“Mi Vida”: Uranium Investing

An investing framework in the Uranium Market for Centrus Energy Corp

Welcome to the +38 new subscribers this week.

For everyone new, we share actionable market insights and portfolio updates so YOU can make better investment decisions and get an inside view at Tuttle Ventures.

Charles Steen was a geologist who made and lost a fortune after discovering a rich uranium deposit in Utah during the uranium boom of the early 1950s.

Steen named the discovery "Mi Vida" (My Life).

Over the last month, most uranium stocks are up +29% to +90%.

Is 2022 the time for another uranium market boom?

This week, we map out the uranium investment landscape and provide a brief analysis of LEU 0.00%↑, Centrus Energy Corp.

Why does Centrus Energy have a monopoly?

Why is the U.S. buying $1.2B/year of uranium from Russia?

Future Valuation Constraints

Final Word

Why does Centrus Energy have a monopoly?

LEU 0.00%↑ Centrus Energy Corp. is an American company that supplies nuclear fuel worldwide for use in nuclear power plants.

Formerly known as USEC Inc., the company emerged from bankruptcy in 2013 and we believe is in a position to benefit from geopolitical positioning in a new era of energy investing.

Centrus Energy has a monopoly in a niche corner of the uranium market.

As of August 12, 2022, the stock is up 86% this year.

Is this the top or the start of a new wave of investment into the uranium energy sector?

Centrus was recently permitted by the U.S. Nuclear Regulatory Commission (NRC) to make High Assay, Low Enriched Uranium (HALEU) at its enrichment facility in Piketon, Ohio.

The plant is now the only licensed HALEU production facility in the United States.

Let me explain:

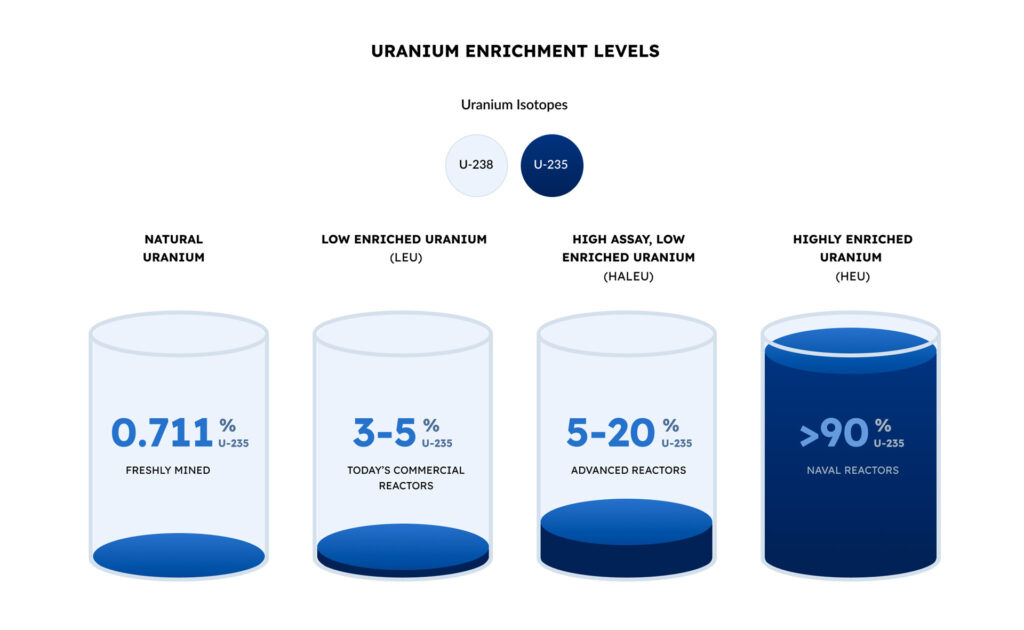

Uranium-235 powers nuclear reactors and nuclear bombs, but it is less than 1 percent of natural uranium.

For most nuclear applications, the concentration of natural uranium must be increased in a process called enrichment.

Uranium needs varying levels of enrichment, depending on its use.

In the image below, you can see that Highly Enriched uranium (HEU) is anything enriched above 20%.

Enriching uranium to various levels is essential for commercial use. While this process can fuel advanced reactors, it also poses a risk as it can be misused to produce bombs.

Typical methods for enrichment include: gaseous diffusion and centrifuge separation.

That’s where Centrus Energy comes in to the picture.

The U.S. Department of Energy (DOE) is currently supporting a three-year, $170 million dollar cost-shared demonstration project with Centrus Energy.

The company has already built 16 advanced centrifuge machines for uranium enrichment and expects to begin High Assay, Low Enriched Uranium (HALEU) production by early next year.

The company has a strong competitive advantage as the first mover, especially with government agencies funding the project and a strong demand for the product.

The company is based in the U.S. which is a unique advantage.

Domestic enrichment capability is a national security concern.

The U.S. prefers to maintain nuclear independence for both energy and military operations.

I have always seen myself as pro-nuclear, but realize that prohibitive costs and public perception limit the use of nuclear generation in the United States for the long term.

All of the above information is already priced into the stock.

Key Geopolitical Constraints

While the U.S. prefers to control its enrichment of uranium domestically, it is constrained by the supply of natural uranium mined from Russia.

This is what I believe the market is failing to consider in its valuation of Centrus Energy.

“Preferences are optional and subject to constraints, whereas constraints are neither optional nor subject to preferences.”

- Marko Papic

Preferences take a backseat to constraints.

How does this apply to the uranium market?

I was surprised to find out that the U.S. has been buying billions of dollars of uranium from Russia since 1992.

The reliance of foreign mining operations that is then shipped over to the U.S. is a real constraint for the future of nuclear power energy.

Growing nuclear enrichment domestically means supporting Russian energy companies internationally.

The Megatons to Megawatts Program, also called the United States-Russia Highly Enriched Uranium Purchase Agreement, was an agreement between Russia and the United States whereby Russia converted 500 metric tons of "excess" weapons-grade uranium (enough for 20,000 warheads) into 15,000 metric tons of low enriched uranium, which was purchased by the US for use in its commercial nuclear power plants.

The program replaced domestic uranium supply from miners like Charlie Steen from Utah with Boris from Russia.

Roughly a third of enriched uranium used in the U.S. is now imported from Russia, the world’s cheapest producer.

The original Megawatts program ended in 2013, right around the same time of the bankruptcy and restructuring of Centrus.

Today, the U.S. has a new outstanding agreement with Russia that extends U.S. purchases of uranium out to 2040.

Despite current Russia sanctions, the U.S. has a carveout for uranium.

In 2021, Russia provided US nuclear utilities with 14 percent of their uranium purchases and 28 percent of their enrichment services.

The chain of supply for Centrus Energy looks like this:

Import natural uranium from two sources. Russia’s Rosatom subsidiary Techsnabexport, generally known as TENEX and French Company (Orano) with long-term supply contracts for SWU.

Enrich uranium at its plant in Ohio.

Sell to U.S. nuclear power plants, the U.S. military, and other countries like Japan.

While LEU’s management disclosed that it is one of the most diversified companies in the world in terms of uranium distribution it is not the case for supply.

TENEX supplies uranium under the Transitional Supply Agreement, which runs through 2028 but remains subject to the US-Russia trade agreement that established quotas limiting Russian imports.

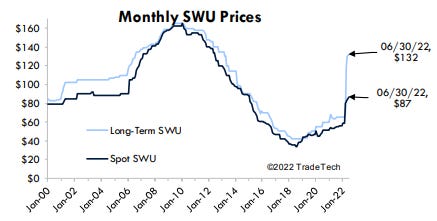

The Russian invasion of Ukraine lead to a dramatic rise in market prices for uranium enrichment.

As the United States seeks to reduce its dependence on fossil fuels, its reliance on nuclear power is set to increase.

Transitioning away from Russia requires major public-private investment and will take years to accomplish.

We think this current supply network is a limiting constraint for growth to consider.

Future Valuations

Despite supply constraints, we are bullish on the future potential revenue growth and gross profitability of the company.

We have a 12-month price target of $70 for Centrus Energy LEU 0.00%↑

This is based on the assumption of 15% revenue growth to reach $361m (TTM) by the end of 2022 and a steady realization of the $1B in backlogged orders over the next 5 years.

We modeled out 3 different revenue scenarios, based on public acceptance of nuclear energy.

We found that even at the lowest levels of public perception, the company could still maintain profitable margins and be cash flow positive from operations in the $100M to $150M over the next 3 - 5 years.

This is mainly because LEU’s long term contracts have locked in uranium prices at or near the bottom.

This means that overall costs are low and stable, paired with a strong growth profile.

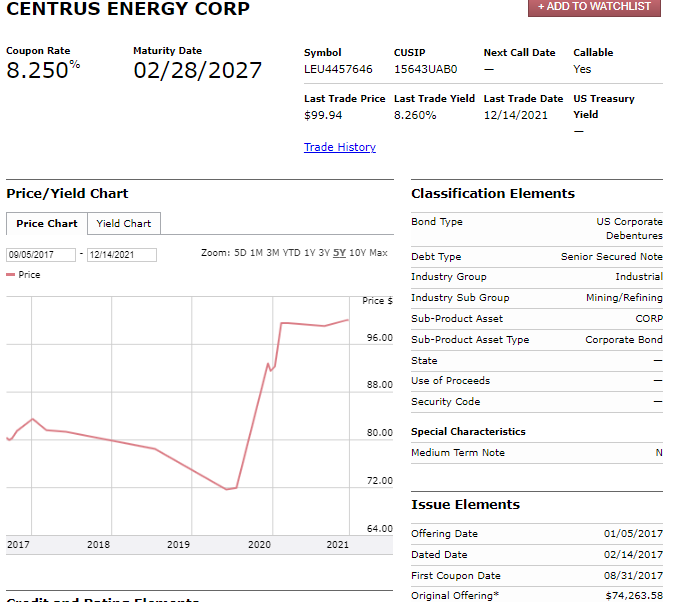

In the debt markets, the $150M in debt is not showing any concerns.

Based on FINRA bond data website, the company’s debt at 8.25%, 2027’s last traded close to par 99.94 on strong volume.

When a bond trades at par, it indicates that there is a high demand for its guaranteed future cash flows, suggesting that investors value and desire its promised payments.

We currently no position in the stock but will continue to closely monitor the future prospects of the company long term.

Tuttle Ventures, acting as a fiduciary for investment clients, may decide to make an initial investment within the next 48 hours for select clients based on individual risk tolerance and preferences.

Final Word

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn or Instagram.

Check out the website or some other work here.

Best,

Darin Tuttle, CFA

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.

Investors are definitely concerned about what a disruption in supply from Russia might do to Centrus financials. It seems to me the demand for HEU should only get stronger over time. The U market seems pretty hairy to me so I don't know how hard or easy it would be to replace that supply from Russia. If they announced some kind of deal to do that it seems like the stock would move more quickly to your price target.