Portfolio Updates

Actionable Market Insights from Tuttle Ventures

Welcome to +95 new subscribers this week & +369 over the last 90 days.

I started Tuttle Ventures in order to help people find lasting financial security.

If you like what you are reading, consider sharing the newsletter with the link below:

Newsletter Rundown:

Portfolio Updates

General Comments

Positive Contributors

Negative Contributors

Final Word

Portfolio Updates

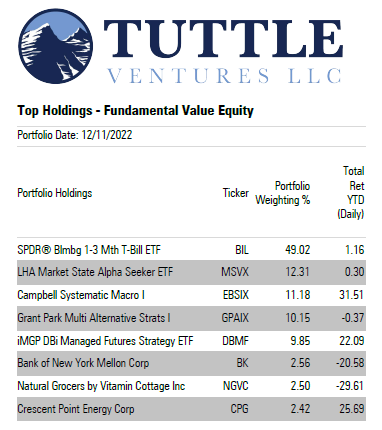

Here are current portfolio holdings as of 12/11/2022:

No changes to the portfolio have been made.

General Comments

Our defensive positioning has detracted from broader market performance over the last month, but outperformed over the last 3 months.

If you remember, we continue to use two indicators to guide our positioning:

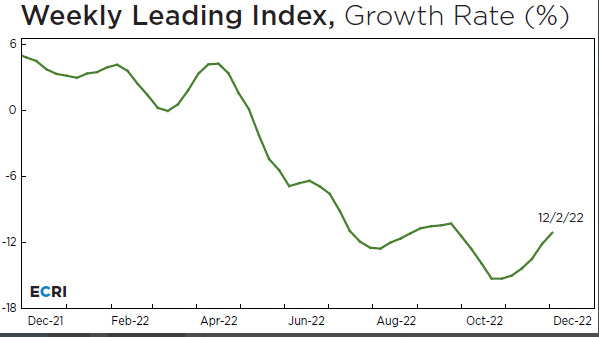

ECRI US Weekly Leading Index

Adjusted National Financial Conditions Index (ANFCI)

Leading economic indicators are the “early warning signals” of a recession.

The Economic Cycle Research Institute (ECRI) maintains a proprietary composite of leading economic indicators.

Here is a chart of the current ECRI US Weekly Leading Index (WLI) which shows that the growth rate is increasing and could be a potential bottom.

ECRI's WLI metric has had a respectable record for forecasting recessions and rebounds therefrom.

Falls in retail sales, consumer confidence, and railroad traffic, and a rise in initial unemployment insurance claims, where more than enough to offset increases in steel production, tax withholding, electricity output, and fuel sales.

While the uptick is positive, we are not confident of a lasting turnaround.

We would like to see the WLI gain back to 95% of its previous level high in May 2022. Historically, this has been a good indicator of when a recessionary period has subsided.

Positive Contributors

The Grant Part Multi Alternative Strategy Fund GPAIX was the best positive contributor +0.46% over the last month. This is mostly because of the fixed income collateral that GPAIX holds and the positive month where bonds have rallied.

Negative Contributors

Crescent Point Energy CPG 0.00%↑ is down nearly -20% this month, dropping alongside the price of oil. If oil prices really do breakdown lower from here, I think it will be a good indication we are headed into a recession.

On Friday, the company announced an increase in its dividend by 25%, which is somewhat positive.

What is interesting is the company’s stance on future oil prices. The latest cash flow guidance for the company is around $80 WTI.

Despite the cash flow guidance at $80 the company is hedging at a $75.69 price floor for Q4 2022E.

The price of oil still has an outsized effect on the performance of the stock.

The $1B in impairment reversals last quarter (which IFRS allows & GAAP does not), was estimated on much higher guidance at $96 WTI. It would have been great if the reversal was done at a more conservative oil price level. This explains the latest P/B discount.

At a Price/Free Cash Flow Ratio of 3.03 it is still in the 90th percentile within oil and natural gas industry, exploration, development and production companies.

After reviewing executive compensation arrangements, I still believe management is aligned with positive shareholder returns.

Overall, the company still maintains a strong balance sheet and continues to generate cash flow.

Final Word

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Vision, Courage and Patience leads to successful investing.

Best,

Darin Tuttle, CFA

This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.