Spring Cleaning -Market Edition

Actionable Market Insights- Vision | Courage | Patience

Welcome, 50 new subscribers to the newsletter this week! 👏

For all our new readers, we share actionable market insights and portfolio updates so YOU can make better investment decisions and get an inside view at Tuttle Ventures — a leading investment manager in Southern California.

Have you ever tried to Spring Clean your entire house in a day?

So much is happening all at once.

The market is making a clean sweep in every corner with broad selloffs.

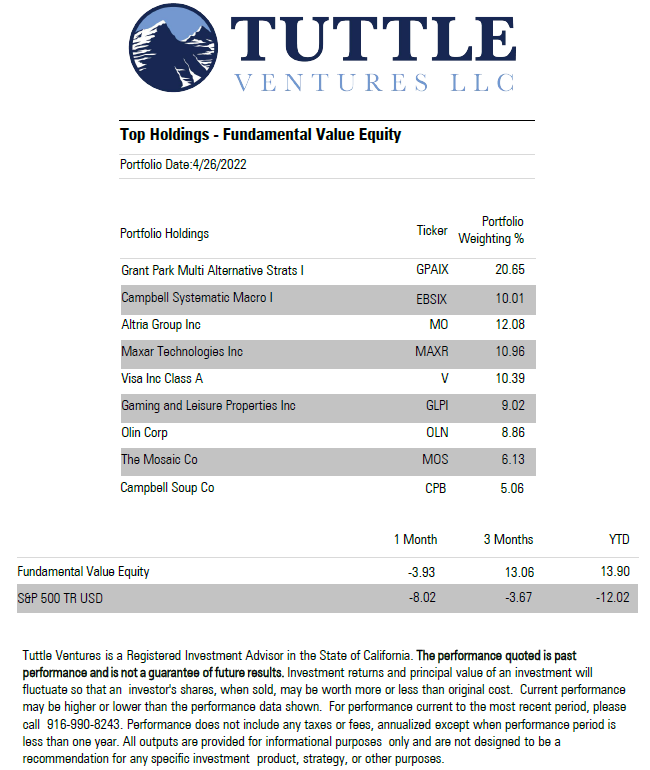

Current portfolio holdings and performance as of 4/26/2022:

New Holding:

We added another global systematic macro fund, Campbell Systematic Macro I, $EBSIX as a core holding. The Fund is up +22% YTD and up +8% for select investor accounts since 3/7/2022.

One of the biggest features of managed futures, often overlooked, is the ability to short bonds.

I’ve been recently following Andrew Beer, who does a fantastic job giving a fair and balanced view under inflationary conditions for the strategy, read more here.

According to the latest HFR Global Hedge Fund Industry Report, Institutional Investors allocated the largest amount of new capital to systematic macro hedge funds since 2015.

This is one of the quickest decisions to allocate to a fund we have ever made. From initial contact with the fund manager in early February 2022 to today. We are continually impressed with management’s track record and positioning across global futures markets.

Positive Contributors:

Campbell Soup Company ($CPB), a staple brand in American kitchens, is up +1.63% over the last 5 days. We think CPB will prove itself with durable revenue growth and higher prices to pass on to consumers on earnings. The company historically delivers seasonally strong gross margins in FY 1Q given a mix of high-margin soup sales this time of year.

Negative Contributors:

The Mosaic Company, $MOS, the largest US producer of potash and phosphate fertilizer, experienced its largest one-day drop in company history.

A $10 drop from 4/18 high.

Fundamentals on $MOS haven't changed. We still have a world fertilizer shortage, especially in Europe. We think unprecedented volatility in the stock allowed option speculators the perfect target for profiting on elevated volatility in the selloff before earnings. Maybe a few more days down from overall market momentum, but we believe this may head back up if the macro picture doesn’t change.

Paul Tudor Jones famously said:

"The illusion has been created that there is an explanation for everything, with the primary task to find that explanation."

He's dead on right. We want to stop trying to "explain" market moves, and start making money.

That’s it.

While we try to provide historical context here to our valued investors—at the same time— know that we spend most of our time thinking about the present and future and what that looks like from an investor standpoint.

40 years of falling interest rates made investing easy. The more leverage, the higher the return. The more risk, the higher the return. It made everyone look smart.

We try to take a contrarian view of the market and continue to share our best and most unique ideas with you.

Here are two current macro research themes that are Top of Mind if you’d like to read more:

Why the US is headed toward Japan

The VIX-Yield Curve Super-cycle

Final Word with a Quick Update on Boxabl:

Many investors have asked that we share an update on Boxabl since our last write-up.

We still believe this company is the future of homebuilding - where housing meets mass production.

Some recent good news:

We think the best-case scenario, Paolo and Galiano Tiramani bring in an outside director with a more disciplined operations background to grow into the newest $1B valuation. (Previously $100m just 9 months ago).

In conversations with Galiano, it looks like they are trying to find a good SPAC (Special Purpose Acquisition Company) sponsor to go public and raise the funds needed for a significantly larger factory.

As a disruptor in the industry- it’s my opinion that the company may need to stay private for longer to show proof of work under factory 1.

These things take time, consider some notable public company timelines:

Amazon, Google, eBay, Netflix, Salesforce — 3 yrs before going public.

Dropbox, Spotify, Pinterest, Lyft, Uber — 11 yrs before going public.

For most investors reading this newsletter, it hasn’t even been 1 year.

These disruptors take time, it will be interesting to see how this plays out.

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn or Instagram.

Check out the website or some other work here.

Best,

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.