What's the Score?

Actionable Market Insights for Investors

BIG WIN

Excited to annouce that Tuttle Ventures was named the Most Innovative Investment Portfolio Manager -West Coast, USA by Wealth & Finance Magazine.

Nominees were judged on their merits with assessment centred around an extensive evaluation of skills and services on offer. Final judgement was cast following a review of expertise within a given field/specialism, dedication to customer service and an ongoing/commitment to excellence and innovation.

This approach has brought W&F much commendation during its use and allows the team to identify only the most outstanding and innovative companies.

We believe this further strengthens our committment to YOU and bring you unique ideas backed by interesting research.

Admired Companies Matter

Over the last few years, I have wrestled internally with the idea of purpose driven investing. This is talked about frequently among investment management professionals.

In my opinion, purpose driven investing boils down to one question:

Should investors invest in what they hope their vision of the future should be or what makes the most money?

I don’t consider the Fundamental Value Portfolio to be a charity. I’m running an investment portfolio and I believe that I have a responsibility to make invetments that will have the highest chance of return for investors.

Don’t get me wrong. There are plenty of studies that demonstrate that incorporating ESG (Environmental Social and Corporate Governance) factors can have a beneficial influence on returns.

However, I think the benefit in returns, specifically publicly traded companies, is merely a byproduct of sound business practices of the era.

In other words, how a company is perceived on ESG factors at any point in time is more a reflection of public sentiment. A company’s ability to shape public opinion in how the public views their company matters to the bottom line.

Purpose driven investing is public relations and politics, not profits

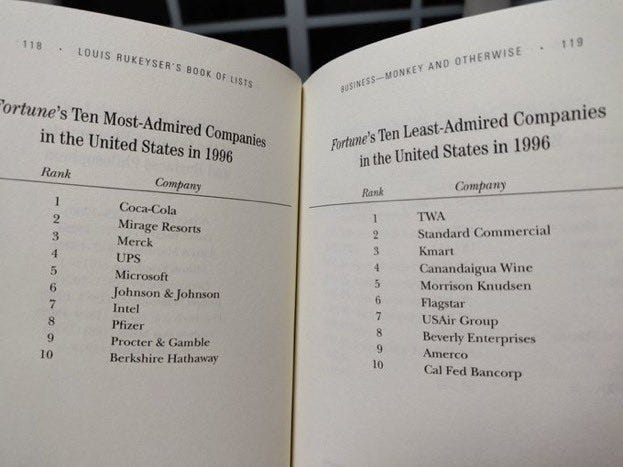

For example: Forbes regularly makes rankings of the Top 10 Most and Least Admired Companies. Going back to 1996, look at the difference between these two lists:

Recognize any on the right?

It’s no surpise that the companies on the left, those most admired (Coca-Cola, Intel, UPS, etc.) are still around today. Household names.

How would each of these admired companies rank in terms of ESG?

Not sure, but does it really matter?

In my opinion, public perception is the deciding factor in any ESG evaluation, the rest should be handled in Washington and not in a corporate board room.

Puzzled by Comscore

Comscore SCO 0.00%↑ is an American media measurement and analytics company providing marketing data and analytics to enterprises; media and advertising agencies; and publishers.

I was told about this company by a small cap portfolio manager who runs a successful fund in the pacific nothwest. He typically makes great calls so I’ve looked under the hood and can’t pin down if this small cap company is worthy of a high conviction play.

Small cap companies typically carry more risk than large cap companies.

Caveat Emptor (Buyer Beware)

Why Should YOU Care?

The story starts centered around Nielsen and Google and monumental shifts in digital marketing post Covid.

Nielsen data measurements dominated during the TV era. They have been the longtime predominant ad currency with all the largest networks paying big bucks to get accurate data on what you watch. The company had $6.29B in revenues in 2020.

Now everyone watches shows from their phones, laptops, tablets, and TVs through Netflix, HBO, and Disney +. Who needs Nielsen anymore when you can go straight to the content provider for data?

Nielsen still holds a key grip on the data currency market because big media companies feel like by buying Nielsen data its better than taking a risk with a different provider.

Comscore, SCOR 0.00%↑ has been the David to Nielsen’s Goliath since its IPO back in 2007. Comscore has had extensive troubles with management that don’t match the real business value.

Management has had a history of diluting shareholder value with financial reporting problems and a history of toxic loans. Despite this, the company has carved some market share by using statistical analysis from small viewer sample sizes to predict what you are watching based on the content being played from the screen.

No More Free Cookies

Google is eventually going cookie free.

Google’s plan to remove third-party cookies from Chrome hasn’t gone smoothly. Back in January 2020 the company announced it would overhaul Chrome by removing cookies that follow people around the web within two years. Hasn’t happened yet.

This is a great set up for $SCOR.

Comscore Predictive Audiences™ is the industry’s first cookie-free targeting capability that enables advertisers to reach desirable audiences based on deterministic audience data and privacy-friendly contextual signals.

Comscore has been cookie free for over a decade, so naturally this should be positive as it can be flexible and adapt to changes made by Google.

A Colossal Deal Denied

On March 14th, Nielsen was trading around $17, when news came out that Elliot and Brookfield made the offer to buy out NLSN 0.00%↑ for $25.40/share and take the company private.

The stock immediately shot up 44% on the news.

Then Nielsen rejected the offer!

Nielsen rejected a roughly $9 billion takeover offer from a private-equity consortium, saying it undervalues the TV-ratings company.

What does this mean for Comscore?

Let’s compare SCOR 0.00%↑ and NLS 0.00%↑ % revenue growth.

Comscore is growing revenues much faster, even if it is only a tiny fraction of the total addressable market.

If you look at the Nielsen private target acquisition multiples and apply them to Comscore, you are looking at a P/S: 2.6, P/B: 2.8, P/C: 23.7.

Comscore should then be trading in the $5.80 - $10.48 price range.

That’s 2x it’s current price of $2.76! Something is not adding up.

Now Nielsen rejected the first deal, Elliott Management and Brookfield Asset Mgmt are back at the drawing board, weighing an even sweeter offer for Nielsen NLS 0.00%↑ after the original $25.40/share offer was rejected... potentially at an even higher multiple.

All the activity has peaked the Street’s interest in digital marketing.

A new coverage report from research firm Craig Hallum prices $SCOR as a potential buy and a $7 price target.

I Still have my Doubts

When I listened to the latest SCO 0.00%↑ earnings call, my biggest concerns have to do with the 1) convertible notes 2) balance sheet and 3) CEO.

I just don’t think management is putting common shareholders first.

Goodwill makes up a massive % of the balance sheet representing 65% of total assets from recent acquisitions.

A nightmare scenario for investors would be any impairments to goodwill. In 2019, there was a massive impairment of assets and could happen again.

The new digital and cross-platform reported metrics may take awhile for any impairments to be realized so its a key area of focus if revenue growth doesn’t take more market share from Nielsen over the next few quarters.

The convertible notes are a major concern. The potential exercise of the 82m shares of convertible shares could fully dilute the common shareholders to zero. In addition, the special dividends being paid to the preferred shares currently continue to be a net cash drag.

The convertible note investors will be entitled to an annual cash dividend of 7.5% on their respective amounts and can request a one-time dividend recapitalization transaction after January 1, 2022 of up to 3.0x LTM Adjusted EBITDA, as defined in the transaction documents.

The activity by the CEO is also odd. Bill Livek announced he was stepping away from the company without naming a successor. The company has had poor management and a rotating chair of CEO’s for several years. Bill plans to leave by 2024. He also purchased 400,000 shares of common stock worth $1,045,499.90 in 3 transactions from March 3 to March 7th representing a 28.584% change in holdings.

In my experience, CEO’s will sell for all types of reasons but usually only buy because of one. They think the stock is going up. However, the convertible toxic shares are a huge red flag and make me discount the CEO’s action.

This is a negative signal for the company and most likely a pass for better opportunities elsewhere.

Final Word

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn or Instagram.

Check out the website or some other work here.

Best,

Darin Tuttle, CFA

Founder & CIO

Tuttle Ventures, LLC

434 N Main, Suite 109, Corona, CA 92880

Congrats on the award!

Congrats on the award!