Fed Pause Platform: Emerging Markets in Focus

Actionable Market Insights from Tuttle Ventures

Welcome to +72 new subscribers over the last 90 days. If you are looking for unique ideas backed by interesting research, you have come to the right place.

If you like what you are reading, consider subscribing today:

Newsletter rundown:

How did we get here?

The Pause Creates a Platform

High Yield Safe Havens

Final Word

How did we get here?

Understanding the current market is important to have a clear view of where the market is headed.

We believe 3 events outside of our expectations have lead to the incredible first half in markets.

Regional Bank Bailout

Raise the Roof: Debt Ceiling Suspended to 2025

The Federal Reserve Pauses Interest Rate Hikes

Let me explain…

Regional Bank Bailout- We believed the Fed was going to hike interest rates until it “broke something”.

Well, it did break the regional banks, and cleaned up its own mess in short order. Any funding pressure in markets was short lived because the The Bank Term Funding Program (BTFP) was established, paying $1 par for bonds that are priced at $0.95 in the market. Advances will be made available to eligible borrowers for a term of up to one year, with firm promises to keep the program going until at least March 2024.

The Bank Term Funding Program (BTFP) sure looks like QE in hindsight...

Highlighted in yellow is the historic action taken in March 2023.

This shift in the banking landscape led to a consolidation of power to a few globally systemic banks, making the bigger banks even stronger and in still in a good position to lend.

Raise the Roof: Debt Ceiling Suspended to 2025- The debt limit is the total amount of money that the United States government is authorized to borrow to meet its existing legal obligations. This includes Social Security and Medicare benefits, military salaries, interest on the national debt, tax refunds, and other payments.

In May the debt limit ceiling was suspended until 2025.

Instead of a new limit, the government simply suspended the existing limit, which means we are now spending with no limit.

Any debt ceiling discussion will have to wait until after the election in 2024.

As Richard Stern of the Heritage Foundation puts it:

Essentially the Treasury has a blank check loophole to run up as much debt as needed to avoid a recession before the election and fund government operations without any problems from Congress.

It’s our opinion that the government will utilize this borrowing capacity to prevent a recession before the 2024 election and ensure smooth funding of any and all government operations including another bailout if necessary.

The Federal Reserve Pauses Interest Rate Hikes

The Effective Federal Funds Rate is the rate set by the FOMC (Federal Open Market Committee) for banks to borrow funds from each other. The Federal Funds Rate is important because it can act as the benchmark to set other rates.

On June 14th, the FOMC FINALLY paused rate hikes after 10 consecutive increases in the Fed Funds rate.

The effective Federal Funds Rate is at 5.08%, compared to 1.58% last year. This is higher than the long term average of 4.60%.

Over the last 30 years, there have only been two instances where the Fed has paused after successful hiking rate cycles.

1994 and 2006. (2018 is not considered a full hiking cycle)

1992-1994: Following the recession in the early 1990s, the Fed lowered interest rates to near-historic lows to stimulate economic growth. However, fearing inflation, the Fed kept interest rates steady for about 17 months from September 1992 until February 1994.

2006-2008: During this period, the Fed held the federal funds rate steady at 5.25% for more than a year, from June 2006 to September 2007. As the financial crisis unfolded in 2008, they began aggressively cutting rates again.

The Pause Creates a Platform

If the Fed continues to pause, we believe this will benefit emerging markets due to the international flow of funds between funding and investment currency countries.

The funding currency will have a low interest rate and is used to finance the purchase of a high-yielding investment currencies.

The diagram below outlines a typical international flow of funds.

Germany, operating a trade surplus, borrows from Japan in JPY at low interest rates. Germany then decides to invest in the US.

In this case, Japan is the "funding currency country" and the US is the "investment currency country".

The US attracts this investment because:

Higher interest rates paid on Treasury Bills

A military industrial complex that has the willingness and capacity to enforce geopolitical strength and pro-western ideology

Access to the technological prowess of the US stock market

But there are limits when investing in the US…

Inflation poses a significant risk on Treasury Bills higher real yield

An endless war machine in Ukraine cannot be funded without public support and propaganda

Tech companies trading at 200x P/E can defy gravity for only so long

This leads to the incentive to look outside of the US to invest in countries that have positive demographics and growth above and beyond US equity expectations.

High Yield Safe Havens

A high yield safe haven is an emerging market investment currency country that has favorable political and economic alignment with the US.

Based on the analysis by Adam Parker of Trivariate Research, the asset class expected to benefit from the Federal Reserve's pause on interest rate has emerging markets at the top of their list.

A pause in interest rate hikes can benefit emerging markets since higher interest rates increase the value of the U.S. dollar, making it more difficult for these markets to pay their dollar-denominated debt. A pause of rate hikes puts an upside cap on the pressure for emerging market countries to pay interest.

Emerging markets started raising interest rates first (ahead of developed markets post-COVID), and they’re likely to be the first to cut interest rates as well.

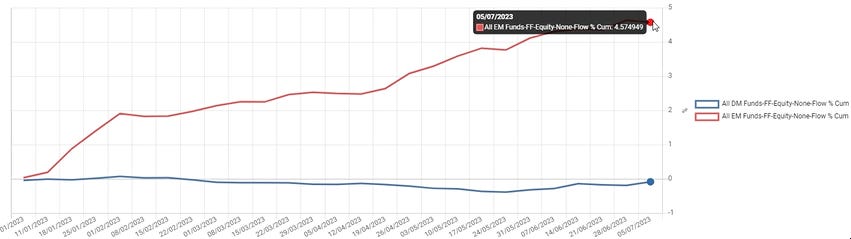

Based on the latest YTD fund flow data, emerging market equities have taken in 4.5x more flows than developed market equities.

This is the second has amount of flows for the year, only behind money market fund flows.

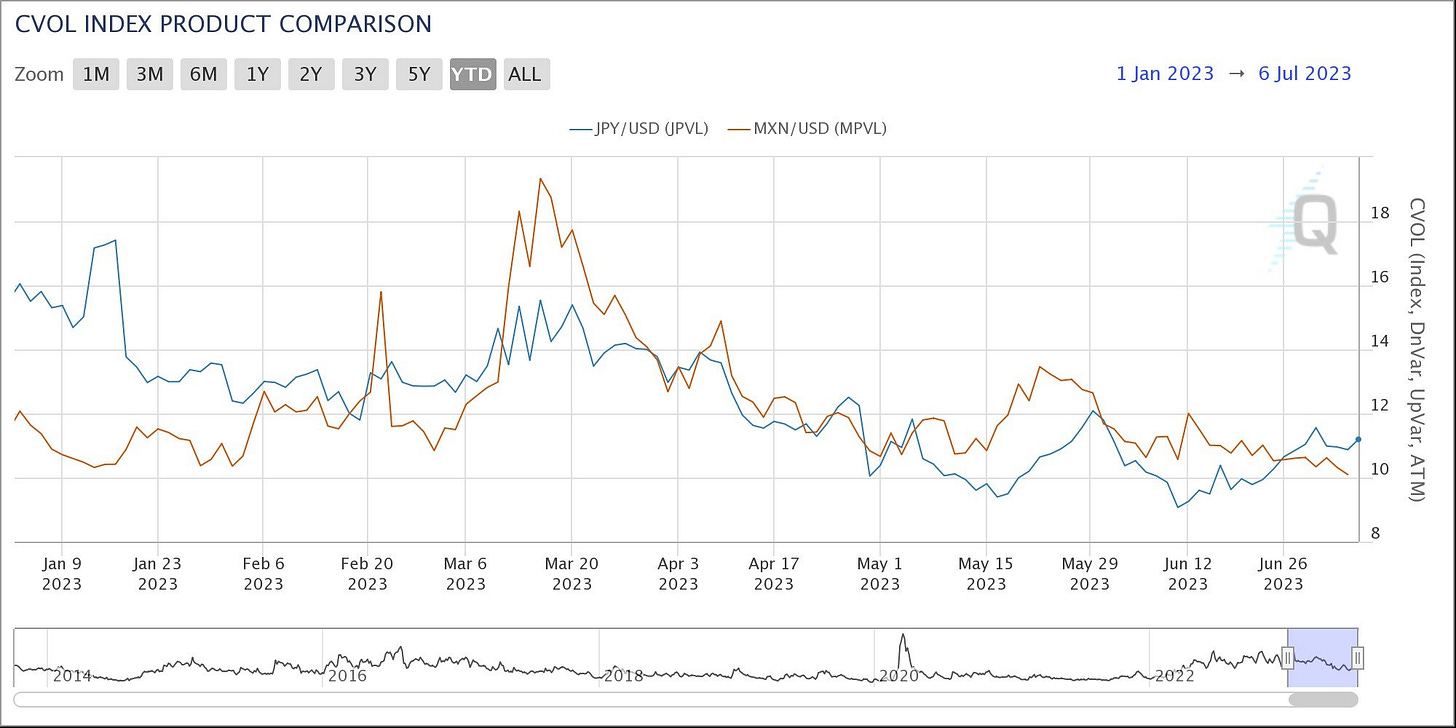

We have also found that during periods of heightened market uncertainty or so-called risk-off episodes, investors tend to move into currencies that are perceived to have safe haven qualities.

The Fed carry trade has been on an absolute tear this year with EMFX implied vol around the lowest it's been in several years.

Carry trades need low volatility interest rate differentials to be profitable.

Based on our research we have found if you separate diversified emerging market equity fund returns between "Investment Currency Countries" and "Funding Currency Countries" there is a +/- 15% total return YTD...

Here, the definition of an investment currency country is based on a positive US Interest Rate differential and allocates an equal weight to the top 10 country ETFs in the category with a quarterly rebalance.

According to Blackrock’s Midyear Investment Framework Emerging Markets are a top priority:

We tactically prefer EM equities to DM peers as EM policy looks closer to easing.

We like the yield and safety on offer in developed-market government bonds, as well as the carry in emerging markets like Brazil and Mexico, and the margin of safety offered in their currencies.

In terms of geopolitical strategy, the U.S. is expected to make significant investments in countries like Brazil, Indonesia, Mexico, Poland, the Philippines, and India, boasting attractive equity risk premiums.

The Indo-Pacific Economic Framework for Prosperity (IPEF) U.S. foreign direct investment in the region totaled more than $969 billion in 2020 and has nearly doubled in the last decade.

Trade with the Indo-Pacific supports more than three million American jobs and is the source of nearly $900 billion in foreign direct investment in the United States.

With 60 percent of the world’s population, the Indo‑Pacific is projected to be the largest contributor to global growth over the next 30 years.

International investing involves special risks including, but not limited to political risks, currency fluctuations, illiquidity and volatility. These risks may be heightened for investments in emerging markets.

Our second half of 2023 investment thesis is based on the perspective that investment flows are directed towards the most efficient return on investment.

By combining domestic investments in deflationary sectors with diversified investments in emerging economies, it is possible to navigate the complexities of inflation and yield curve control while capitalizing on profitable carry trades.

Potential Questions and Further Considerations

What is the likelihood that the Fed has truly stopped hiking rates?

How much of the reverse repo operations will genuinely be utilized to purchase newly issued debt?

Can AI and Technology investments effectively counteract inflationary pressures?

How will the targeted emerging economies manage their inflation, and what are the risks if they don't?

What are the potential implications of the U.S.'s geopolitical and military influence on these investment strategies?

Why wouldn't other funding countries invest directly in these emerging economies?

In subsequent newsletters, we will delve deeper into these questions and examine the evolving investment landscape.

We believe that by understanding these macroeconomic factors and their interconnections, we can craft a more nuanced and effective investment strategy.

Final Word

We're grateful for the opportunity to learn, grow, and invest alongside you at Tuttle Ventures.

If you'd like to discuss your portfolio, please schedule a time below:

Book a meeting with Darin Tuttle

Book a meeting with Darin Tuttle

Best regards,

This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.

Great insights, especially your points on the US-global geopolitical dynamics. Thanks!