The Stock Market is not Rational

Investing Insights from Tuttle Ventures

Welcome to +32 new subscribers over the last 30 days.

If you are looking for unique investment ideas backed by interesting research, you have come to the right place.

This weeks newsletter is sponsored by:

All-in-one digital protection for the whole family, powered by AI

Aura uses cutting-edge AI technology to scan the internet to identify where your personal information could be exposed. With Aura, you can take control of your online privacy and secure your digital footprint. Try Aura free for 2 weeks, no obligation.

Sometimes the stock market will make me appear much smarter than I actually am, and at other times, significantly less so.

We aim to create a trusting relationship with our readers that assures we will do our best.

Most good investors are rational, while the stock market is not.

Financial markets are complex systems with many moving parts driven by good, bad, or irrational reasons. The market itself really represents nothing more than a pendulum, swinging back and forth through the median line of rationality. It spends very little time at the point of rationality and a majority of the time wildly on one side or the other.

It is not until the pendulum swings in the opposite direction when things become obvious in hindsight.

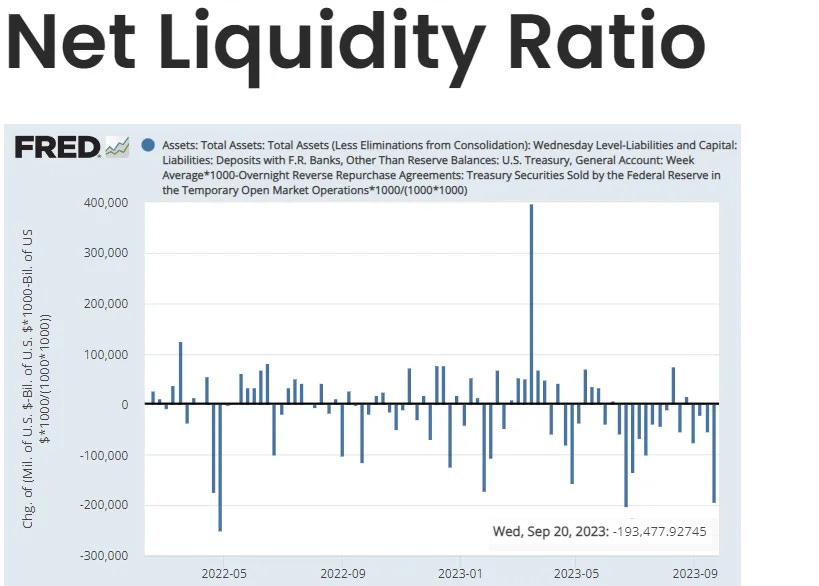

Net Liquidity Correlation Breakdown

In markets the goalposts are always changing…

Something works until it doesn’t.

Correlations are not constant.

From March 2020 to February 2023, the stock market's response closely followed the Net Liquidity Ratio with a two week lag.

As the signal gained in popularity, (and the correlation remained strong) critics cited the lack of treasury bill maturity schedules and net new issuance as key missing factors.

The Bank Term Funding Program (BTFP) and regional bank bailout essentially rendered the signal useless for the past 6 months.

The program had such an outsized effect, the ratio was nothing more than noise.

The primary reason was because the market was sourcing liquidity from something not captured in the model.

Despite this, we have weekly updated the Net Liquidity Ratio published on our website.

We noticed an outlier effect during our market review.

This week the ratio logged its third largest drawdown ever over the past 18 months…(-$193B)…

Based on the timeliness of the drawdown, and the current market pressure we are seeing, we think it could mean that the BTFP is not being used at the same level it was before.

The FDIC could be using proceeds to pay down a corresponding amount of its emergency loans from the Fed.

A footnote in the full PDF version of the DTS noted that the payment was in fact associated with the FDIC plans to initiate a substantial paydown in the program.

As of last Wednesday, the Fed’s “other credit extensions” were down $95B from their May 3 peak.

If the BTFP is indeed being repaid in full, we think this could make the Net Liquidity Ratio relevant again until the end of 2023.

Which would then lead the market lower in the short term.

This is something we will continue to monitor going forward…

Final Word

We're grateful for the opportunity to learn, grow, and invest alongside you at Tuttle Ventures.

Vision, Courage, and Patience leads to successful investing.

Like what I have to say?

Let’s discuss your individual investment portfolio by scheduling a time below:

Book a meeting with Darin Tuttle

Best regards,

This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.