A new Corona office to better serve YOU!

Actionable Market Insights for Investors

Checkout the new office location Here.

This will allow me to better serve you —my door is always open.

Quick Sidebar If investing really isn’t your thing

Look, I get it, not everybody enjoys talking about investments as much as I do.

If investing really isn’t your thing, but you do want to get your finances in order, then you need to download my 1-Page Daily Productivity Tracker HERE.

Most people don’t know, but I taught myself how to code [DAX, M, HTML].

Learning how to code gave me the opportunity to build enterprise-scale KPI dashboards for successful CEOs and a Fortune 500 company.

It’s not easy creating a comprehensive task management and reporting system, but through the process I got to think like a CEO. I realized the condensed structure allows for valuable actionable insights (and a catchy newsletter headline).

The 1-Page Daily Productivity Tracker is the perfect way to stay on top of your schedule and get things done. This simple tool allows you to see your entire day at a glance, so you can plan your time accordingly and make the most of every minute. The tracker also features space for important projects and BIG WINS, so you can keep all your thoughts in one place. Whether you're a busy professional or a student with a hectic schedule, the 1-Page Daily Productivity Tracker is a must-have for staying organized and on track. Download it HERE.

Back to Basics - Narrow the Focus, Increase the Quality

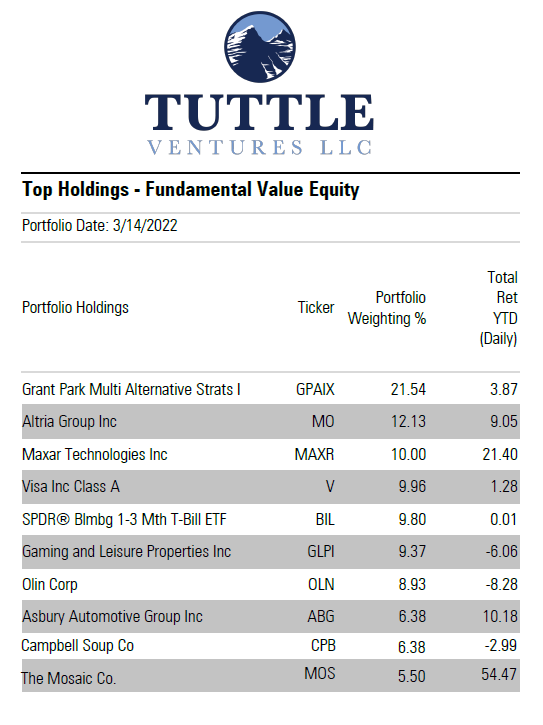

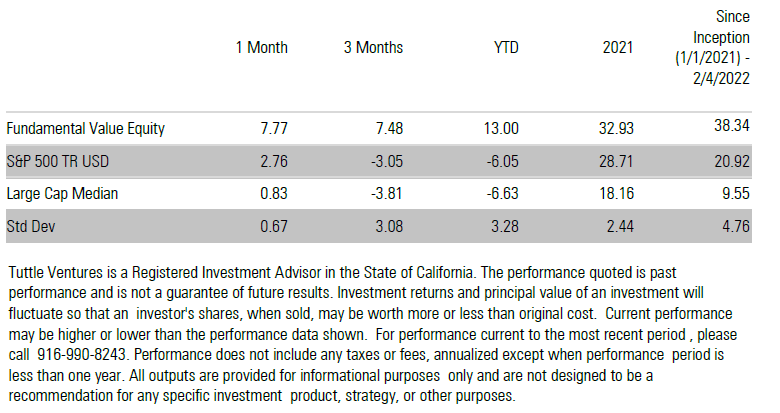

Let’s visit how the Tuttle Ventures Fundamental Portfolio has performed so far:

Positive Contributors:

Since I wrote about $MAXR Technologies here, the stock is up +9.77%.

We are excited about the recent boost and long term opportunities for this company.

Negative Contributors:

Campbell Soup Co , $CPB, is down -5% since its last reported earnings. A concern is that 15%+ of the cost of goods sold is tied to the price of oil. These costs have not been passed on to the consumer in the form of higher prices. Our long term view is that under an inflationary period, the demand for soup products will act as an inferior good - (demand increases when real incomes fall). This has yet to be accepted by the broader market.

Let’s Keep it Real

Aggressive bull markets:

Reward undisciplined businessmen, substandard businesses, aggressive investors, and greedy investment bankers - Richard Lawrence from “The Model”

Price discovery was buried due to free money. The bull market has turned.

How are you positioned for the most widely predicted, written about, analyzed, and forecasted recession in history?

If you huddle for cash - you will slowly learn that inflation is a tax.

It’s time to get serious about what to expect over the next year.

How it started:

Low interest rates → Low discount rates → High price multiples.

How its going:

High interest rates → High discount rates → Low price multiples.

A combination of allocations to commodities, real estate, infrastructure and value equities, could help reduce the risk of another 60/40 'lost decade' and improve the real risk/reward for multi-asset investors.

We believe it is ultimately Free Cash Flow (FCF) generation, that drives an effective capital allocation, providing company management with a cushion and flexibility to return capital to shareholders, reinvest for growth or pay down debt.

The Weighted Average Cost of Capital (WACC) for a median company under our coverage has increased to 9.1% vs. 7.3% one year ago.

We are overweighting companies that have a Cash Return on Invested Capital (CROIC) greater than their Weighted Average Cost of Capital (WACC).

CROIC = EBITDA/(equity capital + preferred shares)

There are two companies that we believe have a good position for the road ahead:

$AVGO, Broadcom- This may be the semiconductor company I have finally been waiting for. Strong competitive position across many semiconductor franchises, resilient gross margin profile (+63% TTM) and healthy FCF generation ($13.7B TTM) underpin the bullish view on the company.

$PM, Phillip Morris- Solid product innovation in reduced-risk products (like iQOS) should drive profitable growth ahead, with the company on track to become a majority smoke-free company by 2025. Management's plan to introduce innovation at a wider variety of price points over the next few years should also help to address affordability issues, drive accelerated growth and capture more share.

Boring, high barrier to entry, slow-growing businesses that pile free cash flow into dividends & buybacks earn shareholders higher compound annual growth rates than you would think.

That’s a wrap

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn or Instagram.

Check out the website or some other work here.

Best,