Shifting Geopolitics - Is it working?

The West has weaponized the global financial system is it working?

Newsletter rundown:

The West has weaponized the global financial system

Most investors are ill prepared for the shift in geopolitics

Research has shown that sanctions have mixed results

The West has weaponized the global financial system.

Over history, the US has frequently imposed comprehensive economic sanctions on countries that are perceived as threats against international peace and stability.

(Think trade embargos and other actions against Iran, Cuba, North Korea, and Russia).

The comprehensive sanctions are designed to cause social and popular unrest, which either destabilizes the nation-state or forces the country’s policymakers to change course.

Or at least that’s how its supposed to work.

This new kind of war spans across resources and reserves and is most visible in the weaponization of the US dollar.

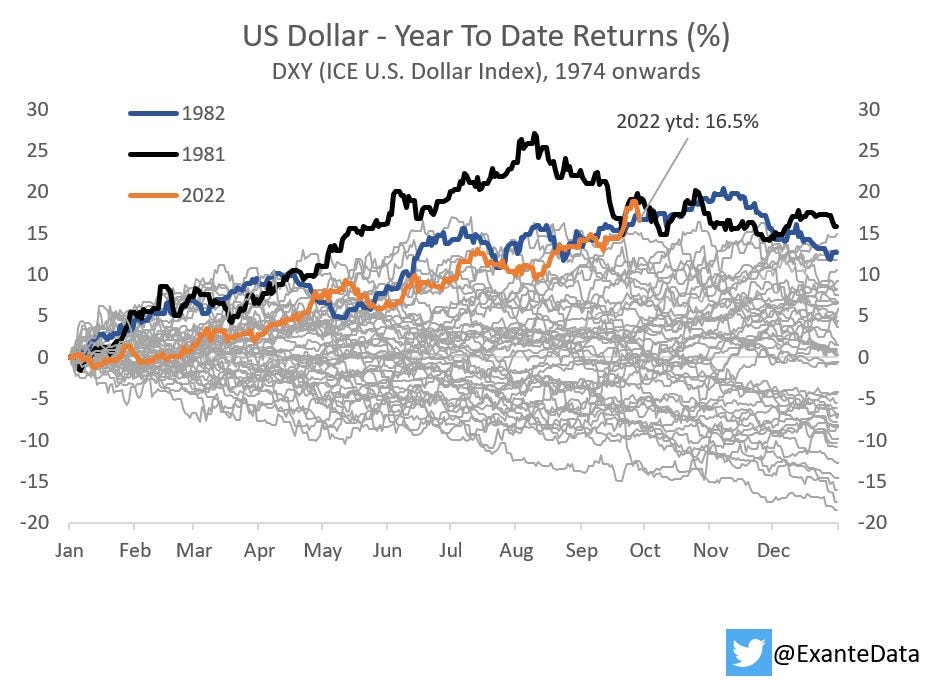

We are seeing the best YTD performance for USD in 40 years.

The last time the USD (DXY index) performed as well as this year (+16.5%) was in 1982.

If the goal has been to create a stronger dollar, it is working.

This is made possible because the US dollar still dominates world trade.

Data from BIS shows that the share of dollar-denominated trade in 2019 was a market-leading 88.3% (out of 200%, as two currencies are involved in each trade transaction) Credit to Hindustan Times.

Dealing with the dominant dollar benefits US investors and gives foreign investors few alternatives to turn to.

This further supports my theory that the next major default will be sovereign rather than corporate.

Most investors are ill prepared for a shift in geopolitics for two reasons:

When you own a globally diversified portfolio- you own an allocation to equities across the globe, including international and emerging market stocks, in addition to the U.S. stock market. A strong US dollar hurts currency translation returns for foreign companies.

When a trade war with China breaks out, a passive investor does not choose a side.

When trade war breaks out, a passive global investor looses on both sides.

This is because political instability and war depresses global trade.

As a consequence, a decline in globalization leads to lower future expected returns for portfolios that solely rely on global synchronized growth.

Most investors only invest in equities or fixed income.

Rarely do I see investors who allocate to currencies or commodities.

This means that an investor misses out on both the risks and opportunities that are available to these asset classes in times of shifting geopolitics.

Just look at the distribution of returns.

What is interesting is to apply this during times of war.

War can create inflation either because it impacts the supply of strategic commodities or because government debts built up to finance the war effort result in pressure for higher inflation as a means to more easily finance the debt.

I believe we are currently seeing both.

By avoiding currencies and commodities altogether, most investors miss out on the outsized movements that can create opportunities and diversification in a risk managed portfolio.

Do Sanctions even work?

Sandeep Baliga of Northwestern University performed a unique study for the Centre for Economic Policy Research.

Baliga looked at the effectiveness of sanctions in changing the sanctioned country’s desired behavior.

He turned to game theory, mapping out different scenarios to anticipate how a political leader or regime would respond in the face of comprehensive and targeted sanctions.

His conclusions were insightful.

While sanctions are a valuable alternative to more severe measures, including the lawful use of force, it is a mistake to think that sanctions are low-cost.

The most significant cost in a period of inflation?

Time.

While most sanctions are quickly resolved, some took much longer to play out.

This could mean inflation stays higher for longer if the Russian Ukraine conflict is not resolved.

Baliga also found that sanctions rarely worked within dictatorships.

This is because sanctions are designed to incentivize cooperation.

Dictators often do not seek cooperation and suppress citizens dissent when challenged.

If a country refuses to cooperate, the sanctions will not lead to positive results.

While I do not see Putin as a dictator, I do not see any signs of cooperation.

It will be interesting to see how things play out going forward, as always we will continue to actively manage risk for our clients.

Final Word

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Vision, Courage and Patience leads to successful investing.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn or Instagram.

Check out the website or some other work here.

Best,

Darin Tuttle, CFA

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.

Ack, been thinking about this, as I'm very aggressively invested in tech and China is looking belligerent AF towards Taiwan, which just so happens to be central to the global tech economy and ecosystem.

Even if the US doesn't get involved militarily, a sanctions regime on China (similar to Russia, say) could be disastrous for the global economy.

On the counter-point side, I saw a good analysis from Noah Smith recently about how the West's sanctions on Russia have hobbled its imports, which are central to its war machine. I'll link that in a sec.