The 3 Types of Financial Couples Every Investor Should Know

Unlocking Harmony in Money Matters: Navigating the Complex Dynamics of Couple Finances

American couples are some of the most financially smart and resilient in the world.

While every couple has its unique makeup, who you choose to save, invest, and plan for the future with is important.

Researchers have shown that if couples manage their money in sound ways, their marriages can benefit too.

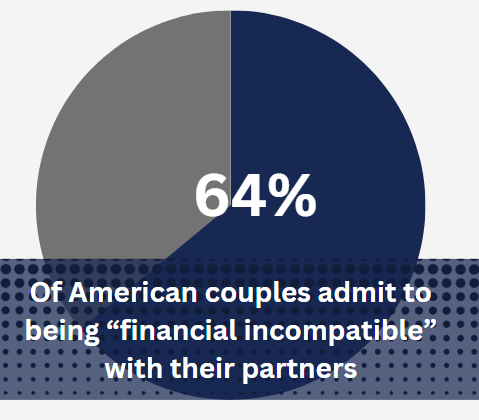

A new survey finds that 64% of couples admit to being “financially incompatible” with their partners.

Unfortunately, this friction can lead some to commit so-called financial infidelity, hiding purchases from their partner. In this survey by the fintech firm Bread Financial, 45% of coupled adults admitted they’re guilty.

That’s where a financial advisor can provide value.

As a financial advisor, at Tuttle Ventures, I have recognized three primary types of financial couples:

The 2 Spenders

The 2 Savers

The Balanced Couple – The Spender and Saver

Understanding the dynamics of each is crucial to navigate the personal behavioral aspects of financial planning, investments, and goal setting.

Let’s delve deeper into each type…

1. The 2 Spenders

Traits: We have fun here. After all, what good is money if you don’t have the chance to enjoy it? Both partners in this coupling tend to spend money more liberally, with big dreams and aspirations. Some build empires, while others showcase what wealth can do for their life. Often they choose to spend and deal with the consequences later.

Their motto? “Work hard, play hard.”

Advisor’s Strategy:

I set the bar high and hold the couple accountable to their goals. Together we get a sustainable financial pace that fits their lifestyle and keeps things fun.

I show the long term tradeoffs in financial decisions, showing short and long term impact of impulsive decisions. We set up a way to enjoy working towards those short and long term goals that fall in place with the couples values.

We look to automate as much of daily cashflow as possible.

The timing of meetings is not well defined, but we do set strict terms on when a financial advisor needs to be “in the loop” to minimize the potential for long term regret such as large asset purchases, income changes and changes in tax domicile.

For a spenders couple, our financial flows model is geared to be flexible.

Separate spending account for each member of the couple are typically a larger % of overall income (e.g. 20-30%). We identify non-negotiables on commentary about the other members spending and bring everything back to the what they share in values.

As the financial advisor, I enjoy sharing the big wins with the spenders (and saving for the future along the way).

2. The 2 Savers

Traits: Both partners are cautious about spending and lean towards saving more. The beauty of this pair? There’s a world of potential to achieve all their financial dreams. The least common of couples (but the highest percentage of millionaires in the US). Feelings about money can be strong, reflecting past trauma or lack of education.

Advisor’s Strategy:

It’s essential to explain the concept of “enough” and tap into their natural discipline to frame stretch goals while keeping stability.

We encourage transparency to stop “stuffing under the mattress” and let their money go to work for them.

We look for balance by setting cash targets, investing based on well defined buckets, and “fun goals” so they don’t hold themselves back from their own growth and development by clinging to comfort.

We set date and dollar specific goals to avoid procrastination or feeling paralyzed with fear.

We set frequent discussions on finances typically 4 times a year to ensure alignment on mutual goals.

For a savers couple, the separate spending accounts in the budget outline are typically a small % of overall income (e.g. 10%) but solve many potential financial issues that could arise.

3. The Spender & Saver

Traits: Yin and Yang. This pair has one person who tends to spend without hesitation, while the other leans towards saving. The magic lies in their balance.

Advisor’s Strategy:

We have a no judgement zone. Everyone is on the same team and one type is not better than the other.

These are my favorite couples to work with because there is so much potential to reach ALL of their financial goals. We take the time in the early meetings to compliment the balance that each member brings to the couples finances. Just like with the savers, we explain the meaning of “enough” and tap into the couples natural discipline to create stretch goals.

Recognizing the strengths each partner brings to the table is vital.

Setting clear goals and the frequency of financial discussions ensures that both partners are on the same page.

It’s essential for the spender to identify specific, big-ticket goals, while the saver should be ready to compromise on a few, ensuring a harmonious financial journey.

As always, transparency and communication are the pillars to financial success.

Bucketing investment strategies often works for retirement distributions.

In the budget outline, we ask the spender to target a few big ticket goals over the next year that they have (Date and Dollar specific) we then seek for the saver to compromise on a few of those spends based on current or future planned resources.

Then we ask the saver to set a defined saving goal (date and dollar specific) we look for the spender to comprise and agree to save. After each goal, we add the phrase “so that…” so the goals are aligned on common values.

Over time, as the financial advisor we act as a guardrail for the couple to minimize long term regret. We focus on making the financial goals the primary tradeoff when conflicts arise.

The Separate Spending Account Philosophy:

Having separate spending accounts is an effective strategy I endorse for all these couple types. Why?

Autonomy: It gives each partner some financial freedom. They don’t have to explain or discuss every purchase with their other half.

Avoid Conflicts: Keeping discretionary spending separate minimizes potential money disputes.

By understanding and respecting each type, every couple can find a harmonious and efficient path to financial freedom. With the right guidance, any couple can navigate the financial waters smoothly, ensuring a secure and prosperous future.

Final Word

Thank you for reading and I am grateful and humbled to be able to learn, grow, and invest alongside you at Tuttle Ventures.

Vision, Courage, and Patience leads to successful investing.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn, or Instagram.

Check out the website or some other work here, proudly serving in Corona, California.

Best,

Darin Tuttle, CFA

NOTE – This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.