Invest for the future, not today

Actionable market insights from Tuttle Ventures

Welcome to +68 new subscribers this week & +433 over the last 90 days!

If you are brand new, you’ll find unique ideas backed by interesting research to help you make smarter investment decisions.

In some personal news, last week’s newsletter The 4 Most Common Portfolio Mistakes was picked up by NYSE’s ETF Central!

Next week, you’ll see me on the wire as a featured writer with a link to the Substack.

I highly encourage newcomers to go back and read through the past 65+ newsletters since we launched Tuttle Ventures.

Packed with:

Our Most Popular Macro Views: Wall Street Could be Heading To A Black Swan Event, Bonds Never Lie, Our Landmark Inflation Call

Private Equity: Boxabl, Socket Security, Midtown National Group (MNG)

Key Business Highlights: Forbes Article, Awards, & TV Appearances

Why I Advise other Investment Advisors: Who Advises your Advisor?

Soon I will be reserving the newsletter archive for only paying subscribers, so get in while you still can.

It's my goal to help minimize long-term regret.

I'm willing to put aside differences in short term market views to focus on timeless investment principles.

There are no facts about the future.

Most of my clients and advisors I advise are not in a state of panic because we have been proactive and prepared for what has come so far.

Diversification is not what it used to be.

Accelerated events to the downside are not unique.

Current events have shown that investors might need to take a unique approach to gain real diversification in extreme events.

At Tuttle Ventures, we are not afraid to stand out from the crowd.

Remember we invest for the future, not today.

Current Portfolio Holdings:

I’m going to reserve portfolio commentary for next week.

Instead, I encourage every reader to consider your current investment strategy.

Stop watching mainstream financial media and start thinking for yourself.

Your “digital diet” can have an outsized impact on not only your investments but also your attitude and perspective on life.

We will continue to monitor signals from the Adjusted National Financial Conditions Index (ANFCI) and ECRI US Weekly Leading Index to help guide portfolio positions.

We are also paying attention to the fixed income markets and net liquidity conditions of the Federal Reserve.

You can read more about our methodology in our newsletter from back in July when we last made portfolio changes.

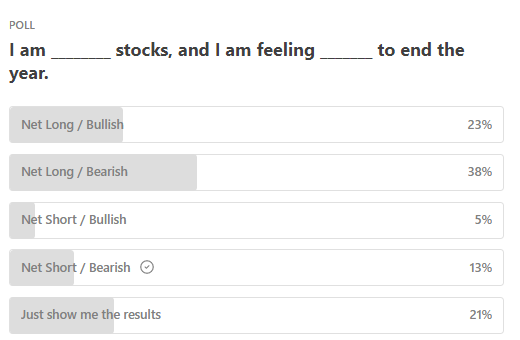

I found the results from our “Phone a Friend” open market poll to be interesting.

38% of readers are still net long, even though they are bearish on equities over the next 3 months.

This was my first poll and I plan to send out more in the future.

There are so many new readers, I want to get a better sense of what you are feeling and thinking.

If you have a new idea for a poll, please leave a note in the comments down below.

Final Word

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Vision, Courage and Patience leads to successful investing.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn or Instagram.

Check out the website or some other work here.

Best,

Darin Tuttle, CFA

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.