The Great Escape

Fighting Back Recession Fears and Restoring Faith into Year End

Mirroring the legendary escape of Steve McQueen from a World War II prisoner-of-war camp, the U.S. stock market has deftly maneuvered out of the shadows of looming recession forecasts, charting a path of resilience and unexpected turns.

I’m rooting for the escapism to continue as we maintain our bullish view for risk assets heading into year end.

Here is what we are looking at:

The Fed is done hiking

The Fiscal Money Printer is still on

Although the journey might be filled with ups and downs, we anticipate that the S&P 500 will gradually grind higher as we approach the end of the year.

The Fed is done hiking

Markets have come around to the view that central banks will not quickly ease policy in a world shaped by supply constraints. We see them keeping policy tight to lean against inflationary pressures.

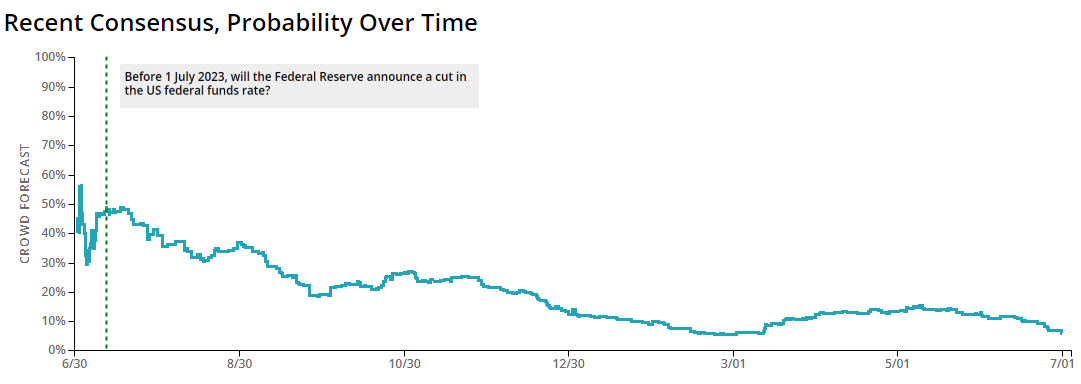

Over 2023, the crowd consensus grew increasingly skeptical about the likelihood of a rate cut by the Fed.

The chart above from the Good Judgment Open Project Forecasts shows how the rate cut expectations were crushed throughout 2023. The consensus started at 40% to a drop of 7% at the July close.

Focusing specifically on the period close to an election, the Fed has been more inclined to lower rates or adopt more accommodative policies as Election Day nears.

In the two months prior to Election Day, the Fed has acted to lower rates or ease policy in four election cycles (1984, 1992, 2008, and QE3 in 2012). Only in September 2004 did the Fed increase rates close to an election.

The last time the Federal Reserve announced a cut to the US federal funds rate was 15 March 2020.

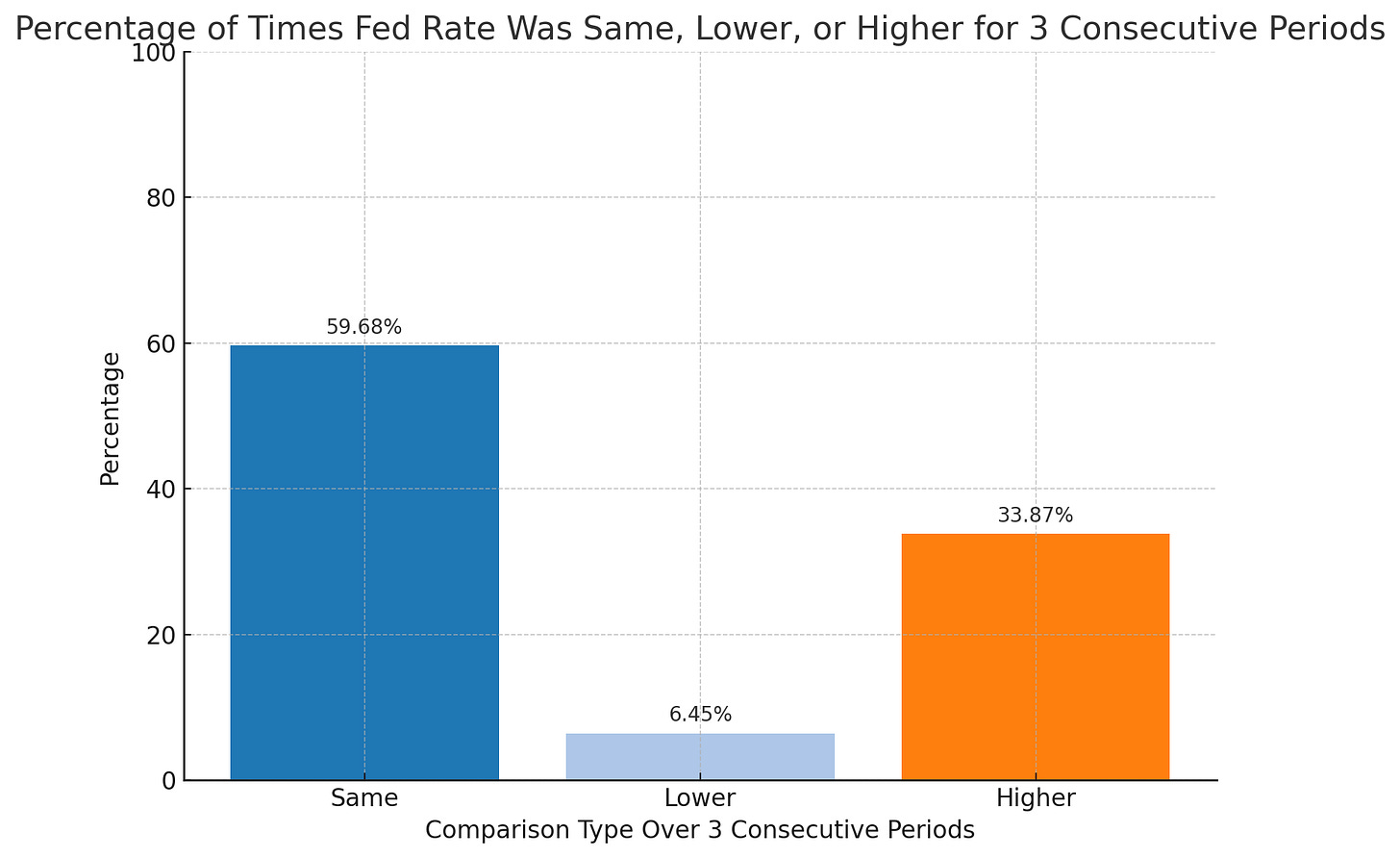

In fact, the odds that rates stay the same for a period of time, after a hiking cycle, is nearly 60% going back the last 40 years.

The Fiscal Money Printer is still on

The government is spending at wartime levels while at full employment.

US Federal Government Spending as a % of GDP is at 23.14%.

This is higher than the long term average of 20.59% going back to 1947.

Today federal, state, and local expenditures as a share of GDP are back at the highs reached during World War II.

This infusion of government funds can lead to higher corporate profits, which is a driver for stock market growth.

Within the same breath, the unemployment rate is at 3.9% which is relatively low by historical standards.

Even under ideal free-market conditions, using policies to expand the economy (like pumping more money into it or increasing government spending) wouldn't decrease the purchasing power of people's wages. Instead, the stimulus simply increases the prices of financial assets, goods, and services nominally, with no real change in the economic standing or purchasing power to those who are underinvested.

In the short term, we believe this will be beneficial for risk assets and window dressing going into year end, while the longer term stagflation risks are still prescient.

Final Word

Thank you for reading and I am grateful and humbled to be able to learn, grow, and invest alongside you at Tuttle Ventures.

Vision, courage, and patience leads to successful investing.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn, or Instagram.

Check out the website or some other work here.

Best,

Darin Tuttle, CFA

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.