Invest better with less effort

Actionable Market Insights from Tuttle Ventures

I am writing this week from my hometown, El Dorado Hills in Northern California, visiting friends and family for the celebration of Independence Day.

Thank you to the 10 new subscribers this week, joining the Tuttle Ventures newsletter for actionable market insights to make better investing decisions.

Quick Notes:

Mid Year Check In

The Power of Simplicity in a World of Overwhelming Choice

Final Word

Mid Year Check In

This week I thought it would be insightful to share a live client account with permission.

In practice, live account performance includes transitioning out of legacy securities, managing the timing of cash inflows/outflows and trading costs.

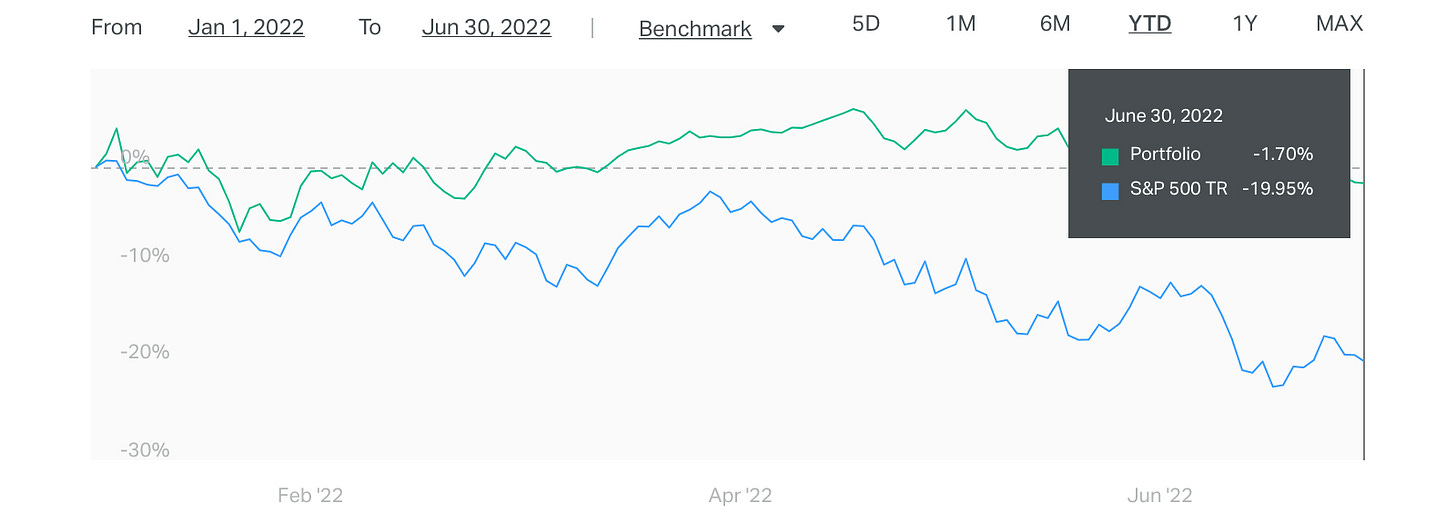

Here is the time-weighted return (TWR) for the first half of the year (Jan 1 - June 30th 2022) for an actively managed client portfolio, net of trading and investing fees, transitioned to a discretionary account with the Fundamental Value Portfolio.

This is not a guarantee or a recommendation of any particular security or investment product. All investing involves risk. Past Performance is not indicative of future results.

As you can see, the outperformance vs. the S&P 500 TR increases over time. Avoiding large drawdowns preserves more capital for future growth.

This is also a visual reminder of the challenging market environment we are in. We believe that truly diversifying strategies require active risk management and we are optimistic about the opportunities with a “head start” for the second half of the year if financial conditions improve.

The Power of Simplicity in a World of Overwhelming Choice

To make better investing decisions, we need to narrow the focus to increase the quality.

As I work with some of the most wealthy and successful young professionals across the country, I have gained a greater appreciation of keeping things simple.

Simplicity is not easy to achieve. In fact, I personally find it very difficult and have had to work really hard the extract the essentials in core investment decisions and comprehensive financial planning.

Distilling ideas into coherent tradeoffs and removing distractions takes discipline and hard work. However, starting the process is critical for successful investing.

I highly recommend Brian Portnoy’s book: The Power of Simplicity in a World of Overwhelming Choice, if you want to go deeper.

Erik Norland, executive director and senior economist of CME Group, does a great job outlining simple tradeoffs.

Erik explained possible scenarios for the second half of the year:

Option 1, we stay on the path of hiking rates to fight inflation — at the risk of upsetting equity markets.

On the other hand, the Fed could stop hiking rates to support financial markets — at the risk of failing to contain inflation.

I’m not trying to complicate investment decisions beyond this narrow view.

Currently our portfolio is positioned to profit under the first scenario.

Final Word

As an advisor to other advisors, I am happy to share the positive experience I have had with the Altruist platform as a simple all-in digital solution for clients and portfolio management.

If you are interested, check out the platform here.

As part of Altruist’s referral program, I am paid 5bps for every $1 an Advisor onboards.

Additional FAQs about the referral program can be read here.

P.S.

Catch the TV rebroadcast if you are interested in watching!

https://tuttleventures.com/darin-tuttle-eye-on-earnings-for-nike/

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn or Instagram.

Check out the website or some other work here.

Best,

Darin Tuttle, CFA

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.