Hitting our Stride

Hi, Mom I'm on TV! New Holdings and Increase in Diversification

Warm welcome to 52 new subscribers this week!

We don’t think about growing followers.

We think about creating something worth following.

For everyone new, we share actionable market insights and portfolio updates so YOU can make better investment decisions and get an inside view at Tuttle Ventures — As seen on TV, talking stocks this week with Oliver Renick on TD Ameritrade Network!

All paying subscribers will get an additional post which includes:

Full link to the broadcast, behind-the-scenes Q&A, an outline of what it was like landing the opportunity, how we prepared to go on TV, and what it was like working with the producer of the show.

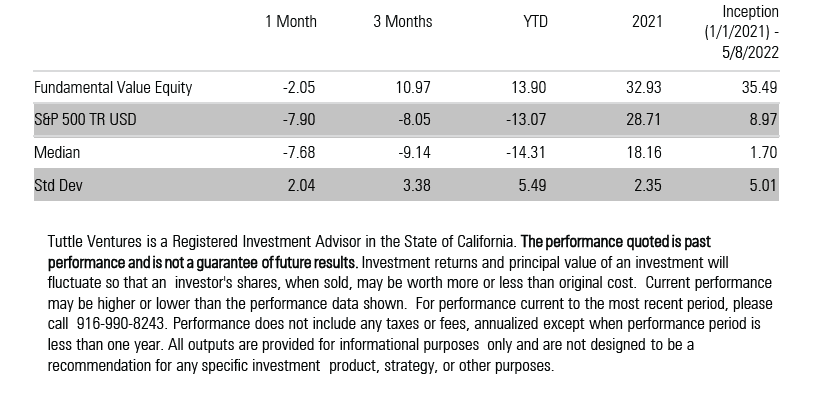

Ok, now back to our Fundamental Value Core portfolio holdings and performance as of 5/8/2022:

New Holdings | Positive Contributors | Negative Contributors

Positive Contributors

CPB 0.00%↑ , Campbell Soup Co.: +10.65% over the last month, the market has finally gained an appreciation of the company as a relative safe-haven due in part to its cash flow position. FCF for the quarter ending January 31, 2022 was $637m and a product lineup of inferior goods that increase in demand as prices go up. Long Goldfish and Chicken Soup.

OLN 0.00%↑ , Olin Corporation: +17.34% over the past month, Strong Fundamentals, Firm in the value lane: P/E of 7, EPS of 8.91, 15% Net Income Margin, 1.3B in FCF and 16% FCF/market Cap (Cash Cow), 9.4 B in Revenue TTM and 2.6B in EBITDA. Olin is the best example of our Fundamental Value Portfolio playing both Offense and Defense. The Company just announced a Joint venture with Plug Power to provide hydrogen production and operational support, for "green hydrogen plant in 2023". Long ammunition.

Negative Contributors

FSM 0.00%↑ , Fortuna Silver Mines: -13.95% over the past month. We continue to be long-term bullish on the stock. The announcement of a share buyback midquarter is out of tradition. It looked like a desperate play by management to reduce the selloff. May 11th is their earnings report. Q1 had the highest close on gold for a quarter ever, so the hope here is with YoY 90% higher production in gold, that their Q1 numbers will blow away Q1 from 2021. Silver prices lagged a little, but as a percent of production, I am more interested in gold price. Costs increased just as fast as revenues so there is concern with margins for a higher cost gold producer.

With investing in miners, you have to embrace the higher risk if you want to see upside. This also means there will be extreme pullbacks where many of the casual investors get out and never come back.

General Comments

At +13.90% Year to Date performance, we are only -5.68% down from our peak of +19.58%. We continue to be humbled by the market, despite foreseeing this global macro picture (Reread newsletters on: Stagflation and Bond Math Doesn’t look good). The truth is we are unable to correctly time the market.

That being said, we believe we are currently “hitting our stride”, with great positions for the future investment landscape.

This week we made some moves to our portfolio. The goal of these moves was to

1) Reduce Portfolio Cross-Correlations

2) Play Offense and Defense

3) Reduce equity beta to 0.50 (A statistical measure that represents how sensitive is the stock price to a change in the overall market.)

New Holding

This week we sold all of our Visa, $V of ~10% and purchased 15% into MSVX 0.00%↑ , LHA Market State Alpha Seeker ETF.

This sale had nothing to do with Visa’s fundamentals and everything to do with portfolio risk management.

Quick comment our rationale for Visa: Visa posted earnings in line with our expectations, we continue to believe the company is the toll road of financial transactions and management is expertly guiding the payments infrastructure giant through a geopolitical and cryptocurrencies minefield.

However, Visa as part of the S&P 500 index, is to much of a headline risk in this market sell off. We have had Visa as a place of “market beta” refugee. This is no longer needed. Visa was our most household recognizable name but had the strongest correlation to the broader market at 0.70 on a trailing 5-month basis. To expect different results from the market, we had to let Visa go to decrease our overall market risk.

LHA Market State Alpha Seeker ETF, MSVX 0.00%↑

In 2018, the Thompson brothers, Mike and Matt Thompson, both Chartered Financial Analysts (CFAs), who run the portfolio together —caught my attention as risk managers who thrive under the right market conditions. If ever there was a period to pay attention to volatility it is today.

The brothers focus on Volatility-informed, tactical active management for portfolio diversification. My research for the past several years on volatility as an investable asset class has evolved overtime. I have gained a new appreciation of the level of precision it takes to be able to participate on the long and short end, staking the right sizing on the futures curve and reduce negative carry with the right products. Both Mike and Matt agree in principle on many of these same points and we look forward investing in the strategy. Read more from my twitter thread here.

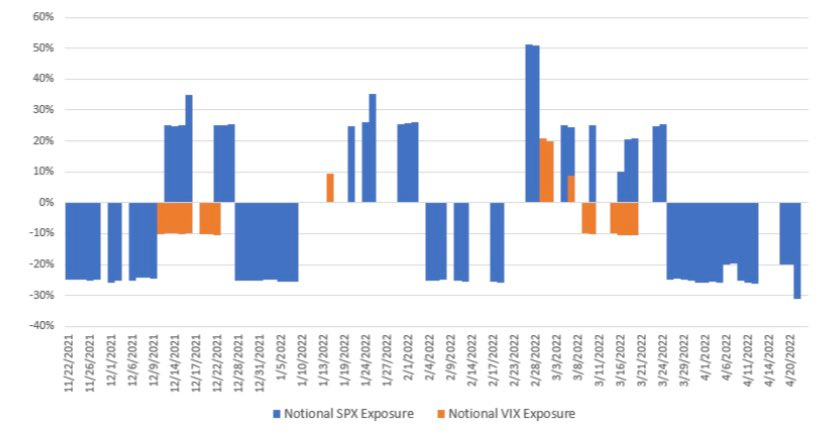

Here’s an outline of VIX Signaling and Positioning over time:

Since our initial purchase of the fund, which was at a slight premium to NAV, the fund is trading at 10x its 3 month average volume. Read the fund prospectus and Factsheet here. We expect that assets will continue to grow as risk transfer markets like managed futures and volatility gain in popularity.

Reduce Portfolio Cross-Correlations

Our new portfolio correlation matrix below is a specific area of pride.

I can promise that 99% of investment advisor portfolios do not have this level of cross correlation diversification. Removing Visa and adding LHA Market State Alpha Seeker ETF improves our standout diversification.

In the matrix below, boxes in orange have negative correlations to other portfolio assets, while boxes in blue have higher correlations to other portfolio holdings.

At the top, you will notice that MSVX 0.00%↑ , LHA Market State Alpha Seeker ETF has a negative correlation to our managed futures holdings.

The low correlation with managed futures is the greatest aspect of adding this alternative asset class alongside our core equity holdings.

Final Note

Our paid archives are getting a complete facelift!

Paid Subscribes will now get historical archives and access to all our research including:

Our Investment Strategy →

Individual Company Analysis→

Portfolio Holdings for the Fundamental Value Fund changes over time + trade rationale→

Private Equity research/write ups/investor updates (Midtown National Group, Boxabl, Wormhole, Resolve, etc.) →

Global Macro Indicators + Trade Rule Funnel →

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn or Instagram.

Check out the website or some other work here.

Best,

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.