Initial Balance (IB) to trade 0DTE?

Actionable Market Insights from Tuttle Ventures

Welcome to +31 new subscribers over the last 30 days.

If you are looking for unique investment ideas backed by interesting research, you have come to the right place.

We are grateful for 17 Substack publications that now recommend our newsletter.

I highly encourage newcomers to go back and read through our past 100+ newsletters since we launched here.

This weeks newsletter is sponsored by:

Get smarter in 5 minutes with Morning Brew (it's free)

There's a reason over 4 million people start their day with Morning Brew - the daily email that delivers the latest news from Wall Street to Silicon Valley. Business news doesn't have to be boring...make your mornings more enjoyable, for free.

For every signup I receive $3.75, which is a great way to support.

Newsletter rundown:

Space X Investor Update

Reverse Repo gets a $125B boost over last 2 days

Initial Balance (IB) to trade 0DTE?

RustDesk Paid version takes off

Final Word

Space X Investor Update

Falcon 9 is the world's first orbital class reusable rocket.

Reusability allows SpaceX to refly the most expensive parts of the rocket, which in turn drives down the cost of space access.

Yesterday, Falcon 9 launched 22 satellites into space and 4 new crewmembers were sent to the International Space Station.

As I’ve said in the past, short term commercial viability of the SpaceX investment depends on exit opportunities for Starlink.

SpaceX Starlink satellites in orbit now surpass 5,000. Costco’s in Japan are now offering Starlink packages in retail stores.

Telecommunications giant Telekom Malaysia eyes a possible partnership with Starlink.

Per CEO Amar Huzaimi Deris, “There are many ways Starlink can play in the market. TM as a network or infrastructure provider, for instance, forging (a relationship) with Starlink to offer similar services in the industry… This would allow both entities to tap into a broader consumer base by providing cutting-edge connectivity solutions.”

We are encouraged by the momentum over the last few months.

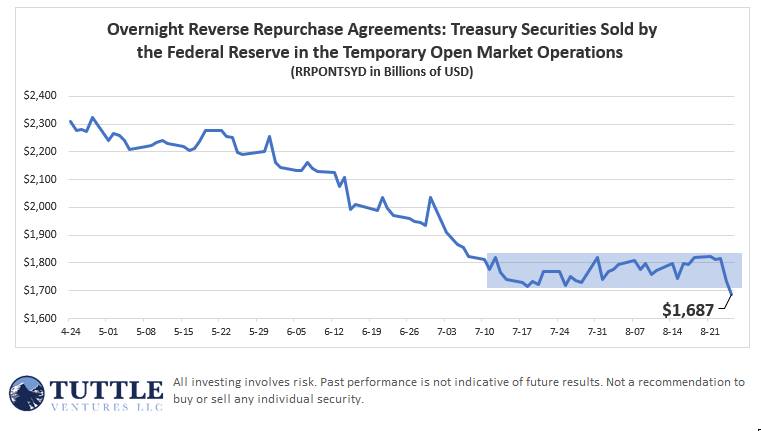

Reverse Repo gets a $125B boost over last 2 days

I’m reading Scott Skyrm’s latest book: The Repo Market: Shorts, Shortages, and Squeezes.

The book has opened my eyes to the world of interbank lending and settlement. Non-banks interact with the Fed through their overnight reverse repurchase balances.

Significant changes have occurred in the structure of the government securities market over the past two decades, including new types of market participants, increased use of advanced technology, innovations in execution venues, widespread use of high-speed and automated trading strategies, and emerging concentrations of activity.

We continue to watch the Reverse Repo Market closely.

The Reverse Repo closed down big this week... which means more liquidity was freed from overnight sweep.

-$129B in last 2 days!

This was a move so big I had to adjust my y axis.

So what caused the big shift?

There could be many reasons, but a new research article caught our attention.

Amalia Estenssoro and Kevin L. Kliesen in an article titled “The Mechanics of Fed Balance Sheet Normalization” the St. Louis Fed published an economic research note admits : QT is not possible without drawing down Reverse Repo.

The article does a great job highlighting the spillover effects of the regional banking crisis and how bank reserves directly tied to reverse repo levels are the most logical choice to drawdown to implement a tightening mandate.

So where do things stand? On August 14, 2023, the Fed balance sheet was at $8.19 trillion (about 30% of GDP), bank reserve balances were at $3.22 trillion (about 12% of GDP), and ON RRP facility take-up was at $1.79 trillion (about 7% of GDP).

As QT-II continues at an accelerated pace, the Fed is likely to reassess the optimal level of reserves in the near future.

We believe if this drawdown trend continues, it could be the start of second cash infusion this year.

This is bullish risk assets because the largest banks manage risk at an aggregate level.

Excess cash can be released and freed from overnight holdings to buy longer dated treasuries.

When risk management department of the largest banks look at their daily risk budgets, traders and speculators now have a longer timeframe than overnight to realize trades and take on risk.

Initial Balance (IB) to trade 0DTE

This week we took notice of using the Initial Balance to trade intraday market direction. The idea is outlined on twitter here, discussed with machine learning application here, and empircally researched here.

Initial Balance (IB) is the price range data, which is formed during the first hour of a trading session. The first 30-second IB range has also been statistically significant over the last few weeks.

Essentially the question is if there is relationship between what happens in the first hour of the session and the rest of the session or it’s totally random?

If Reverse Repo is known by the primary dealers at the market open, the amount of risk to trade for the day is already set as a range within the first hour.

This makes logical sense on why this technical trading strategy could be significant.

The rules of engagement are simple and is not designed to go beyond a single day.

Do NOT go Short above IB High. Do NOT go Long below IB Low.

Markets typically crash from one place: below the IB low. By definition, a market that is stronger would be trading above the IB high.

Alignment and protect yourself is how you avoid disaster.

We are looking to incorporate this technical signal in broader trading strategies.

RustDesk Paid version takes off

RustDesk is a full-featured open source remote control alternative for self-hosting with unique security features and minimal setup.

I first wrote about RustDesk back In March 2023 when I wrote: “The Bronze Age of RustDesk”.

With closed source software (also known as proprietary software), the public is not given access to the source code, so they can't see or modify it in any way. But with open source software, the source code is publicly available to anyone who wants it, and programmers can read or change that code if they desire.

Commercial open source software economic models will dominate the future of building going forward.

We are at the point today where open source is poised to become the primary economic model for core development of software because of its unique ability to innovate, scale, and generate revenue.

Rust programming language allows you to write safe AND efficient code.

RustDesk is able to function without additional tools like VPNs, port forwardings, firewalls or Neural Autonomic Transport System (NATs).

The cross-platform compatibility is also unique because the software is designed to work seamlessly on various operating systems, including Windows, macOS, and Linux.

RustDesk launched its paid version 2 months ago. Without official numbers posted by the company, we estimate ~$1M in subscription ARR from zero in ~30 days.

This is based off the tens of thousands of GitHub stars, hundreds of contributors, and millions of users.

RustDesk has remained at the top of #GitHub trending for 3 days since the release of version 1.2.2.

The global remote desktop software market is projected to grow from $2.83 billion in 2023 to $9.27 billion by 2030, at a CAGR of 18.5% according to Fortune Business Insights.

When compared to the popular competitor AnyDesk, RustDesk is a far more straightforward and an easy-to-use tool with almost zero setup time.

Back in September 2021, AnyDesk raised $70M at a $660M+ valuation. AnyDesk software has been downloaded 500 million times since it was founded in 2014, and on average it sees more than 900 million sessions each month.

We believe RustDesk has the potential to become a $1B unicorn not just because of the surge of remote and hybrid working but the open source foundation it is built upon.

We will continue to keep you updated on company progress.

Final Word

We're grateful for the opportunity to learn, grow, and invest alongside you at Tuttle Ventures.

Like what I have to say? Let’s discuss your individual investment portfolio by scheduling a time below:

Book a meeting with Darin Tuttle

Best regards,

This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.