Winning with money is just math and everything else is overcoming the emotion of it.

Vision | Courage | Patience

Winning with money is just math and everything else is overcoming the emotion of it.

This week, The New Home Company (NWHM), one of my top stocks, was up 83% on news of an acquisition by Apollo ($APO) for $9 Per Share in a $338m Transaction.

Press release here.

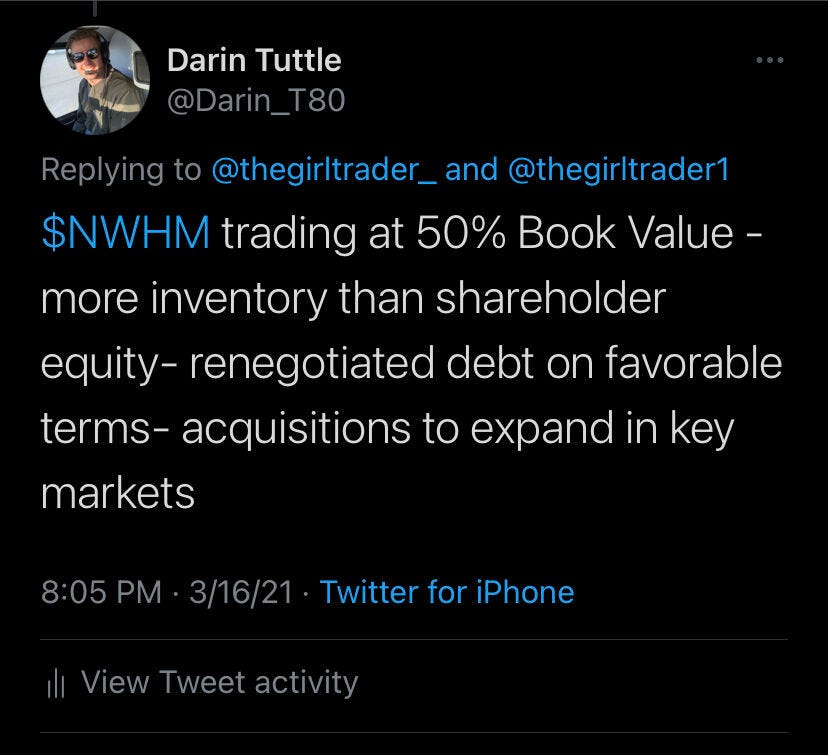

I’ve been bullish on NWHM for months. This announcement is NO SURPRISE but rather a validation of my research and investment process.

Anyone who follows me on Twitter, knows I’ve been one of the few voices to support The New Home Company as a deep value stock.

This home builder based in Irvine had been trading at 50% of book value, amid a very strong home market, quality brand, stable margins and strong management team.

These calls do not happen everyday. The management team at Apollo will take New Home Company private will a cash payment 2x what we paid for the company.

I’m not naive enough to pretend that Tuttle Ventures will only hit home runs, but the past few months have been very rewarding.

I feel compelled to share these early successes.

—What’s the next big idea I can’t stay away from?

This is the future of homebuilding - housing meets mass production.

Boxabl is based in Las Vegas and specializes in the future of factory module construction technology. Boxabl’s goals is to build almost any home faster, and for less, with homes costing $49,500 and taking 90 minutes to complete construction.

You have to see it to believe it. Check it out here.

The company's first order is a $9M+ top line ticket from the U.S. federal government of 20,000 homes.

The company is targeting $50M and plans to use proceeds to build out its manufacturing space and for raw materials.

I’ve reviewed the SEC audited financials posted on 7/8/21, and this company is still very much in the idea phase, a speculative investment, and not suitable for all investors.

In the US, the inventory of homes for sale is startlingly low. The potential market share for a discount homebuilder with profitable economies of scale would treat a disrupter like Boxabl very well.

According to the National Low Income Housing Coalition, The U.S. has a shortage of 6.8 million affordable homes.

To be clear, the opportunity at Boxabl will not be held in the public investment portfolio. This is because Boxabl is a private company for accredited investors only.

-Keep up to date for future newsletter updates.

As always, if you'd like to schedule a time to discuss your personal goals and financial life, click here!

P.S. Click HERE to watch the full rebroadcast to the live Coherra webinar.

—Best,

Darin Tuttle

Founder

Tuttle Ventures, LLC