Freedom Leveraged: How Individual Liberties Enhance National Security

Unit economics of individual liberties for technological advancement and national security

Welcome back to version 2.0 of the Tuttle Ventures Newsletter!

I’m grateful to the 5,240+ followers who’ve stayed and the 17+ Substack authors who still recommend this newsletter despite the quiet stretch.

For newcomers, I focus on unique investment ideas supported by novel research.

From SpaceX to overlooked market niches, explore our subscriber archive with more than 150+ newsletters.

2025 has been a year of tremendous change for me personally.

(Closing Tuttle Ventures, starting a new job, getting divorced, and losing +45 pounds)

If you’re curious about that journey, you can read more here:

From “I quit” to “What’s next?” – The Power of Not Giving Up

In 2026, as I resume consistent writing, I plan to share well‑researched geopolitical and investment insights that matter to you as an investor.

Let’s talk about the big idea shaping my investment framework going into 2026 Freedom Leveraged.

***Legal Disclaimer***

These are solely my personal opinions, not investment guidance, and the newsletter will continue to be free for the foreseeable future.

Newsletter Rundown:

Freedom Leveraged Defined

Why Should We Care?

Freedom as a Growth Multiplier

Unit Economics of Individual Liberties

Final Word

Freedom Leveraged Defined

Freedom Leveraged is the concept that individual liberties are not a cost to national security but rather an exponential engine that powers growth.

That’s the most basic definition I can come up with.

When people are free to question, create, explore, and compete, the nation becomes stronger, not weaker.

Scholars like Michael Doyle and Bruce Russett have long argued that democracies possess structural advantages: legitimacy, cooperation, and more durable alliances but they have never framed individual freedoms as a form of leverage.

Source: Normative and Structural Causes of Democratic Peace, 1946-1986

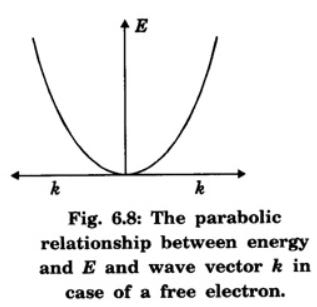

A real-world example of the Freedom Leveraged concept is in physics.

Stay with me for a second…

Free‑range electrons generate energy through constant movement and collisions, creating self‑reinforcing cascades.

Free electrons create multiplicative effects, not linear ones.

Source: Motion of a Free Particle – Quantum Mechanics

When electrons are free to move, energy is limitless and each interaction increases the probability of more interactions.

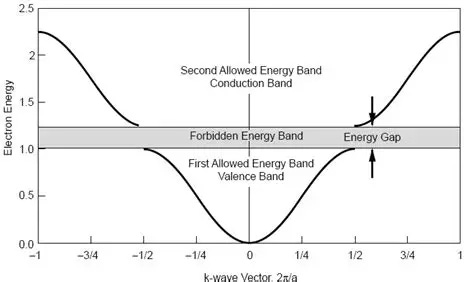

On the other hand, controlled electrons stay stable but stagnant.

Since the electrons are valence bounded within a defined energy state, they are unable to trigger the chain reactions that lead to exponential outcomes.

Source: Electron energy plotted as a function of wave-vector k

If the physics metaphor feels off, just know that freedom boosts the rate of productive collisions, and those collisions can compound into innovation that closed systems cannot replicate.

Bottom line: Freedom isn’t just a value — it’s a multiplier, and multipliers are what make exponential growth possible.

As is the case with all leverage, this works in both directions.

Freedom magnifies volatility in the short term, yet it produces far greater stability and ingenuity over time than any controlled system can match.

Tapping into this freedom for exponential growth is the reason why the U.S. is still the best place to invest.

Why Should We Care?

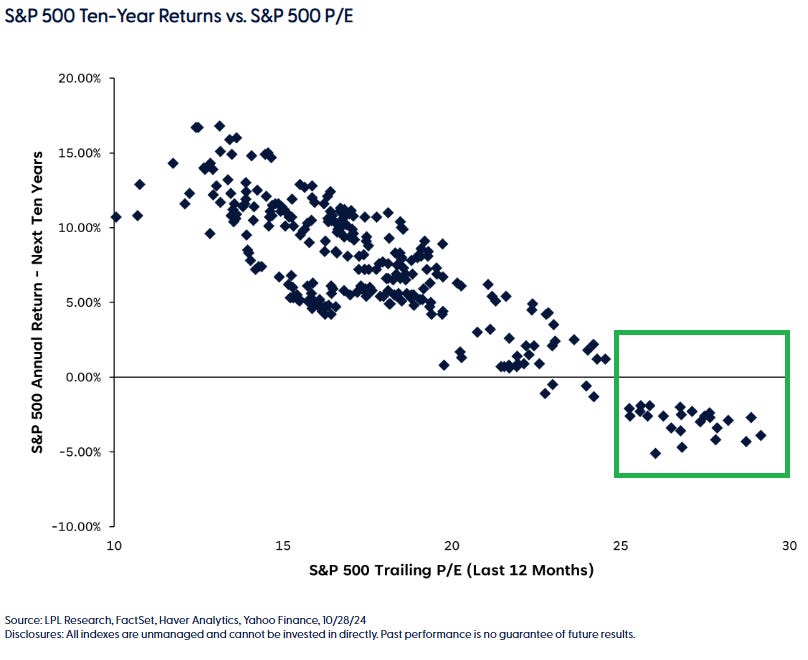

For U.S. investors navigating an elevated‑valuation environment (like today’s S&P 500 index above a 22 Price to Earnings Ratio) this is especially relevant.

According to LPL financial, when the S&P 500’s trailing P/E ratio is elevated, subsequent 10‑year returns tend to be lower.

Source: Do Good Times Make Bad Times? P/E Ratios and Forward Returns

The correlation between 10-year returns and valuations is compelling, but it does not mean stocks are set up for lackluster performance every month, quarter, and year for the next decade.

Instead of treating U.S. valuations as a ceiling, think of it as a premium on a system with structurally higher innovation throughput.

That is why it is critical for investors to double down on the individual freedoms within the U.S. to grow earnings up to a sustainable level.

Freedom as a Growth Multiplier

Some would argue, ok, valuations are high, just invest internationally then.

When evaluating international opportunities, the question isn’t just valuation; it’s whether the underlying system allows enough freedom for compounding innovation to occur.

As I said before, in mathematical terms, controlled systems grow linearly—steady but limited—while free societies grow exponentially, because individual decisions increase the system’s overall rate of innovation.

Freedom raises the growth rate r, and over time, exponential curves always outperform linear ones.

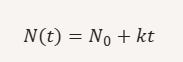

For example, think of innovation capacity as a function N(t) over time.

In a controlled system (like an authoritarian model), growth behaves more like linear accumulation:

Where:

N0 represents the initial value where the state directs and allocates resources

k is the constant rate of growth where milestones of innovation are predefined and planned

t is time, which is capped by central decision‑maker’s timeline and constraints

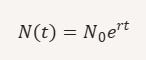

In an open system, freedom acts as a multiplier, a form of leverage:

Where:

N0 represents the same initial value of resources

e^ = compounding effect of millions of independent decisions rather than a central decision maker

r is the growth rate of unplanned innovation

t is time uncapped across multiple timelines

Freedom increases r relative to k because:

More ideas enter the system

More experiments run in parallel

More failures occur early (volatility), which accelerates learning

More competition drives iteration

This is exactly how startups out‑innovate state‑run enterprises.

Unit Economics of Individual Liberties

In 2026, I’ll be tracking freedom‑driven growth indicators like new business formation, patent velocity, capital flows, and regulatory friction.

I’m still refining the framework, but I just wanted to kick things off here to share that I’ve been thinking about individual liberties the way venture investors think about unit economics.

I haven’t fully cracked the model yet, but the goal is to identify which liberties deliver the highest marginal return on innovation and long‑term growth.

Final Word

The more I study markets, the more convinced I am that individual liberties function like leverage: they amplify volatility in the short term but create far greater resilience, innovation, and long‑term returns.

As investors, our job is to allocate capital toward systems where compounding is structurally possible, not artificially constrained.

That’s why the U.S., despite its noise and imperfections, remains the most fertile ground for innovation‑driven growth.

In the months ahead, I’ll be digging deeper into how freedom shapes earnings power, sector leadership, and long‑run investment outcomes.

If you’ve made it this far, thank you and I’m excited to build this next chapter with you.

Best,

Darin Tuttle, CFA

This information is for educational purposes and is not intended to provide, and should not be relied upon for, accounting, legal, tax, insurance, or investment advice. This does not constitute an offer to provide any services, nor a solicitation to purchase securities. The contents are not intended to be advice tailored to any particular person or situation. We believe the information provided is accurate and reliable, but do not warrant it as to completeness or accuracy. This information may include opinions or forecasts, including investment strategies and economic and market conditions; however, there is no guarantee that such opinions or forecasts will prove to be correct, and they also may change without notice. We encourage you to speak with a qualified professional regarding your scenario and the then-current applicable laws and rules.