Faith, Action, Blessings

Faith, Action, Blessings for investing—

🌺Aloha from Hawaii.

This week, I was able to spend time with my family, focus on the major things in life and celebrate the early wins that Tuttle Ventures has accomplished.

I also had some early morning and late night phone calls, working to help make investing better for my clients. Some have been asking, “How they can stay invested in an uncertain world?”

For me, it’s very simple.

It goes like this: Faith, Action, Blessings.

Not the reverse.

-credit: Dasarte Yarnway

We have to constantly have the optimism that proceeds action, even when the future is unknown.

In investing, this means dealing with uncertainty.

How do we deal with uncertainty?

We break down individual investments, screen out irrational fears and assess potential favorable outcomes.

The mathematical properties of uncertainty rely on statistics.

While not a perfect system, statistics can give us a window of possible outcomes and get a blueprint for the future.

Over the past 91 years, the S&P 500 has gone up and down each year. 27% of those years had negative results.

When you buy a passive index you get the best and worst companies all together.

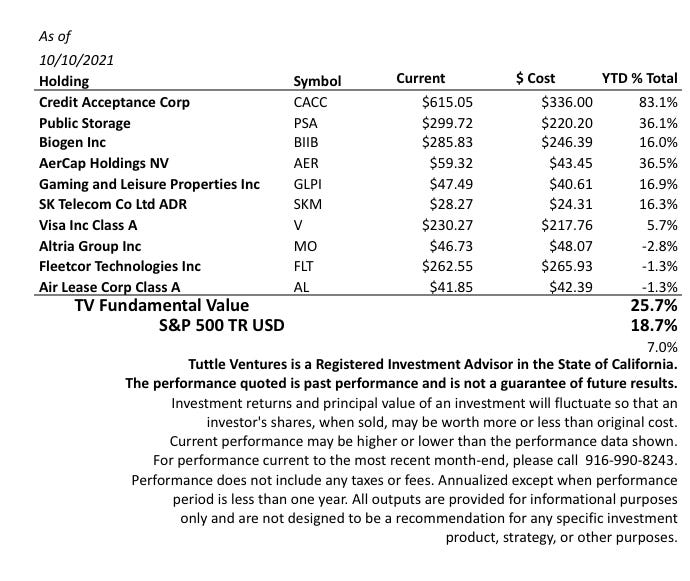

At Tuttle Ventures we take a different approach. So far this year, Tuttle Ventures fundamental value is outperforming the market by +7%.

Rather than trying to predict highs and lows, it’s important to stay invested through a full market cycle in companies you believe in.

Focus on the time you stay invested, not the timing of your investments.

As always, if you'd like to schedule a time to discuss your personal financial goals click here!

PS: Here is a link to an article I was featured in discussing the latest trends in investment management here.

Best,

Darin Tuttle, CFA

Founder & Chief Investment Officer

Tuttle Ventures, LLC