Individual Bonds or Bond Funds?

An age old debate with higher interest rates

Welcome to +15 new subscribers over the last 30 days.

If you are looking for unique investment ideas backed by interesting research, you have come to the right place.

"Should I own individual bonds or bond mutual funds?"

It's a question we're asked frequently, especially by those worried about the effects of rising interest rates.

If you're not familiar with the ins and outs of each option, it can be hard to decide.

The real answer is, it depends.

The decision often comes down to the amount you have to invest, the preference for a professional manager, and the need for a predictable value at maturity.

Typically we have found that accounts with $1,000,000 or more to invest in fixed income, can be considered for individual bond investing.

With a new higher level of interest rates, we are able to find an adequate supply of quality bonds at reasonable prices, while still obtaining diversification.

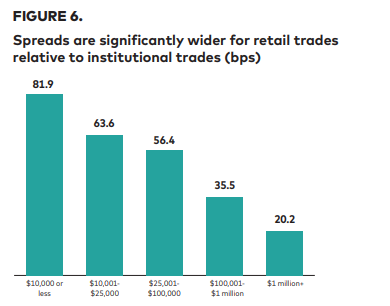

Recent research by the Investment Advisory Research Center at Vanguard, highlights transaction costs are one of the biggest factors in the decision.

Institutional buyers typically get better prices and access to the newest bond issues compared to retail buyers.

If you are trading individual bonds less than $100,000, your transaction costs can be 3x or 5x more than a buyer of $1,000,000 of the same bond!

Specifically, between January 2019 and April 2021, the effective spread for transactions with a par value between $25,001 and $100,000 averaged 56.4 basis points (bps), while transactions with a par value of over $1 million averaged 20.2 bps.

While shopping for low transaction costs is important, it doesn’t tell the whole story.

If you are looking for predictable value and certainty for your financial goals, then individual bonds may be a better fit.

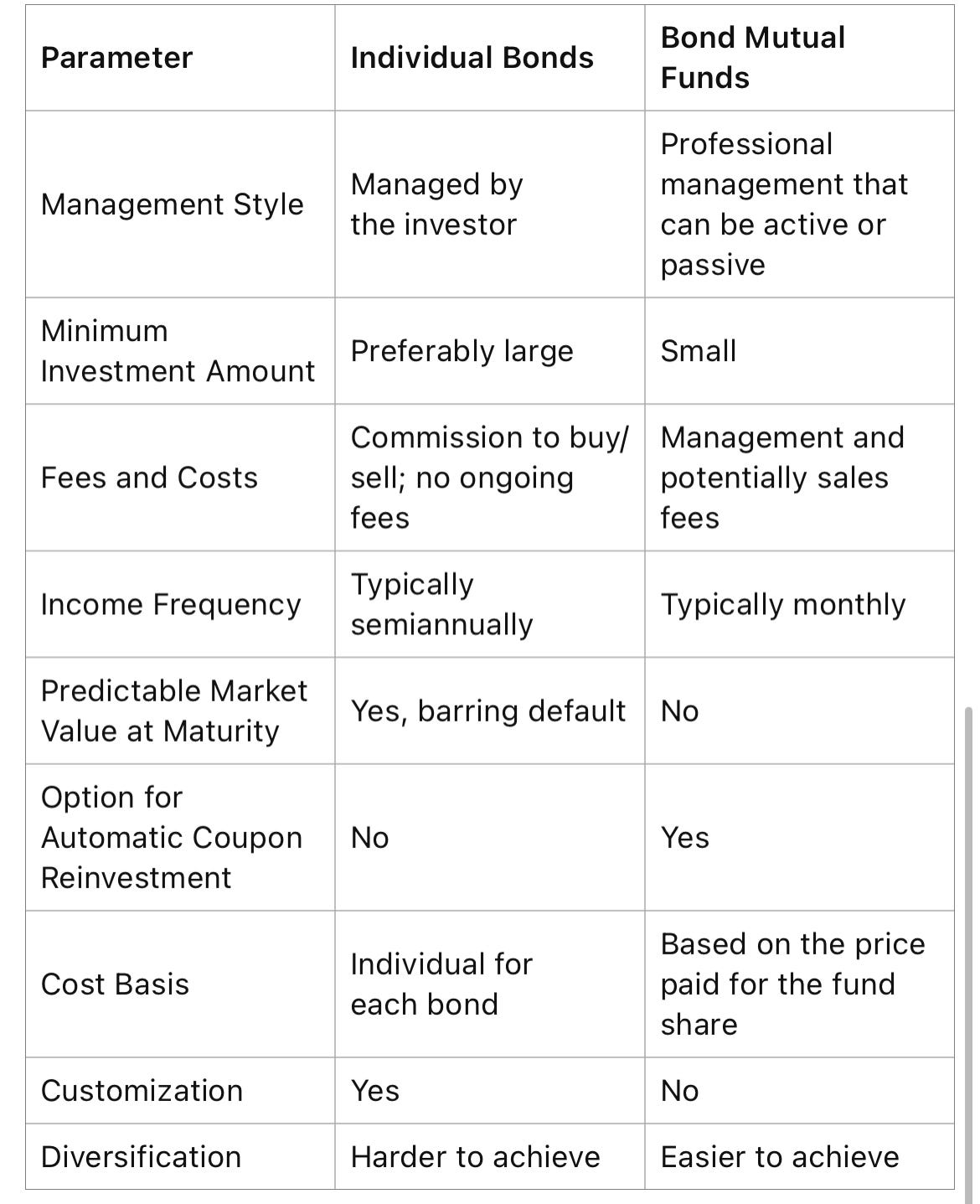

Sometimes it is helpful to look at the full picture:

Behavioral preference is another important consideration. If seeing the NAV of your fund fluctuate and having no control over certain tax consequences makes you uncomfortable, then bond funds might not be the best solution for you.

It is important to realize that while you cannot eliminate the emotions involved in investing, you can recognize how a certain investment might make you feel and adapt your investment choices accordingly.

For some investors, holding individual bonds helps them get to their sleep at night number.

Final Word

We're grateful for the opportunity to learn, grow, and invest alongside you at Tuttle Ventures.

Vision, Courage, and Patience leads to successful investing.

Best regards,

This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.

Good stuff. Getting excited about locking in 7 or 8% quality coupons again some day, and riding them as rates pull back and the bond market pops 20 or 30%. It's been decades and people have forgotten :)