3 Strikes to Signal a Recession

Actionable Market Insights from Tuttle Ventures

Welcome 20 new subscribers this week!

We hope you find the Tuttle Ventures Newsletter of value with actionable market insights to make better investing decisions.

Quick Notes:

Portfolio Updates

3 Strikes to Signal the Recession

Final Word

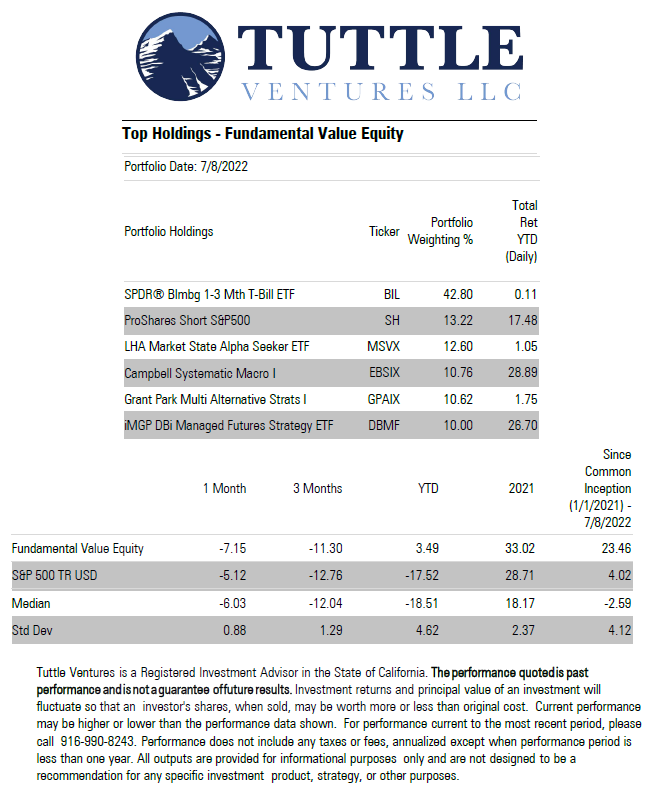

Portfolio Updates

The best money you will ever make is the money you DON’T LOSE in a bear market

We have rebalanced into significantly more defensive investments.

My experience as an investment manager has been that understanding long-term economic and stock market cycles is key to risk management.

We believe a recession is coming but the US is clearly not in one yet.

In all cases we moved out of the stock market and replaced stocks with a larger percentage of cash, cash equivalents, and a small percentage of inverse S&P 500 ETF.

Our goal is to provide some growth during a long term bear market recession and a downward trending stock market.

We will achieve this by:

A higher allocation to cash

A blended allocation to 3 distinct managed futures strategies- Broadly diversified long/short across commodities, interest rates, currencies, equities, and fixed income

An inverse S&P 500 ETF to profit in the down trending market

A tactical fund that profits from large swings in volatility

The strategy that I outline can have tax consequences for taxable accounts with capital gains and may not be appropriate for all individual investors. This is why clients should consult with their financial advisors before making any chances to their investment accounts.

3 Strikes to Signal a Recession

Rising rates and high inflation should continue to erode the economy over the coming months here are 3 strikes that lead to our latest decision.

#1 US Weekly Leading Index Turned Negative

About six weeks ago, one of the most reliable US recession indicators flashed its “recession signal.”

In May, the growth rate of the Weekly Leading Index turned negative.

Historically, that has indicated that in the next 6 to 9 months from May 2022, we may see a recession and sustained negative GDP growth in the US economy.

The Economic Cycle Research Institute (ECRI) maintains a proprietary composite of leading economic indicators. It has an impressive record, going back decades, of signaling recessions and busines cycle changes.

Here is a chart of their current ECRI US Weekly Leading Index:

Strike 1.

#2 Tighter Financial Conditions Ahead

The Adjusted National Financial Conditions Index (ANFCI) is a comprehensive weekly update on U.S. financial conditions in money markets, debt and equity markets, including “shadow” banking systems.

This index isolates a component of financial conditions uncorrelated with economic conditions to provide an update on financial conditions relative to current economic conditions.

The index is designed to have an average value of 0 and a standard deviation of 1 over a sample period extending back to 1971.

Positive values of the NFCI have been historically associated with tighter-than-average financial conditions.

Negative values have been historically associated with looser-than-average financial conditions.

Here, you can clearly see we have broken into positive territory signaling tighter financial conditions ahead.

Strike 2.

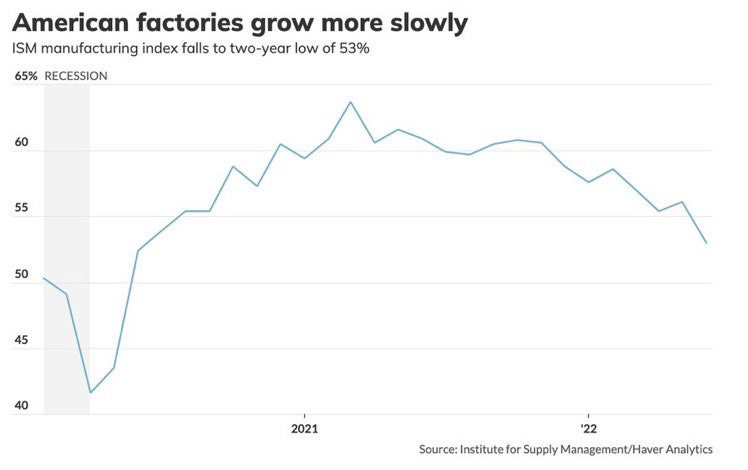

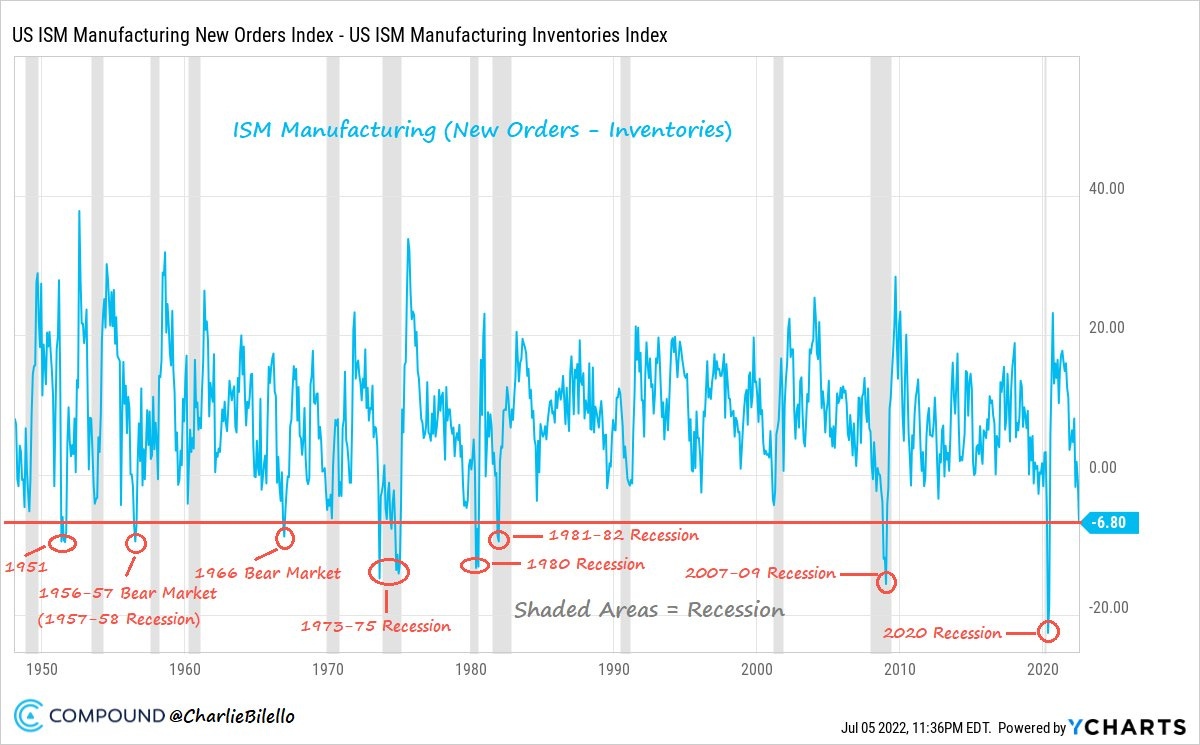

#3 ISM Manufacturing falls to two-year low

Equities tend to digest Fed tightening much better with a rising ISM.

New orders fell for the first time since May 2020.

The last 5 times the spread between New Orders - Inventories in the ISM Manufacturing Index was this negative, the US was already in a recession.

Strike 3.

We expect a recession, with a lag, after monetary policy gets tighter.

Final Word

This isn’t timing the market.

This is looking at the economy and identifying when companies are facing an uphill battle and preparing beforehand.

To Quote Hedge Fund Manager Stanley Drunkenmiller :

I never use valuation to time the market. I use liquidity considerations and technical analysis for timing. Valuation only tells me how far the market can go once a catalyst enters the picture to change the market direction.

After the ECRI US Weekly Leading Index confirms that the economy has turned upward and is positive, I will then wait for the S&P 500 index to break above its 50-week moving average.

That is the signal we are looking for to reenter the stock market and it is an indicator that the long term bear market recession is over and a new bull market is starting.

Sell High, Buy Low.

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn or Instagram.

Check out the website or some other work here.

Best,

Darin Tuttle, CFA

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.