Keeping a vision: managed futures as a unique source of uncorrelated returns

Actionable Market Insights from Tuttle Ventures

Welcome to +28 new subscribers this week & +442 over the last 90 days!

If you are brand new, you’ll find unique investment ideas backed by portfolio insights to help you make smarter investment decisions.

This week NYSE’s ETF Central published The 4 Most Common Portfolio Mistakes.

It was a great experience to be able to share my investment insights outside of Substack and work with a professional writing and editing team.

Stay tuned for more collaborations like this in the future.

This week’s newsletter, TLDR (Too Long Didn’t Read):

Keeping a vision: managed futures as a unique source of uncorrelated returns

Portfolio positioning; positive and negative contributors

Economic signals are still bearish

Keeping a Vision

If you see a man running down the freeway in short shorts and a tank top you would think he’s crazy…

But if there’s 300 people running along with him- then it’s a marathon.

The marathon is the ultimate test for any runner. It pushes people to their physical limits in terms of how fast and far they can go before giving up, but also tests mental strength as well with all those who compete against one another during the race.

The concept of "normal" is often based on context and perspective. This same concept can be applied to many situations in investing.

What may appear outlandish or unacceptable in one situation, could just be part of the norm in another.

Running your own race and not focusing on the herd is how you are able to keep pace for yourself.

It's important to strive for open-mindedness and consider circumstances before passing judgement on someone's investment actions or choices.

I encounter this almost on a daily basis, advising other advisors.

In particular, allocating to managed futures or commodity trading advisors (CTA’s) is generally met with skepticism.

Sometimes you have to run your own race.

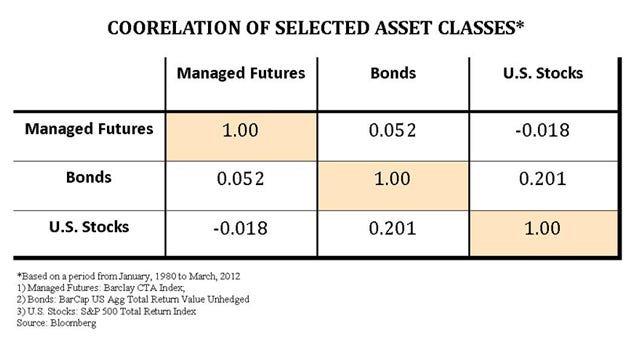

Historically, managed futures have provided a unique source of uncorrelated returns.

Although adding managed futures to a portfolio may provide diversification, managed futures are not a perfect hedging mechanism; there is no guarantee that managed futures will appreciate during periods of inflation or during stock and bond market declines.

What we have seen is managed futures capture sources of returns outside of a traditional 60/40 portfolio.

This includes:

Negative duration positioning by shorting US Treasuries

Long and short commodities

Long and short currencies

No matter if there is a downward or upward moving market, outsized volatile moves tend to favor trend following strategies.

This is because CTA’s may be constructed simply by focusing on highly statistically significant price trends, agnostic to typical asset class restraints.

Managed futures are designed to capture outlier and outsized returns across trending asset classes.

Current Portfolio Holdings:

Positive Contributors:

The smaller equity portfolio positions CI 0.00%↑ and NOC 0.00%↑ had outsized returns this month.

Cigna is up nearly 13% this month and a new 52-week high.

Northrop Grumman is up nearly 13% this month and a new all time high.

At the time of purchase, back in July, both of these stocks were chosen based on fundamentals. Each had the highest trailing four-quarter total cash return relative to their sector.

Remember: Annual Net Cash Flow / Invested Equity = Cash on Cash Return.

As valuations have become compressed, effective use of cash is a premium that the market has agreed is worth paying for.

This week we will most likely be looking for an exit at these elevated prices.

Negative Contributors:

Grant Park Multi-Alternative Strategy Fund (GPAIX) was flat for the month.

Currencies was the Fund’s best performing sector as the dollar rally strengthened. The Fund reduced equity exposure due to last month’s sell-off. This was triggered by further bearish longer term signaling last month which hurt returns for this month in the rally.

Minimal losses in commodities as the Fund reduced exposure due to peaks in price movement.

Fixed income exposure finished the quarter nearly flat as prices rose then sharply fell throughout the quarter.

We don’t anticipate any changes at this time.

Economic signals are still bearish

Leading economic indicators are the “early warning signals” of a recession.

The Economic Cycle Research Institute (ECRI) maintains a proprietary composite of leading economic indicators.

Historically, this econometric has predicted recessions six to nine months before a recession starts. This would place the next recession sometime between October 2022 and January 2023.

The latest update shows the Weekly Leading Index (WLI) growth falling again.

It has fallen to its lowest reading since June 5, 2020.

We consider this a continued warning signal for risk assets and plan on keeping the outsize cash position in BIL 0.00%↑ .

Final Word

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Vision, Courage and Patience leads to successful investing.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn or Instagram.

Check out the website or some other work here.

Best,

Darin Tuttle, CFA

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.

You had me at "uncorrelated" 🤩

A few questions, if you're willing and able:

1) Is intention for DBMF to hold at that position size for the very long haul? Or is it more of a medium-term play to profit from volatility and dodge downside? Either way, seems like a nice diversifier and stabilizer. 👍

2) Are there any ETFs alternatives for the GPAIX and EBSIX funds?

I plugged the portfolio into portfoliovisualizer.com's backtester:

https://www.portfoliovisualizer.com/backtest-portfolio?s=y&timePeriod=2&startYear=1985&firstMonth=1&endYear=2022&lastMonth=12&calendarAligned=true&includeYTD=false&initialAmount=10000&annualOperation=0&annualAdjustment=0&inflationAdjusted=true&annualPercentage=0.0&frequency=4&rebalanceType=1&absoluteDeviation=5.0&relativeDeviation=25.0&leverageType=0&leverageRatio=0.0&debtAmount=0&debtInterest=0.0&maintenanceMargin=25.0&leveragedBenchmark=false&reinvestDividends=true&showYield=false&showFactors=false&factorModel=3&portfolioNames=false&portfolioName1=Portfolio+1&portfolioName2=Portfolio+2&portfolioName3=Portfolio+3&symbol1=BIL&allocation1_1=48.96&symbol2=MSVX&allocation2_1=12.17&symbol3=GPAIX&allocation3_1=10.83&symbol4=EBSIX&allocation4_1=10.69&symbol5=DBMF&allocation5_1=9.85&symbol6=BK&allocation6_1=2.5&symbol7=CI&allocation7_1=2.5&symbol8=NOC&allocation8_1=2.5

Quite notable to me are: exceptionally low standard deviation & max drawdown, high sharpe and sortino ratios, and exceptionally low market correlation. I'm super curious about your "when" & "how" for deploying all that BIL into presumably higher risk assets in the coming quarters (or years)...