Portfolio Updates

Actionable Market Insights from Tuttle Ventures

Welcome to +121 new subscribers this month & +288 over the last 90 days.

I started Tuttle Ventures in order to help people find lasting financial security.

If you like what you are reading, consider subscribing today:

Newsletter Rundown:

Portfolio Updates

General Comments

Final Word

Portfolio Updates

Here are current portfolio holdings as of 12/31/2022:

(Last updates to the portfolio were made on 11/21/2022)

General Comments

2022 was a tough year for most investors.

The Fundamental Value Portfolio was no exception.

The outperformance for our positions proved to be most effective in the first half of the year, while the second half proved to be more difficult.

That being said, closing the year positive on a total return basis, has some merit.

As uncertainty has increased, we have leaned towards more diversification and stability.

We think the second half of the year proved to be more challenging because we did not expect the sudden turn in commodity prices and the market’s counter of bear market rallies.

We also saw the timing of our defensive positioning and a lack of the managed futures to capture any significant trends over the last 3 months to be headwinds.

It's my goal to help minimize long-term regret.

While we are optimistic about the future, I'm not willing to shrug off everything and pretend like a stock market rebound is a guarantee in 2023.

In our opinion, the greatest hurdles in 2023 could be lower corporate profits and the abundant reserves held back by the Fed, which could reignite inflation.

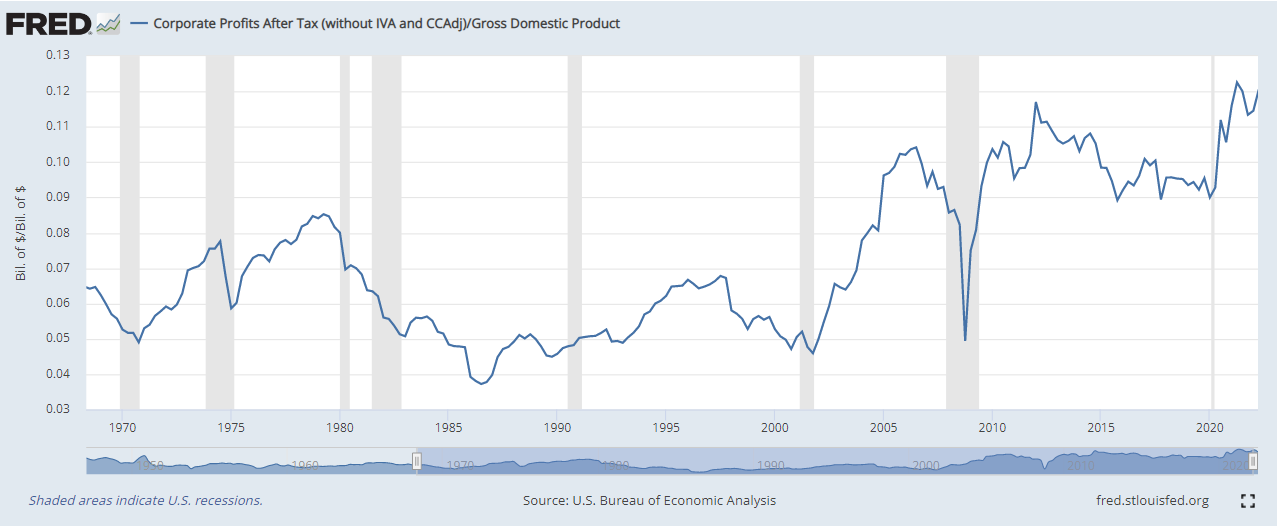

U.S. Corporate Profits as % GDP are near all time highs. We expect this to come down going into 2023.

Overnight Reverse Repo Agreements casually reached record high levels on the last trading day of 2022 at $2.55T. We think this presents a tightrope for the Fed to walk to balance net liquidity conditions and a balance sheet runoff.

We still believe an active approach to gain real diversification is the best set up for the coming year.

Top of mind is the outsized cash position and following through on our market outlook to allocate to emerging market debt.

We will continue to monitor signals from the Adjusted National Financial Conditions Index (ANFCI) and ECRI US Weekly Leading Index to help guide portfolio positions.

We are also paying attention to fixed income markets and net liquidity conditions.

Final Word

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Vision, Courage and Patience leads to successful investing.

Best,

Darin Tuttle, CFA

This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.