Net Liquidity Correlation Breakdown

Actionable Market Insights from Tuttle Ventures

Welcome to +110 new subscribers this month & +306 over the last 90 days.

I started Tuttle Ventures in order to help people find lasting financial security.

If you like what you are reading, consider subscribing today:

Newsletter Rundown:

Business Update

Weekly Leading Index Recap

Adjusted Financial Conditions

Net Liquidity Correlation Breakdown

Final Word

Business Update

We are going live on the Charles Schwab custodial platform!

You will now be able invest in the Tuttle Ventures Fundamental Value Strategy as a separately managed account on the Charles Schwab platform.

If you’re interested, please reach out to your Schwab Advisor Services Representative to schedule an onboarding call.

As many of you know, this has been months in the making and I could not have done it without the support of great readers like you. Thank you.

This change will help us better serve advisors and comply with the SEC’s new marketing rule on portfolio updates and performance.

*This should not be construed as a recommendation, endorsement of, or sponsorship by Schwab. The views expressed are those of the third party and are provided for information purposes only. Please read the Managed Account Services™ Disclosure Brochure for important information and disclosures.*

We continue to use two indicators to guide our positioning:

ECRI US Weekly Leading Index

Adjusted National Financial Conditions Index (ANFCI)

Weekly Leading Index Recap

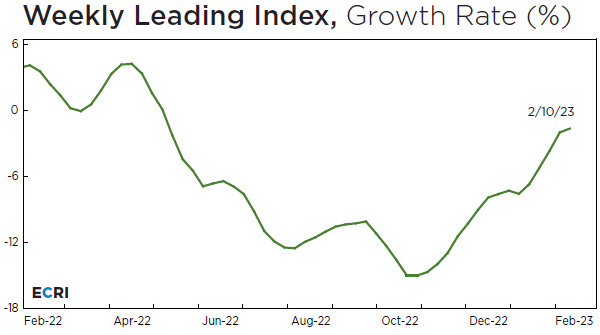

Leading economic indicators are the “early warning signals” of a recession.

The Economic Cycle Research Institute (ECRI) maintains a proprietary composite of leading economic indicators.

Here is a chart of the current ECRI US Weekly Leading Index (WLI) which shows a strong increasing uptrend since the bottom in October.

As we mentioned back in December, we wanted to see the WLI gain back to 95% of its previous level high in 2nd Quarter 2022.

We are now at that level.

Historically, this has been a good indicator of when recessionary pressures have subsided.

We consider this a positive sign for equity markets going forward.

Adjusted Financial Conditions

The Adjusted National Financial Conditions Index (ANFCI) is a comprehensive weekly update on 105 U.S. financial conditions across three categories of financial indicators (risk, credit, and leverage).

We like this measure because adjustments are made to remove the variation based on inflation.

Billionaire hedge fund manager Paul Tudor Jones frequently references the ANFCI to make inferences about portfolio positioning.

The weekly data goes back to the 1970’s, includes “shadow banking” metrics and is a key input in our investment outlook.

Positive values have historically been associated with tighter-than-average financial conditions. (Bad for risky assets)

Negative values have historically been associated with looser-than-average financial conditions. (Good for risky assets)

The index suggests financial conditions loosened again for February 10:

In fact, financial conditions have loosened considerably since October, with bond yields falling, bringing down mortgage rates, and the stock market has posted solid gains. See the green highlighted arrow showing the big turnaround.

Despite sharp monetary policy tightening, financial conditions have eased.

During Jerome Powell’s February FOMC Meeting Press Conference, there were a lot of questions about why financial conditions are loose while monetary policy remains restrictive.

We never got a straight answer.

If you look at Powell’s comments from back in September, he believes financial conditions immediately reflect current and prospective policy decisions:

The way I think of it is, our policy decisions affect financial conditions immediately. In fact, financial conditions have usually been affected well before we actually announce our decisions. Then, changes in financial conditions begin to affect economic activity fairly quickly, within a few months. But it’s likely to take some time to see the full effects of changing financial conditions on inflation.

Despite all of the interest rate hikes, why are we now back to the same levels seen in February of 2022?

Maybe financial conditions don’t reflect the immediate impact of interest rate hikes like Powell suggests….

If monetary policy is not driving financial conditions then who is?

Net Liquidity Correlation Breakdown

In finance the goalposts are always changing…

Something works until it doesn’t.

Correlations are not constant.

Since March of 2020, the market's response closely followed net liquidity conditions with a two week lag.

Until the start of 2023…

Remember, the Net Liquidity Ratio is equal to: Fed liquidity = Fed balance sheet - Treasury General Account (TGA) - Reverse Repurchase Agreements (RRA).

As this liquidity ratio gained in popularity, (and the correlation remained strong) critics cited the lack of treasury bill maturity schedules and net new issuance as key missing factors.

I believe the critique makes sense, as long as the demand for treasury bills is coming from a source outside of the US monetary system.

For example, if Japan still has strong demand for treasury bills- its a way to export inflation and increase liquidity in the US.

Andy Constan did a great job outlining this ongoing debate and how it related to the upcoming debt ceiling here:

Andy argues the debt ceiling is an ongoing political reality.

This shifts the most important liquidity factors to: bills issuance, TGA size, and the pressure valve of reduced bills issuance and TGA spend down (which many rightly suggest gives investors more cash on hand).

Until the TGA goes to zero and the government shuts down, the already planned spending will happen.

Andy points out that “No one is getting more money because the TGA is being used. Just the same money [already planned to be spent].”

This is important because Andy assumes demand for treasuries is coming from the US and not an outside demand source.

To accommodate the debt ceiling, fewer bills than originally expected got issued and investors have turned to buying meme stocks instead of buying treasuries.

Instead of derisking as liquidity conditions have changed, investors have increased risk with meme stocks and 0DTE options.

This means the market is sourcing liquidity from something not captured in the current model.

This is something we will continue to monitor going forward…

You can check out the latest Net Liquidity Ratio published on our website HERE.

Final Word

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Vision, Courage and Patience leads to successful investing.

Best,

Darin Tuttle, CFA

This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.