Mid Year Review 2023

What we got right and wrong from our investing playbook

Welcome to +82 new subscribers over the last 90 days.

If you are looking for unique investment ideas backed by interesting research, you have come to the right place.

I highly encourage newcomers to go back and read through our past 103+ newsletters since we launched Tuttle Ventures.

Packed with:

Our Most Popular Macro Views: Bonds Never Lie, Our Landmark Inflation Call

Investment Positioning: Investing Playbook

Venture: SpaceX, Midtown National Group (MNG)

All available — in the archive for our subscribers.

2023 Investing Playbook Midyear Recap

Today we are reviewing our 2023 Investing Playbook.

By evaluating the performance of investment themes which we articulated back in December 2022, we can gain critical insights into what worked and what didn't, and adjust future investment strategies accordingly.

For reference we made 3 main calls:

Why Bond Math Looks Good in 2023: the case for going back into fixed income (mostly right)

We believe the market has done enough and sufficiently repriced bonds at attractive levels across most possible scenarios for 2023.

Higher yields are a gift to investors who have long been starved for income at the lowest risk premiums in decades.

At 4.25% yields or greater, short-term government bonds, emerging market debt and mortgage securities are appealing.

Risk‑Off, Yield‑On: Emerging Market Debt in Focus (mostly right)

For fixed income investors willing to move out on the risk spectrum, Emerging Market Debt presents a significant yield pick-up opportunity.

A quick formula to remember for all investors: Fed pivot = dollar weakness

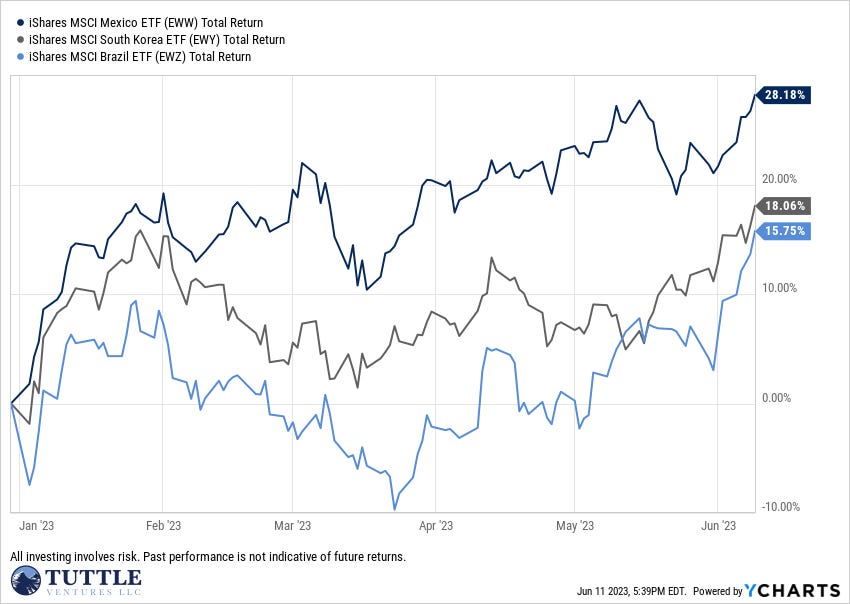

Countries at the top of our list: Current cross-asset signals favor Mexico, Korea and Brazil. (mostly right)

We like the set up for Mexico, Korea and Brazil.

In 2023, we believe Mexico will benefit from increased industrial production. While the US pretends to be the recipient of shifting supply chains, Mexico is in a much better position.

All of this depends of course on a weaking US Dollar. US Dollar to Mexican Peso Exchange Rate is at a current level of 19.27, down from 19.29 the previous market day and down from 21.29 one year ago.

We expect this trend to continue.

What we got wrong

To be fair, 2023 has proved to be more challenging than 2022.

I would note that this year we have missed the run up in technology stocks.

The Dow is up year-to-date as of June 11, 2023 by 2.30%. But if you deduct the performance of its two major tech components, Apple and Microsoft, the Dow is negative year-to-date.

The NASDAQ Index is down -12.25% since its market high on November 19, 2021 while at the same time up 33.13% year-to-date. Driven by big moves in Nvidia (+167%), Apple (+43%), Alphabet (+38%), Microsoft (+37%), and Amazon (+39%).

A few tech companies are driving the headline indices.

I think one of the reasons why we missed this price action is because we did not have a strong conviction view from the playbook.

Many of the most economically sensitive stocks are down -33%: transports, consumer discretionary and banks.

They are now tracking their performance in a similar way as they did heading into the 1990-91, 2001-2002 and 2008-09 recessions.

What we got right

One of the biggest themes from the playbook was Fed pivot = dollar weakness.

We believe this is one call from the playbook that we got right.

In turn this has benefitted the economies of Mexico (+28%), Korea (+18%) and Brazil (+15%).

We had mentioned that Mexico would benefit from increased industrial production.

While the US pretends to be the end recipient of shifting supply chains, Mexico has been in a much better position with the capacity to assume these trade shifts and negotiate from a position of strength.

Going forward, we are only halfway into the year. We plan on going back to the drawing board and doing our homework to put together the best investment research ideas we can.

Final Word

I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Vision, Courage and Patience leads to successful investing.

Best,

Darin Tuttle, CFA

This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.