframe with new cash, allowing the institutional trading desks to express market ideas beyond one day. This benefits the stock market because sometimes a trade doesn’t always work out the way you want if you're only trading for one day.

2. Capacity for margin

Leverage is the use of debt or borrowed capital to undertake an investment or project. Margin trading refers to the practice of using borrowed funds from a broker to trade a financial asset, which forms the collateral for the loan from the broker.

TBills are marginable at favorable collateral requirements. This kind of borrowing typically encourages speculation because traders are looking to earn a higher rate of return than what they borrowed.

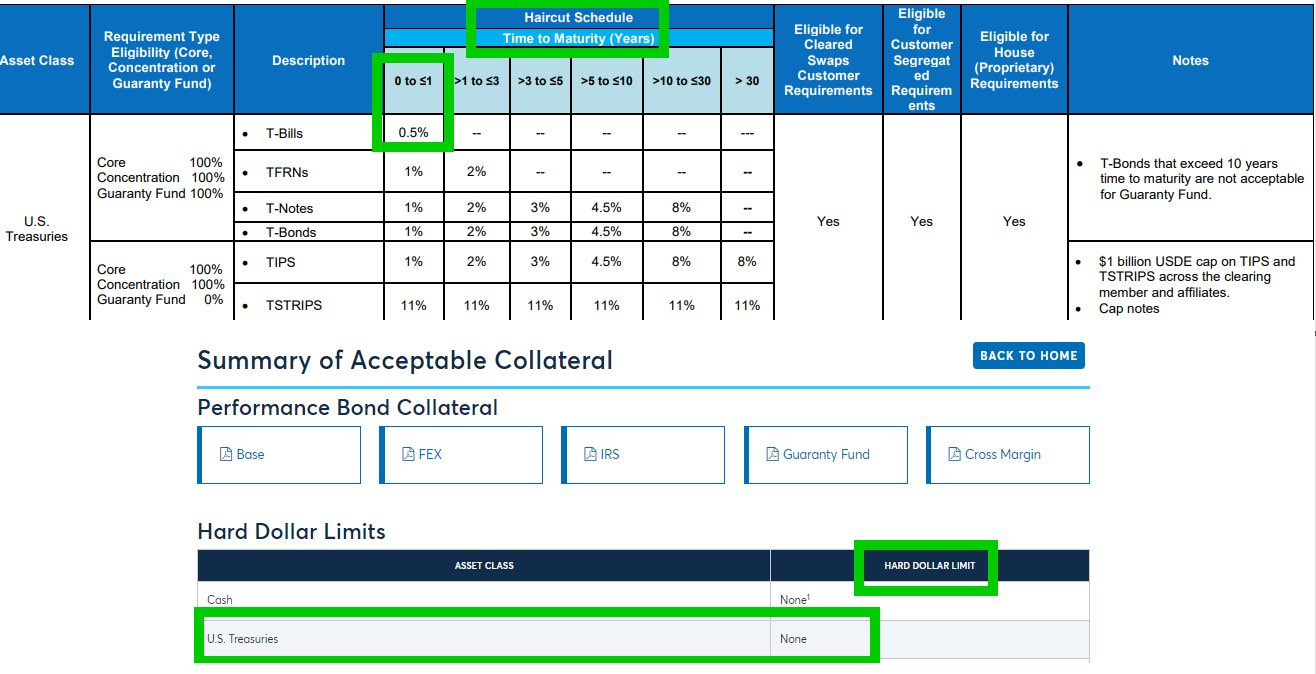

In the image below, notice how United States Treasury Bills, which are relatively safe and highly liquid assets, have little or no haircut (highlighted in the box in green) whereas more volatile or less marketable assets might have haircuts as high as 50%

Oftentimes its not unusual to find an institutional trading desk levering up 2,3,7x relative to the amount of TBills held as in the GC account as collateral.

The current spike in leverage, as reported in the National Financial Conditions Leverage Index, (NFCI) is no accident.

So, what does all this mean?

In my opinion, this is incredibly bullish for risk assets (like the stock market) short term. As long as the RRP continues to draw down and flow into MMF holding TBills, there will be a positive multiplier effect to the upside.

Critics who naively say that a shift of flows for RRP to MMFs holding TBills is not expansionary will need to specifically address the increase in time to maturity and leverage in order to update my view.

As reported by SophiaKnowledge, similar dynamics played out this week with RRP neutralizing 70% of TGA drain.

All of this evidence suggests to me that the drawdown of the RRP is positive for risk assets.

Of course, I could be wrong. The Fed could change the RRP rate higher, which would push the flow of funds back to overnight. However, based on what I know now, I believe the Treasury net issuance schedule and foreign purchases, being as low as they have been in years, does not give the Fed the capacity or the incentive to take such a risk in the short term.

Final Word

We're grateful for the opportunity to learn, grow, and invest alongside you at Tuttle Ventures.

Like what I have to say? Let’s discuss your individual investment portfolio by scheduling a time below:

Book a meeting with Darin Tuttle

Best regards,

This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.

Very interesting update..thanks!