How safe do you think flying is?

Actionable Market Insights for Investors by Tuttle Ventures

First off, BIG thanks to the 30 new subscribers this week!

I promise to deliver Actionable Market Insights straight to your inbox - if you like what I have to say, don’t forget to share with a friend.

We all want to know who the best pilots are before we get on our flight, but how can you tell if someone is good?

In 2019, there were a total of 333,000 active pilots working in the aviation industry.

Any pilot can look good when the sky is full of sunshine and rainbows, but how do they act under pressure?

Those of us who have been through a few market cycles know that rough skies bring out the best companies.

CEOs, much like Pilots, can separate themselves from the pack by demonstrating strong leadership and stable balance sheets. They are able to adjust, accelerate or take market share.

Companies that powered through the post GFC era (08/09+) include Veeva, Uber, Asana, Twilio, Okta, Zendesk, Etsy, Workday, Shopify, Hubspot, Square, Palo Alto Networks and many, many more...

We are just getting started and there are plenty of great takes on good companies.

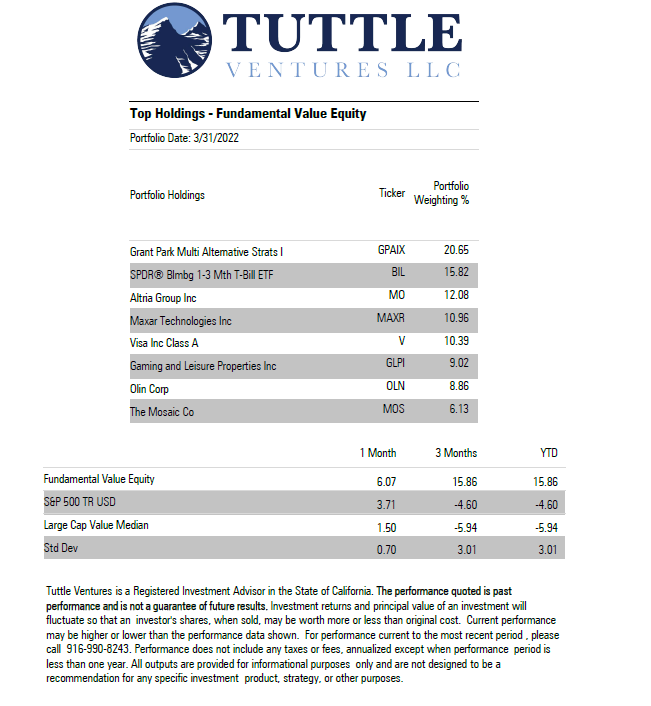

Portfolio in Review

Let’s recap current holdings and latest performance YTD:

You’ll notice cash balances are up. We have not yet pulled the trigger on current stocks on our watchlist.

Biggest Portfolio Contributors

MAXR technologies $MAXR up YTD 33.66% no change to our fundamental view, read my latest write up here.

The Mosaic Co, $MOS, is up YTD 69.54% previous write up here.

A quick note

Russia has weaponized its energy exports.

China has weaponized its control over the supply chain.

The goal is to starve the West from critical resources…

Largely successful— this has acted as the catalyst to rising inflation that was brewing under the surface for sometime.

Inflation is much higher than people think, now attacking real goods. Demand is getting destroyed while prices rise, costs going up everywhere… this is the predominant narrative.

Both will need to be addressed with viable solutions before I pull back the reigns on the inflation trade. There’s total misalignment between Fed funds and inflation.

It’s our hope that these solutions will come from the US in the energy and financial sector as I outlined in detail in the past here.

Gaming REITS still on a roll

A core holding in the Fundamental Equity Portfolio (around 10%) is Gaming & Leisure Properties, Inc. ($GLPI), a Real Estate Investment Trust (REIT) engaged in the business of acquiring, financing, and owning real estate property to be leased to gaming operators in triple net lease arrangements.

The REIT owns 51 assets across 16 states, geographically diverse, with strength in the northeast, midwest and south. (limited footprint on the Vegas strip).

$GLPI is an innovator, having been spun off by Penn National Gaming, $PENN in 2013 in an initiative led by its chairman, founder and largest shareholder, Peter Carlino. The first real gaming REIT of its time, the company has benefited from its first mover advantage. Ceasers, MGM and now Blackstone all copycat the asset spinoff and tax efficiency that comes with selling the land to a third party company.

Gaming REITS have a moat in their niche. The land is literally un-duplicated anywhere else, with licensed premises that thrive under the favor of regulators and state governments.

The number of commercial casinos in the United States year-over-year has been relatively consistent, showing a steady increase from 2010 until 2016, after which the number of casinos began to slightly decrease each year.

In 2020, there were 462 commercial casinos operating in the U.S., down from 465 the previous two years.

A Cash Cow

At it’s core, the company acts as a release value for efficient operations of the gaming industry. The company can provide temporary financial relief to its tenants who could be struggling from business disruptions or increase distributions during more prosperous times.

The reliable Free Cash Flow from operations is a staple for this niche market.

My favorite quote from the company’s latest earnings call comes from CIO Matt Demchyk:

"We're really not in the business of, "strategic transactions"-

We're only interested in cash flow and cash returns.

That's who we are and that's who we've always been.”

Narrow the focus to increase the quality.

This is a pilot who knows the destination.

$GLPI maintains a consistent financial policy, having never decreased its dividend and a 5.85% Forward Dividend Yield, 18% Return on Equity (ROE), and 43% Net Profit Margin.

This company is still in the value lane with a P/CF of 13.79 vs. 5-year avg. of 14.06 including Net Debt/EBITDA below 5.5x as it executes accretive growth.

Coming off of a record-breaking 2021, U.S. commercial gaming revenue in January, reached $4.50 billion, the industry’s fastest-ever start to a year.

We will continue to keep this as a core holding, with key risks being the high payout ratio commitment and an industry that is vulnerable to regulatory changes. Dividend stocks are vulnerable to rising interest rates. As rates rise, dividend investors may become less attracted to riskier dividend paying stocks to trade in for the risk-free rate rate. With the ten-year at 2.32% we believe we may still have a long way to go.

On the Watchlist

$AVGO-Grew its revenue 15% y/y, is now capturing a 60% operating margin, raised its dividend 14% (2.6% current yield), and issued a new $10B repurchase plan (4% of shares).

$MSBHF, $ITOCHY, $MITSY- If you ever wonder why my Twitter timeline is filled with Japanese, its because I always search for foreign stocks in their home language. In August 2021, $BRK.B disclosed its investments in Japanese trading companies: $ITOCHY, $MARUY, $MSHBF, $MITSY & $SSUMY. They have rallied 23% since then, boosting the combined value of Berkshire’s stakes from below $6.4B to nearly $7.7B in under six months.

$VWTR- Provides water development solutions for end-users by identifying, acquiring and developing water rights, often within fragmented agricultural markets, and over time converting these water rights to higher valued municipal and industrial uses.

Flying Blind

I need your help.

When it comes to understanding how I can best help you and your investment goals, I’m flying blind. If you’ve read this far, I’m confident there is something that I can do to improve your reading experience.

Please take 2 minutes and fill out this survey to help me better understand how to best serve YOU!

https://tuttleventures.typeform.com/survey

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn or Instagram.

Check out the website or some other work here.

Best,

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.