Fishing in the Debt Pool

A Closer Look at Debt's Role in Stock Performance

In the investing world, the allure of companies with no debt is undeniable. They seem like safe harbors in the stormy seas.

However, this apparent safety can be misleading.

In this post, we dive into why fishing in the "debt pool" for long term equity returns might actually be a more strategic move for investors.

The Deceptive Calm of No-Debt Waters

At first glance, companies without any debt appear to be financially sound, risk-averse, and stable. But is this always a sign of good health and potential growth? Not necessarily.

The Data Tells a Story

We performed a side-by-side comparison of companies with nearly zero long-term debt and those with long-term debt, focusing on their 3-year total stock returns.

Here's what we found:

(We prescreened companies with a market cap over $200M on US Listed Exchanges.)

Higher Mean and Median Returns: Companies with long-term debt showed higher average and median 3-year total returns.

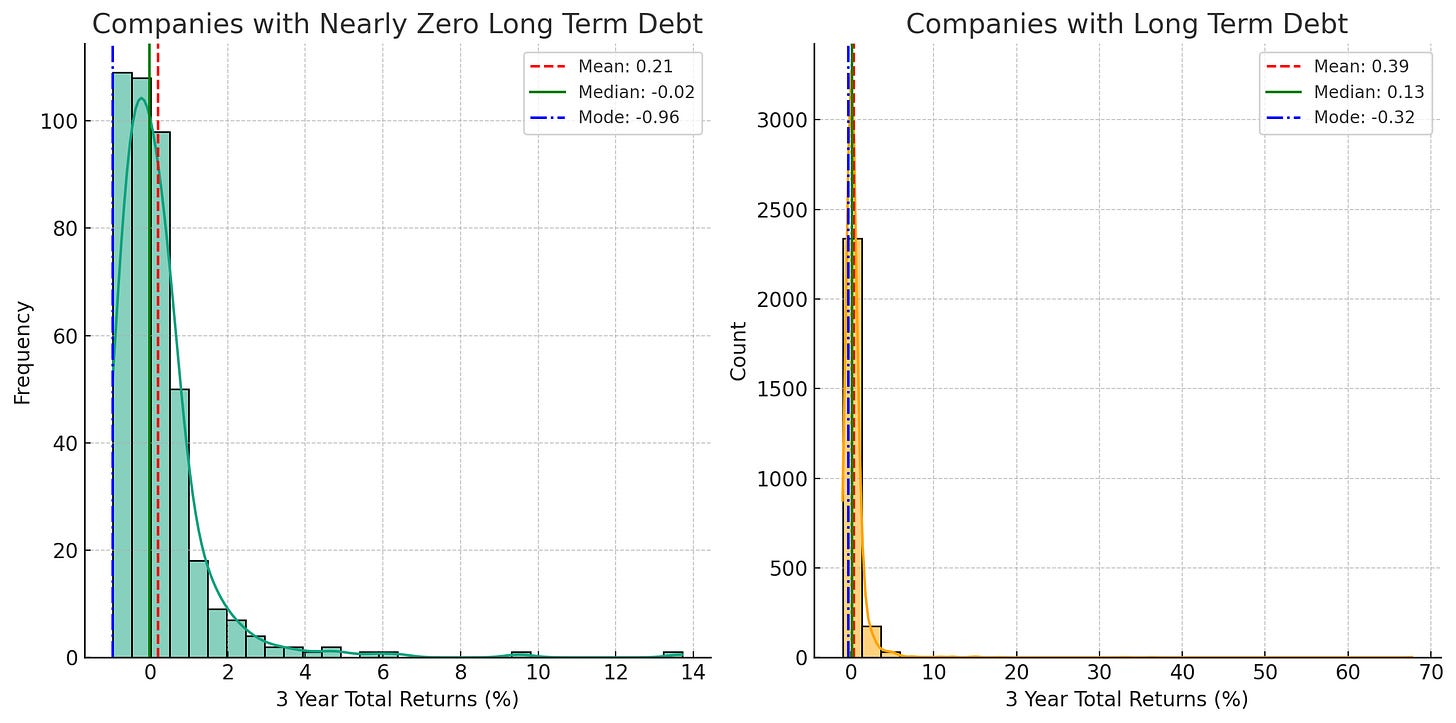

Here are two charts comparing the distributions of 3-year total returns for companies with nearly zero long-term debt (left) and companies with long-term debt (right) side by side.

The mean return is higher for companies with long-term debt (0.39% vs. 0.21%), suggesting that on average, these companies may have experienced better performance over the three-year period.

Better Win/Loss Ratios: These companies also had a higher win/loss ratio for positive stock returns, suggesting a higher likelihood of picking a winning stock in this group.

If you were to randomly select 30 stocks from each distribution and hold over the 3-year period the win/loss ratios for choosing stocks with positive returns is significant based on debt levels.

For the distribution of companies with nearly zero long-term debt, the win/loss ratio is 0.5 This means there is an equal number of winning (positive return) and losing (negative or zero return) stocks.

No better than a coin flip.

For the distribution of companies with long-term debt, the win/loss ratio is approximately 1.67. This indicates that for every losing stock, there are about 1.67 winning stocks, suggesting a higher likelihood of selecting a stock with a positive return in this group.

One possible explanation is that the timing of debt has been widely recognized as a crucial factor influencing the long-term performance of stocks.

In the study 'Debt Structure Adjustments and Long-Run Stock Price Performance,' the researchers established the initiation of debt in public companies (debt IPOs) often aligns with periods when the market holds the most optimistic views about the future potential of these firms.

With the recent change in interest rates, we believe companies without debt will face more pressure than companies that have already borrowed.

The Value Trap of No-Debt Companies

1. Growth Limitations

Companies without debt often miss out on leveraging debt as a tool for growth. Debt can be a low-cost capital source for funding expansions or new projects, which these companies forgo.

2. Opportunity Costs

The absence of debt might signal a lack of profitable investment opportunities. If a company isn't reinvesting in its growth, it risks falling behind its debt-embracing competitors.

3. Risk Aversion

An overly cautious approach might protect the company's current assets, but it also hinders its ability to capitalize on lucrative opportunities that require some risk-taking.

4. Market Perception

The market may view no-debt companies as lacking ambition, potentially leading to stock undervaluation.

5. Capital Allocation

Effective capital allocation often involves a balanced mix of debt and equity. Companies avoiding debt might not be optimizing their capital structure, potentially leading to lower shareholder value.

Understanding the Risks

Investing in companies with debt does come with its risks, notably the potential for financial distress or bankruptcy. However, debt can also be a catalyst for growth and higher returns, making it a potentially lucrative pool for investment fishing.

A Balanced Approach

Rather than shying away from all debt, a balanced approach might serve investors better. Companies leveraging debt intelligently can offer greater growth potential and returns, while those without it might actually be hidden value traps. So next time you're fishing for stocks, consider casting your line into the debt pool – you might catch a bigger fish than you expected.

Final Word

Thank you for reading and I am grateful and humbled to be able to learn, grow, and invest alongside you at Tuttle Ventures.

Successful investing requires vision, courage, and patience.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn, or Instagram.

Check out the website or some other work here.

Best,

Darin Tuttle, CFA

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.

Great article as always.

The explanation might also be reversed: certain types of businesses have more stable cash flows and therefore more capacity to borrow. These companies tend to be higher quality and therefore have better returns than more speculative lower quality companies with low capacity to borrow.

I couldn’t see the time period for your study but it would be interesting to compare the win-loss ratio in rising vs falling interest rate periods.

I also have wondered how companies with low-rate very-long term debt perform in an inflationary environment. Is this an investable thesis? Like BRK 35-year yen bonds, but on a larger scale.