Zooming in on Maxar Technologies

Actionable Market Insights for Investors

Valuation dispersion among all stocks is the widest it has ever been —as far back as we have data.

It’s quite possibility the best time in modern history to run a fundamental stock portfolio with a value-tilt.

Our select portfolio of investments is raising the bar for what investors should expect from a professional money manager. No one should be paying active fees for passive performance.

My favorite comment from investors is that we provide unique ideas backed by interesting research.

As of February 28, 2022, the portfolio is overweight Basic Materials, Energy and Consumer Defensive Stocks vs. the S&P 500.

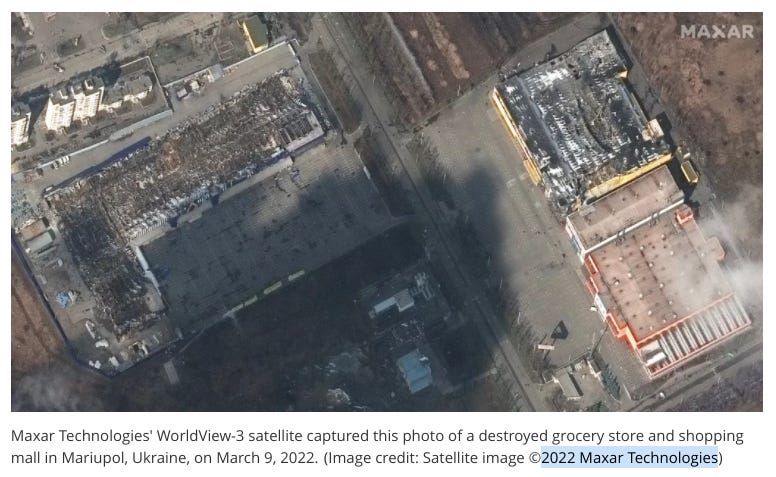

New Position: Maxar Technologies MAXR 0.00%↑

Maxar Technologies is our newest high conviction investment. Maxar is a trusted partner and innovator in Earth Intelligence and Space Infrastructure.

The company has had contracts with the US government for over 20 years. Now they are going global, selling their satellite imagery and analytics to public and private commercial bidders outside of the US.

Maybe you noticed the watermark logo plastered on nearly every satellite image from Ukraine. The free advertisement has been incredible.

Shares remain very inexpensive at only 6x 2023 expected FCF/share.

Growth prospects are on the table with $1.9bn in backfilled orders. Accounting rules prevent backfilled orders from being included in the $279mm EBITDA in 2021 at 50% operating margins.

Debt trades solidly at a premium to par.

The delay to the new Legion satellite launch looks to be back on schedule. This new satellite technology will allow up to 15 intraday high-res 3-D images from anywhere in the world.

This type of high resolution, highly accurate collection capacity is unrivaled by the competition.

MAXR 0.00%↑ currently trades at $33 but we believe it will be a $50-$55 stock once the Legion constellation is safely placed into orbit June 2022 and begins generating cash flow.

The best way to sum up this investment is we believe Maxar is selling shovels to Goldminers during the California Gold Rush. The tactics of war have evolved and Maxar will be well positioned for the future.

Positive Contributors:

This week, we decided to take some gains off the table.

We sold a majority of MUR 0.00%↑ , Murphy Oil, the Houston based junior crude oil and natural gas producer for a 23% realized gain. We believe oil services will outperform operators in the current environment. The consensus view is hyper focused on inflation.

We are all commodity traders now. From cars, to cabinets, to gas, to mortgage rates, to home remodels, to airplane tickets. The inflation narrative is everywhere.

Efficient oil service operators will stand out.

We are doing our homework on HAL 0.00%↑ , Halliburton and SLB 0.00%↑ , Schlumberger Limited as potential replacements. We will take more time to digest earnings and see if there is more clarity in how consumers are valuing topline services in the coming weeks.

We sold 50% of the original position in MOS 0.00%↑ , The Mosaic Company, the largest U.S. producer of potash and phosphate fertilizer.

The stock has soared 54% YTD, due to the structural imbalance in commodities, which I wrote about a month ago. The rationale for selling is really as simple as taking gains along the way while still participating in the commodities tsunami.

Negative Contributors:

We cut ties and sold gun manufacturer Smith & Wesson Brands, SWBI 0.00%↑ this week, down -12% YTD.

A second consecutive quarter of double digit declines in revenue, working capital, relying on current assets and liabilities was also negative.

I overestimated management’ s ability. I expected them to not only operate at a profit but also generate internal cash flows to self fund growth. This is not happening.

We will continuously look to improve our process by removing acquisitions as part of a fundamental valuation process. In this type of market environment there is no white knight to save even profitable companies with no growth prospects.

Final Word

I have exciting news to share: You can now read Tuttle Ventures Newsletter in the new Substack app for iPhone.

With the app, you’ll have a dedicated Inbox for my Substack and any others you subscribe to. New posts will never get lost in your email filters, or stuck in spam. Longer posts will never cut-off by your email app. Comments and rich media will all work seamlessly. Overall, it’s a big upgrade to the reading experience.

The Substack app is currently available for iOS. If you don’t have an Apple device, you can join the Android waitlist here.

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn or Instagram.

Check out the website or some other work here.

Best,

Darin Tuttle, CFA

Founder & CIO

Tuttle Ventures, LLC

434 N Main, Suite 109, Corona, CA 92880