The Loan Fee Anomaly: A Short Seller's Best Ideas

Actionable Market Insights for Investors

Welcome to +15 new subscribers this week & +358 over the last 90 days!

Today’s takeaway: New research suggests that stock loan fees, which have been largely ignored by the investing public, are the best predictor of cross-sectional returns. If you don’t already have a process in place to keep an eye on loan fees— you probably should start.

What are Stock Loan Fees?

What does the Research Say?

How can this research improve an Investment Process?

What are Stock Loan Fees?

A stock loan fee, or borrow fee, is a fee charged by a brokerage firm to a client for borrowing shares.

From Vanguard to Blackrock, every major player on the street makes millions a year by loaning out securities. Short selling and securities lending are key for price discovery and market liquidity.

According to the Managed Futures Association, pension funds earned more than $1 billion from collection of fees on loaned securities in 2020.

The diagram below outlines a simplified short selling transaction.

Highlighted in yellow is where the loan fee comes into play:

The loan fee is what institutional investors receive as payment for lending out their stocks.

The common range of borrow fee rates is 0.3% to 3% per year. However, when there is high demand for a short sale, it's not uncommon to see borrow fees exceeding 20%.

The higher the fee, the harder it becomes to borrow the stock.

The use of exchange-traded products in passive institutional long portfolios has resulted in record highs for lendable assets and loan balances.

Back when I used to work on Wall Street, securities lending operations was my first love. My first job out of college, I was a bright eyed squire to the knights who traded on the firms securities lending desk.

Traders used the borrow fee rate as a measure of a trade's risk-return ratio.

I saw first hand what trading strategies went boom or bust.

Those that ignored the loan fee wouldn’t make it very long.

Through the pain of operational experience, I respected the loan fee as the arbiter of truth to measure every short seller’s PnL.

The weighted balance between conviction and cost.

What does the Research Say?

Published in August 2022, a cross academic study by Engelberg, Evans, Leonard, Reed and Ringgenberg looked at IHS Markit data and found that equity loan fees are the best predictor of cross-sectional equity returns in a long/short portfolio.

You can read the study for yourself here.

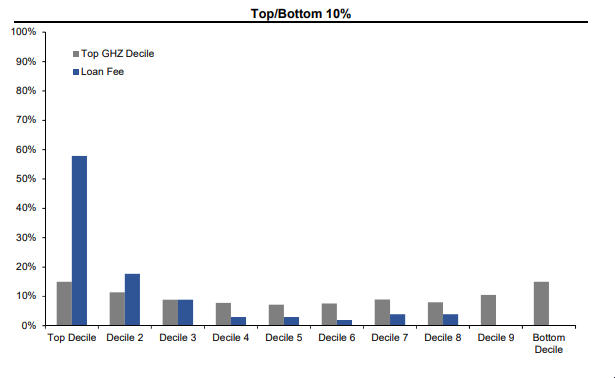

The academics compared 102 market anomalies—including other short selling measures— and found that the loan fee anomaly had the highest monthly long-short return and the highest monthly Sharpe Ratio even after accounting for management fees and transaction costs.

Overall, the results show the loan fee anomaly continues to predict returns even after adjusting for the fact that loan fees are a cost that must be paid by short sellers.

While prior work has shown that existing anomalies reside in high loan fee stocks, the researchers also found that 71% of loan fee outperformance is due to unique information not contained in other anomalies.

The fee rate alone provided enough information to create an outperforming portfolio.

Intuitively this makes sense, based on my own personal experience.

The calculation of a loan fee rate is as much an art and it is a science.

Information is never perfect.

Fee rates are updated intraday and set with the best available information shared across counterparties.

Similar to how banks take into consideration a borrower's credit risk, maturity, taxes, income, savings, and other financial metrics to set an interest rate on a consumer loan—there are a multitude of factors that are assessed when a loan fee is set.

Share availability, average daily volume, options implied volatility, upcoming securities litigation, corporate actions requiring a shareholder vote and other special situations can all have an outsized impact on a loan fee.

This is one of the reasons why an operational background can provide a distinct advantage.

Of course, its impossible to identify all of the information in a loan fee because it includes a huge range of possible sources of idiosyncratic information.

For example, from 2004 to 2019 stocks in the top 10% of loan fees are twice as likely as general collateral stocks to be in some phase of a class action lawsuit.

Just the thought of sitting through a law school class bores me to tears.

Bottom Line: Short-sellers are well known to be informed traders and high loan fee stocks represent investments short-sellers are willing to pay the most for – their very best ideas.

How can this research improve an Investment Process?

For those that invest with Tuttle Ventures, know that we account for loan fees as an integral part of our investment management process.

For the DIY investor, a simple fee loan screen can be set up at most brokerage firms.

Below is an example from Interactive Brokers which shows the highest fee loan securities on a daily basis:

Bottom Line: Once your investment portfolio is on a firm standing and you have a good indication of where your opportunities and vulnerabilities lie— information like this can help identify the signal from the noise.

Final Word

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Vision, Courage and Patience leads to successful investing.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn or Instagram.

Check out the website or some other work here.

Best,

Darin Tuttle, CFA

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.