Freedom Leveraged: Patent Velocity

Tracking the Early Indicators of Freedom‑Driven Growth

Welcome to +34 new followers over the last 90 days and +17 Substack authors who recommend the newsletter.

For newcomers, I focus on unique investment ideas supported by novel research.

Discover more in our subscriber archive with over +150 newsletters.

Legal Disclaimer: These are solely my own personal opinions, not investment guidance.

Top of Mind:

All.Space (https://www.all.space/) is a satellite communications company specializing in advanced multi-link, multi orbit terminals that connect simultaneously to satellites across GEO, MEO and LEO orbits for resilient jam-resistant communications.

It’s essentially a Wi‑Fi router for space, blending multiple satellite networks so the connection stays up even if one link is disrupted.

In April, the FCC moved to revisit the decades‑old satellite spectrum‑sharing rules and opened 600 MHz of spectrum for commercial use, marking a major modernization of U.S. space‑communications policy.

All‑Space’s terminal unlocks 500 MHz of that spectrum and jumps between orbits in milliseconds, creating a connection that’s almost impossible to break.

Over the next five years, this kind of multi‑orbit resilience will be continue to be a strategic geopolitical advantage.

Space is becoming more competitive and the systems that can stay connected are the ones that will define the next era of infrastructure and defense.

This is one company to keep an eye on.

Freedom Leveraged Series

As a reminder from last week, we are going back to our big idea of 2026: Freedom Leveraged.

Freedom Leveraged is the belief that liberty powers prosperity and strengthens national resilience.

At the core of Freedom Leveraged is a four-part investment framework featuring:

Patent Velocity

New Business Formation

Capital Flows

Regulatory Friction

Patent Velocity

This week is Patent Velocity.

Patent Velocity is the idea that the pace and density of patent activity can reveal early investment signals long before revenues or market share show up.

The idea that patents can serve as an early-stage investment signal is not new.

O’Shaughnessy Ventures calls patents “breadcrumbs” that reveal where talent, capital, and long‑term competitive advantage are accumulating long before revenues show up.

Investors should pay attention.

To put this into practice, I rely on tools like:

The Lens (https://www.lens.org/)

A free global patent search and analytics platform for exploring filing trends and citation data.

Patentscope (https://www.wipo.int/en/web/patentscope)

Full‑text access and patent family data, useful for comparing filing density across jurisdictions.

Used well, they turn raw IP filings into actionable insight.

Ok Darin, this is all great … but can you give me a specific example?

A Concrete Example: Fusion Innovation

The Lens’ new Innovation Landscapes prototype transforms global R&D into dynamic maps.

One standout example is the Nuclear Fusion landscape.

You can check it out for yourself here:

(https://link.lens.org/0nh0TwEDIB)

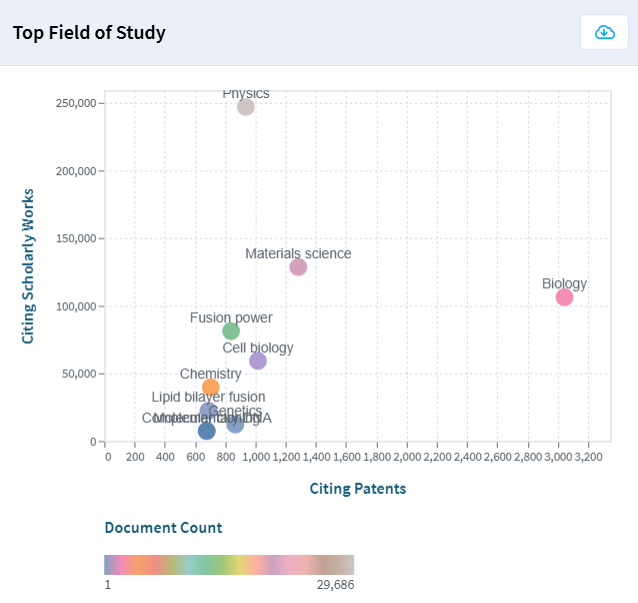

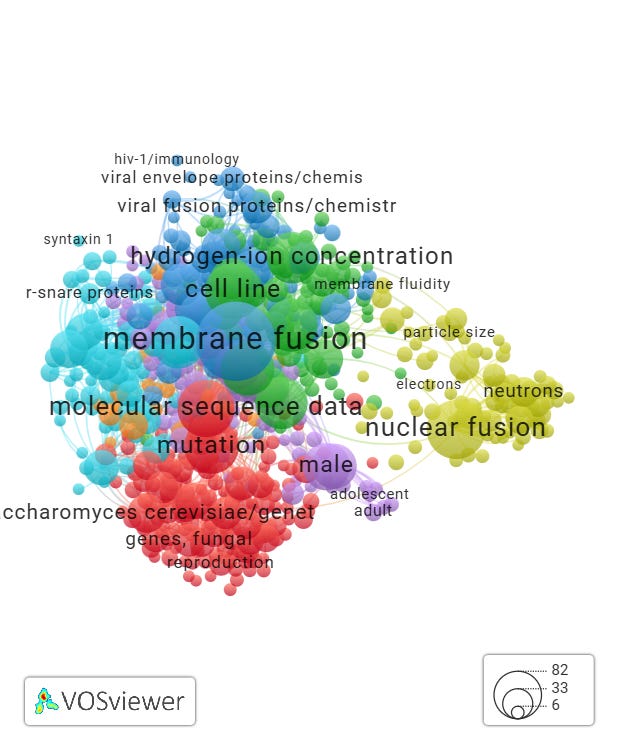

The map makes one thing obvious: fusion innovation isn’t a single race. It’s a set of distinct scientific clusters: physics, biology, materials science each generating its own momentum and highly cited patents.

From this, you can quickly see which scientific approaches are gaining traction and which institutions are driving the breakthroughs.

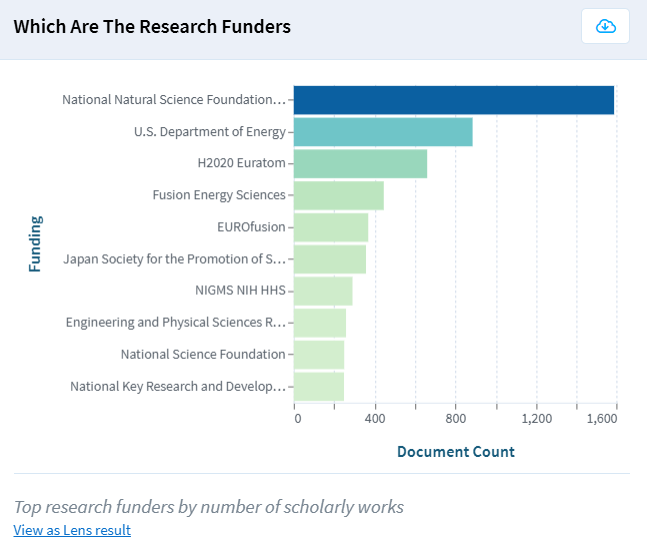

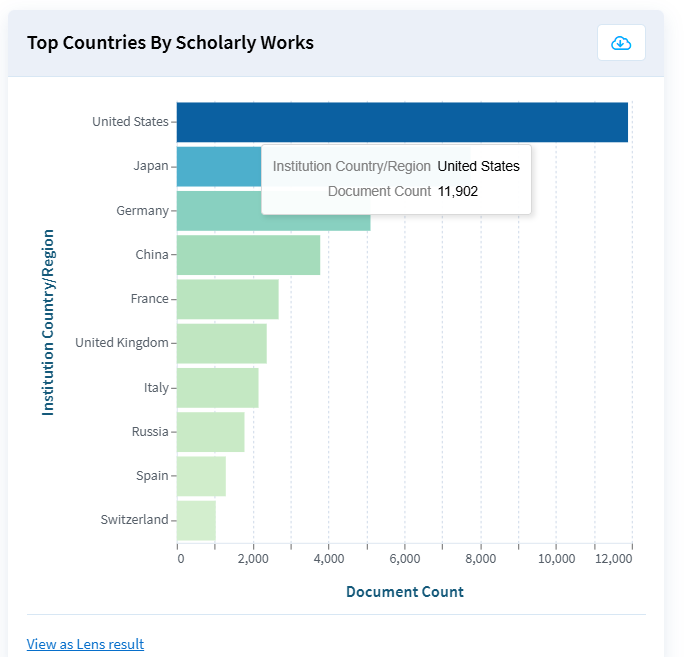

Additional charts reveal who originates the most influential patents and where research funding is concentrated.

A few signals stand out:

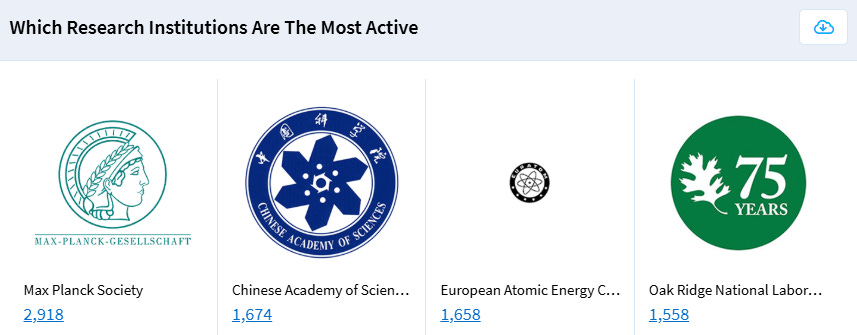

Max Planck Society leads Europe in highly cited fusion patents, making it a key node for anyone exploring fusion‑related investments.

China’s National Natural Science Foundation and the U.S. Department of Energy dominate public R&D funding, with Europe and Japan close behind which is a pattern consistent with today’s multipolar innovation landscape.

For investors, even under multipolar uncertainty we can see that the U.S. continues to be the leader in Freedom Leveraged when it comes to nuclear fusion.

This is why the U.S. continues to be the primary place where investors feel comfortable investing.

Ok Darin this is cool, but why should I care?

Bottom Line: Patent Velocity turns innovation into something measurable. Tools like The Lens and Patentscope make it possible for someone who is new to a frontier investment theme to see who is building what, where momentum is forming, and which institutions are quietly shaping the frontier.

If you want to invest ahead of the curve, start exploring a Lens’ landscape that aligns with your thesis.

Freedom creates the space for innovation and Patent Velocity shows you where that innovation is taking root.

Best,

Darin Tuttle, CFA

This information is for educational purposes and is not intended to provide, and should not be relied upon for, accounting, legal, tax, insurance, or investment advice. This does not constitute an offer to provide any services, nor a solicitation to purchase securities. The contents are not intended to be advice tailored to any particular person or situation. We believe the information provided is accurate and reliable, but do not warrant it as to completeness or accuracy. This information may include opinions or forecasts, including investment strategies and economic and market conditions; however, there is no guarantee that such opinions or forecasts will prove to be correct, and they also may change without notice. We encourage you to speak with a qualified professional regarding your scenario and the then-current applicable laws and rules.