Space X Update: Final Frontier Revenue Breakdown and Growth Outlook

Unpacking the financial performance of the world's leading space company

SpaceX has achieved significant milestones in its core business.

Following Payload’s 1st Annual Space Investor Summit, we believe an update is due.

SpaceX has not disclosed specific annual revenue data for its key operations, which include launch services and the Starlink internet service.

Our revenue breakdown is based on publicly available data and estimates from reputable third-party sources due to SpaceX's limited financial disclosures.

The original analysis authored by Mo Islam, Payload’s cofounder and a former Wall Street analyst, has been a reference point but is not based on access to any SpaceX internal data or proprietary info.

SpaceX 2023 Revenue Estimate

We categorize SpaceX's income into three main streams: Launch operations, Starlink equipment sales, and Starlink service subscriptions.

Our revenue estimates for each segment are as follows: Launch operations include various Falcon 9 and Falcon Heavy launches, as well as the Starship SuperHeavy missions.

Starlink Hardware sales are categorized by customer type, such as Residential & RV and Business, and by mobility solutions like Land Mobility, Maritime, and Aviation.

Finally, Starlink Subscriptions outline the recurring income from customers in similar categories.

Our aim is to offer a clear and concise summary of SpaceX's potential earnings across these sectors, culminating in a comprehensive total revenue estimate for 2023. Please be reminded that these figures are approximate and subject to change as they are based on external analysis and not on official SpaceX financial statements.

For the Launch segment, the Falcon 9 has established itself as a cost-effective and dependable launch option with a 98% full mission success rate.

The Starship's performance has been mixed.

The massive size of the rocket is incredible, but its second test was cut short after briefly reaching space.

This makes 2024 a crucial year for Starship to achieve the same level of reliability and safety as the Falcon 9.

Despite the media focus on Starship, its contribution to the launch business has been minimal so far, though it is vital for future expansion. Starship is crucial for deploying the next phase of the Starlink network.

Starlink Subscriptions

SpaceX is clearly at a point where its ability to scale revenue is real. 2024 will be the first full year of Starlink subscriptions and we believe the key aspect for growth heading into 2024.

Our subscription growth forecast is not contingent on the success of Starship.

Starlink has officially passed the 2 million subscriber mark, SpaceX announced on Sept. 23. During the spring of 2023, new subscription were added at a rate of 3,500 new subscriptions per day.

Forecasting future demand would relate to a 1.6X growth multiple in 2024 and just over 4 million subscribers, while below past estimates the topline revenue is impressive.

If you combine these estimates with the fact that Starlink recently achieved breakeven cash flow, the full picture for 2024 and 2025 begins to take shape.

SpaceX Estimated Growth

Based on current growth trends, we estimate topline revenues could be in the range of ~$20B by 2025.

From the starting point of $4.6B in 2022 as reported in the Wall Street Journal, costs have increased but revenues have risen faster.

This growth is primarily driven by the expansion of Starlink subscriptions and the realization of backlog from the existing launch contract pipeline.

Our backlog estimates represent carryover demand which began in 2018.

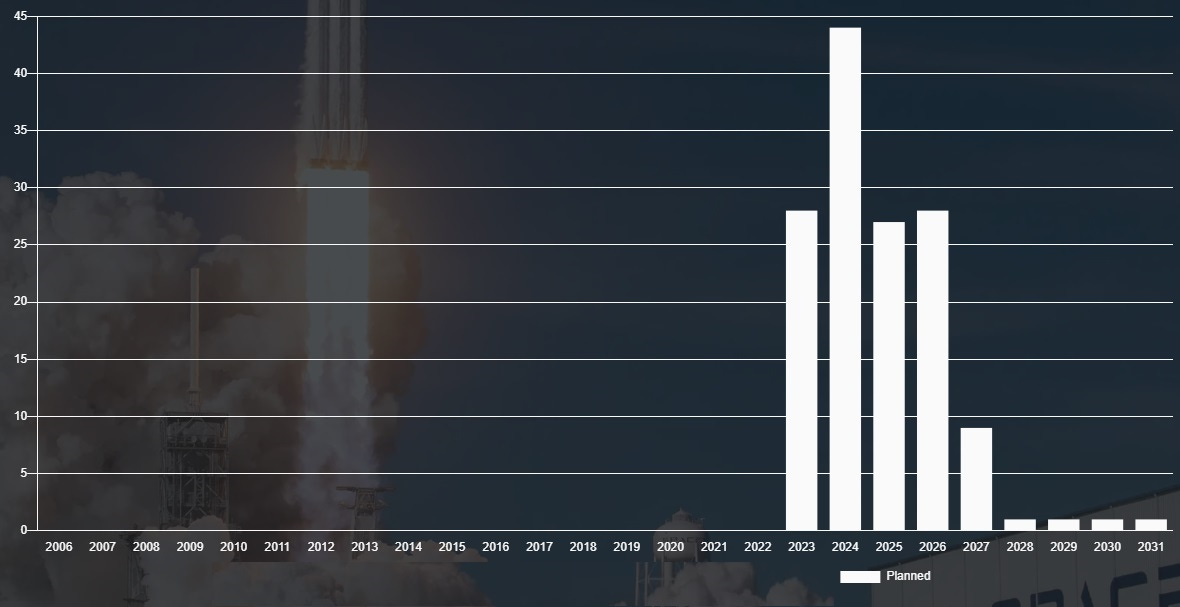

Based on SpaceXstats data, there are 140 planned flights scheduled through 2031.

To clear, SpaceX would need to fulfill 28 planned flights in 2023 and 44 in 2024.

While SpaceX's launch cadence has been steadily increasing at a rate of 1.5x over the last 3 years, additional demand has outpaced capacity.

We estimate that 2024 will continue to be a record year with planned flight demand increasing 3x based on the National Aviation 5 Year Research Plan and overall commercial interests.

Where exactly the market prices a topline of $20B in revenues and $8B in EBITDA in 2025 is still to be determined.

Last week billionaire investor Ron Baron — the founder, chief executive officer and portfolio manager at Baron Capital — told CNBC that he expects a Starlink IPO could make SpaceX worth around $250 billion to $300 billion by that time.

Considering the top holdings of the S&P Kensho Global Space Index and the premium associated with Elon Musk's Tesla, we apply a 33x EV/EBITDA valuation multiple to SpaceX. This multiple reflects the mean valuation of companies in the index and the premium commanded by Tesla.

Applying the 33x EV/EBITDA multiple to the projected $8 billion in EBITDA for 2025 results in a total valuation of $264 billion for SpaceX.

SpaceX's impressive growth trajectory, driven by its expanding Starlink satellite internet service and robust launch operations, positions it as a compelling investment opportunity with the potential to revolutionize the space industry.

Final Word

Thank you for reading and I am grateful and humbled to be able to learn, grow, and invest alongside you at Tuttle Ventures.

Successful investing requires vision, courage, and patience.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn, or Instagram.

Check out the website or some other work here.

Best,

Darin Tuttle, CFA

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.