Supply or Demand

Vision | Courage | Patience for successful investors

Welcome to the 48 new subscribers, this week!👏

For everyone new, we share actionable market insights and portfolio updates so YOU can make better investment decisions and get an inside view at Tuttle Ventures — get to know more of our founding story here.

I greatly appreciate the community we are building and don’t forget to share with your friends! If you’d like me to write about a topic or stock, reply to this post. I will reply personally to every response.

Big news to share!

I'm excited to announce that Socket has raised a $4.6M Series Seed.

Back in February 2022 newsletter, we gave everyone an inside peak into what Feross Aboukhadijeh, has built with the Wormhole.app, a revolutionary way to send files, instantly, anywhere.

A flywheel of the project was Socket Security, which allows developers to detect and block potentially malicious code of open source repositories.

Read the in-depth TechCrunch exclusive here.

The importance of a free and open internet cannot be understated.

Socket’s goal is to safeguard the open source ecosystem for everyone.

When my former teammates and friends succeed, I feel a sense of pride. It's like I helped them achieve their goals even though all I did was provide moral support or encouragement. But more than that, their success reminds me that it's possible to make a difference in the world. When they make the world a better place, it gives me hope that maybe, someday, I can too.

Build. Learn. Share. Grow.

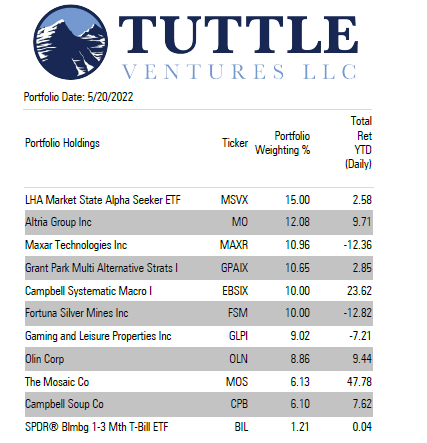

Let’s revisit TV’s core portfolio holdings and performance as of 5/20/2022:

In typical bear market fashion, the selloff is leaving no stone unturned, the Fundamental Value Equity portfolio has been treading water this month, buoyed by early gains on the year in materials, energy and resources.

We believe that we are positioned in the “needs based” economy and did not make any new trades this week.

“Demand Destruction” is suddenly a popular buzzword. Without a quantifiable measure, demand destruction is a spooky word thrown around, everyone nodding their head in agreement, ending any argument before it begins.

But what does this really mean?

Demand Destruction refers to a permanent or sustained decline in the demand for a certain good in response to persistent high prices or limited supply.

Because of persistent high prices, consumers may decide it is not worth purchasing as much of that good, or seek out alternatives as substitutes.

Some substitutes and alternatives are readily available, while others require increasing capital expenditures to shift the way people and companies operate on a day to day basis.

Know the trade-offs and you can find a trade.

Words are powerful — they have the ability to create a moment and the strength to destroy it

I think it’s important to define and quantify demand destruction in order to view the market with clear eyes adjusted for potential risks ahead.

What’s the breakpoint?

Is demand destruction a 10% drop or 20% drop in consumer spending? What about 30%?

At what point does consumer sentiment match consumer spending habits?

I have yet to find great research specifically addressing this topic.

All I know is that the forces of demand destruction far outweigh the forces of supply destruction in the short term, as we have been living in a supply destruction regime for the better part of March 2020 without a recession.

According to Gasbuddy data, the average May monthly diesel gallons per user is now down 34% from its trending average.

On the other hand, the US DOT says March vehicle miles traveled (VMTs) hit the highest ever March level, 1.83% above March 2019.

Is that due to demand or supply?

It is hard to think that demand destruction can happen so suddenly that it can leads the US into a recession in just a two month period.

In my opinion, Demand destruction has been weaponized to lead recession fears and especially negate the energy bull market without a reasonable assessment of the low point.

The word has entered the zeitgeist but has not changed the actual habits of many US consumers. Sentiment is at record lows but spending still remains high.

This overweight market fears without providing valid evidence.

Let’s remember the greatest demand destruction occurred during the lockdowns of 2020. This was a coordinated policy enacted on the local, state and federal level.

For now, I have more questions than answers and appreciate any comments or insights our community of investors can share into how they are quantifying the impact of demand destruction across investment portfolios.

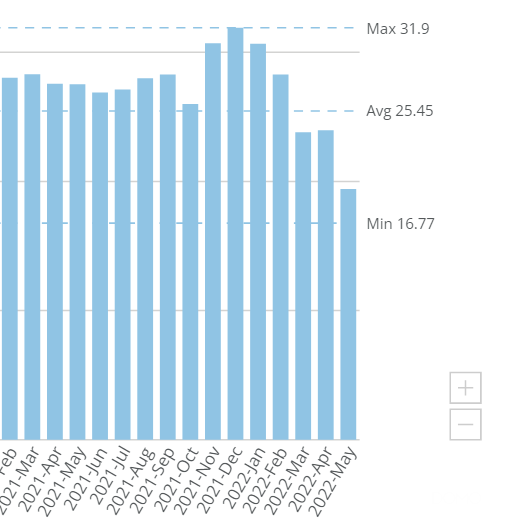

The last time demand destruction was popular in google search?

January 2008

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn or Instagram.

Check out the website or some other work here.

Best,

Darin Tuttle, CFA

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.