Portfolio Updates

Actionable Market Insights from Tuttle Ventures

Welcome to the +38 new subscribers this week and +417 over the last 90 days.

I started Tuttle Ventures in order to help people find lasting financial security.

If you like what you are reading, consider sharing the newsletter with the link below:

Newsletter Rundown:

Portfolio Updates

General Comments

Positive Contributors

Negative Contributors

Final Word

Portfolio Updates

Here are the current portfolio holdings. You’ll notice these are the same holdings since our last published updates on 7/28/2022:

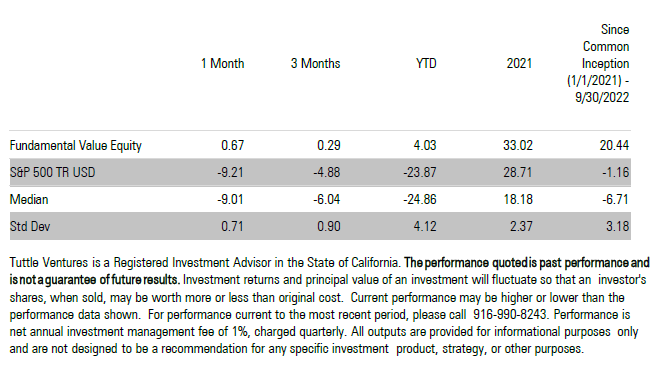

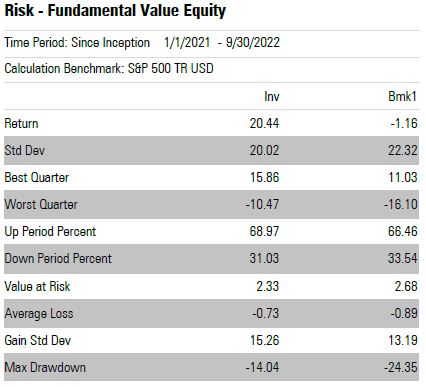

Access to the full Fundamental Value Strategy factsheet is available online here.

General Comments

The market has been challenging and we are continuously looking at second order effects. We would like to be proactive rather than reactive to be able to continue to bring positive risk-adjusted returns for our investors.

Chart provided by the The Volatility Watch Newsletter

The VIX moved back to the top end of its 2022 "wedge" formation after the Fed once again poured cold water on hopes for an economic soft landing by signaling no change on interest rate increases through 2023.

With a recession now the base case as VIX tests pre-crisis levels for the 5th time in 2022, we are in near maximum defensive mode waiting for the next shoe to drop.

After wild moves in the British currency and funding markets over the weekend a possible indicator of broader funding stress, the "shoe" may be European.

In any case, it bears repeating that market crises are processes, not events.

When things eventually settle down, depending on Fed action to control inflation, it's possible that the 60/40 balanced portfolio might make sense again, which is good.

But 4% nominal rates & current CPI >5% are not good.

We do not anticipate making any changes in the near term and continue to stay positioned to gain while the broader market sells off.

If we did want to make a change, it would come first from the outsized cash position. Although a drag to returns overall, we believe cash gives us flexibility to see new opportunities should they come up.

Positive Contributors

At 30% of the portfolio, trend following managed futures strategies continue to outperform specifically DBMF 0.00%↑ .

All three of our managed futures funds employ long and short positions in derivatives, primarily futures contracts and forward contracts, across the broad asset classes of equities, fixed income, currencies and commodities.

Although adding managed futures to a portfolio may provide diversification, managed futures are not a perfect hedging mechanism; there is no guarantee that managed futures will appreciate during periods of inflation or stock and bond market declines.

To the extent that an investment advisor misjudges current market conditions, managed futures can be a volatile investment strategy. Volatility may be amplified by the use of derivatives, and the trending nature of managed futures is designed to follow significant price movements.

Managed futures employ leverage; they are speculative investments that are subject to a significant amount of market risk and they are not appropriate for all investors.

Negative Contributors

We got to speak with the Thompson brothers, who are the primary managers of MSVX 0.00%↑ . Remember, the strategy looks at short, medium and long term volatility relationships. These signals have been mixed and often contradictory this past quarter. With a focus on these VIX interval signals, the fund can either go long or short the S&P 500 or long/short volatility up to net 30% in either direction from a base cash position.

The conversation was productive and we left feeling better about the strategy.

We discussed various scenarios and potential positioning in the portfolio. Based on our analysis, we still think the fund is a good fit for the portfolio, with less negative drag than an outright market short or inverse fund.

Final Word

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures. Vision, Courage and Patience leads to successful investing.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn or Instagram.

Check out the website or some other work here.

Best,

Darin Tuttle, CFA

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.