Mastery vs. Ego

TV promo, 2 New members to the Team, Masters PGA Golf Pro Tips

We are going to be on TV! 📺

I’ll be making a guest appearance talking about our latest research on Value Stocks coming out of Tuttle Ventures LLC.

Check it out LIVE on TD Ameritrade Network with Lead anchor Oliver Renick Thursday, April 21st at 6:45am PT.

Morning Trade Live

Here’s a link to the streaming network:

https://tdameritradenetwork.com/

I’ll be sure to catch a recording after it airs, so stay tuned for that if you can’t make it next Thursday morning.

Someone needs to pinch me because I never dreamed I’d be able to go on TV and talk about what I love to do-wake up and talk about stocks and value investing for our clients!

Welcome 2 new members to the Tuttle Ventures team!

Brandon La Bella, MBA candidate -Equity Research Associate

Tristan Daaboul - Equity Research Analyst

Brandon La Bella, MBA candidate is in his first year of the STEM-certified MBA program at the University of California, Riverside with a concentrated focus in finance.

Brandon is credentialed in the financial industry. He has a passion for analyzing capital markets and understanding where to uncover fundamental value. He is a Certified Futures and Options Analyst (CFOA) and trained in Bloomberg Market Concepts.

While Brandon and I never worked together at my former employer, Brandon saw the positive impact and lasting impression my contributions made. He took it upon himself to reach out to me after leaving Pacific Capital so that he could better understand how an investment management firm does business.

We are continuously impressed with how Brandon takes a disciplined and research-led approach to investment management.

Tristan Daaboul is brand new to LinkedIn so give him a big welcome!

He comes highly recommended from a friend and hedge fund portfolio manager.

Tristan has a passion for the industry and takes the time to listen and ask insightful questions. He is one of our quickest learners and a well-thought analyst.

This week I had a great opporutnity to learn from sports psychologist Gio Valiante.

Golf is a mental game. It takes supreme confidence and poise under pressure to win championships.

Sports psychologist Gio Valiante has trained the best golfers, NFL players and hedge fund portfolio managers.

1 key takeaway from his insights:

Mastery vs. Ego Orientation

Simply put, golfers play the game for different reasons. Some are motivated to “show off” and appear competent to other people. These are called Ego golfers (they play to enhance their ego). On the contrary, Mastery golfers play for the sake of learning and improvement. They care about their golf games, not what others say about their golf games. Tiger Woods, Jack Nicklaus, and Ben Hogan are all mastery golfers. Both orientations have been studied extensively. Research shows that a mastery orientation in achievement domains tends to lead to better, more consistent results.

Mastery Orientated individuals are more likely to persevere in the face of failure, and they are also more likely to seek out new challenges and opportunities for learning. In contrast, Ego Orientation is associated with a fixed mindset, where individuals believe that their abilities are static and cannot be improved.

Our main goal here at Tuttle Ventures is to have the Vision, Courage, and Patience to invest so you can do the rest. It’s our goal to deploy capital proportional to the opportunity at the moment.

We promise to stay dedicated to the craft of investing for our clients, through the good times and the bad.

Final Note

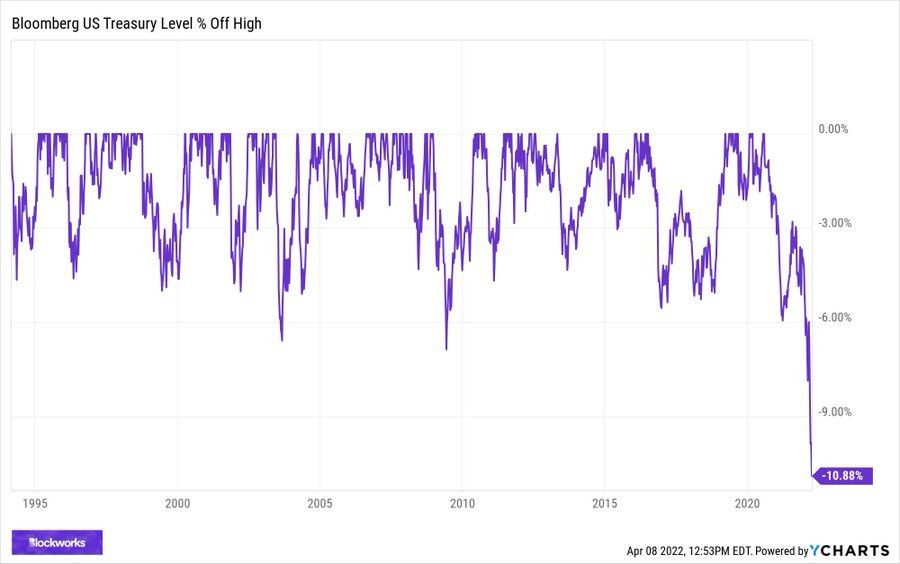

We have talked on numerous occasions about how: Bond Math Doesn’t Look Good.

We are now seeing the worst drawdown for Treasurys since the Bloomberg U.S. Treasury Index began in 1994. Not even close.

Courtesy of Ycharts:

Ouch!

Naturally, we have avoided the allocation to fixed income within portfolios and continue to have a fresh and clear-eyed approach to opportunies that may be presented in the moment. Now that the 10-year is above 2.50%, we are considering the merits- once inflation cools down. This still has not happened. We need wage growth inflation to come back down below 4% levels before we think inflation can be meaningfully held at bay.

We do not attach portfolio performance or any one investment to our ego- when the bond math changes- we will be ready to invest back into the asset class.

Currently we are seeing an uptick in interest rate volatility that has the threads of Japan in the post 1990’s.

What happens to IR vol as rates approach the zero lower bound?

Look no further than Japan...

(Hint, Vol goes up)

Next week I’ll dedicate a deeper dive into why I think the investment landscape in both fixed income and equities in the US is headed to post-1990’s Japan. I took to Twitter to give a rough outline of the premise at the macro level if you want a sneak peek of the idea that we think may guide portfolio decisions over the next 6-18 months.

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn or Instagram.

Check out the website or some other work here.

Best,

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.