Don’t Take No for an Answer Too Easily

A closer look at Teck Resources

This newsletter is brought to you by Yoodli, which is a private real-time AI speaking coach — with stats to improve your performance.

Newsletter Rundown:

A closer look at Teck Resources Ltd TECK 0.00%↑

What’s the probability of a copper resurgence?

What's the right value for TECK given favorable commodity conditions?

Is a single stock position better than diversified commodity exposure?

Final Word

A closer look at Teck Resources Ltd

Teck Resources Limited TECK 0.00%↑ is a Canada-based mining company that operates in copper, zinc, steelmaking coal and energy segments.

We forecast the company as a strong investment over the next twelve months— due to increasing commodity prices, positive shareholder yield, and effective cash management.

We have a buy rating and a price target of $54.

Main risks include volatility of commodity prices, legal liabilities from asset sale, corporate governance concerns, and geopolitical uncertainties.

In Norman Keevil’s memoir, he referred to one of the key lessons in life: “Don’t take no for an answer too easily.”

Teck’s future — and the legacy of the Keevil family are turning a new chapter.

The company has announced an agreement to sell its entire interest in its steelmaking coal business, Elk Valley Resources (EVR), through a sale of a majority stake to Glencore for an implied enterprise value of $9B, and a sale of a minority stake to Nippon Steel Corporation.

Teck finally gave in to the Swiss environmental cartel.

The strategic decision did not come easy —it was ultimately made to optimize the company’s portfolio, reduce risk, and allocate capital to opportunities that better fit its long-term goals.

Rather than get into a debate about the merits of ESG investing— I’m much more focused how much shareholders could be rewarded with its upcoming payday.

Teck has a global presence, with customers in more than 70 countries, and a workforce that includes over 10,000 employees and contractors.

We find the resilience of the company has attractive potential for shareholder payouts ahead of earnings on April 25th, 2024.

What’s the probability of a copper resurgence?

Two leading indicators for increasing commodity prices are:

Demand-Supply Imbalance: When demand exceeds supply, it often leads to higher prices as suppliers struggle to meet consumer needs.

Economic Growth: Strong economic growth, particularly in developing countries, tends to increase demand for commodities, driving prices higher.

Teck’s asset sale places renewed attention to the future of copper prices.

Electrical uses of copper, including power transmission and generation, building wiring, telecommunication, and electronic products, account for about 75% of total copper use. Source

Due to its broad use, we like to use the price of copper as a signal of general economic conditions.

In a recent study published by The Journal of Commodity Markets, copper prices were reviewed across seven factors —inventory, supply, demand, the macroeconomy, finance, and geopolitics.

The results of the study showed that financial and geopolitical factors have played an important role in copper pricing in recent years. The long-run trend of copper prices is mainly determined by fundamental factors, while financial and geopolitical factors have a more direct impact on short-term fluctuations.

In 2023, global economic shifts, conflicts, and anti-globalization sentiments are poised to influence the global copper supply.

The Copper Development Association (CDA) released a new report to determine mineral criticality.

The analysis showed that copper now meets the USGS benchmark supply risk score of 0.40 and automatic inclusion on the U.S. Critical Minerals List.

Teck holds a competitive edge when it comes to supply of this critical resource.

Chile and Peru, together accounting for 35% of global supply, have been focal points for Teck's investments over the past four decades.

With the rise of the financialization of copper and other base metals, the copper price is no longer completely determined only by the fundamental supply–demand relationship.

Last month, copper cash price vs. LME 3-month price hit its most extreme level of contango in thirty years.

Contango refers to a situation in the futures market where the future price of a commodity is higher than the current spot price.

It implies an expectation of rising copper prices over time.

Past research suggests that copper spot and futures prices are highly correlated during strong contango. Source

Considering all these factors, we assume there is a high probability that copper prices will rise over the next twelve months and Teck will benefit.

What's the right value for TECK given favorable commodity conditions?

We start comparative valuations by examining both debt and equity.

Debt for the company trades in line with peers—recently rated investment grade bonds—5.4% 02/01/2043— trade with good volume at 6.1% YTW (yield to worst).

The Moody’s report mentions the excellent liquidity that allows the company to operate through commodity price fluctuations. They go on to mention the company’s cost competitive mines are capable of generating positive earnings and free cash flow at current and even lower copper prices.

At an interest coverage ratio of 67.8, we agree with Moody’s. The capacity to paydown interest debt 67x times over provides the company operational flexibility.

Regarding equity, we believe the asset sale will significantly alter the balance sheet in the next 12 months and gives an opportunity for management to payout shareholders.

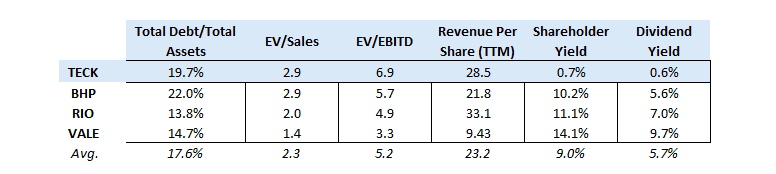

Before the asset sale, TECK's metrics, including Total Debt/Total Assets, EV/Sales, EV/EBITD, and Revenue Per Share, are generally comparable to those of its peers.

Bottom Line: We anticipate management will wisely utilize the ~$9B in cash.

We expect the low shareholder and dividend yield to catch up to peer averages.

The Board has already initiated the process by authorizing a $500 million share buyback last quarter.

We believe it’s highly likely next earnings call will reveal a stock buyback in the 1-4% range of outstanding shares.

An alignment to industry average shareholder yield might include a special dividend or a rise in current dividend policy.

Long-term tests show that high shareholder yield stocks outperform the broader stock market and high dividend paying stocks. Source

Is a single stock position better than diversified commodity exposure?

Whether a single stock position or diversified commodity exposure is better depends on various factors such as investment goals, risk tolerance, market conditions, and personal preferences.

The answer to this question is— it depends.

A single stock position can offer the potential for higher returns if the chosen company performs well. However, it also carries higher risk since an investor's fortunes are tied to the performance of a single company.

On the other hand, diversified commodity exposure spreads risk across multiple commodities, potentially reducing the impact of poor performance in any single commodity. It’s possible are bullish thesis on copper never materializes. A diversified approach can provide stability to an investment portfolio but may limit the potential for outsized gains compared to investing in a single high-performing stock.

Ultimately, the decision between a single stock position and diversified commodity exposure should be based on individual circumstances and investment objectives. It may also be beneficial to consult with a financial advisor to determine the most suitable investment strategy.

Final Word

Thank you for reading and I am grateful and humbled to be able to learn, grow, and invest alongside you at Tuttle Ventures.

Vision, courage, and patience leads to successful investing.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn, or Instagram.

Check out the website or some other work here.

Best,

Darin Tuttle, CFA

This is not investment advice. Do your own due diligence. Past performance is no guarantee of future results. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Investors are encouraged to perform due diligence, consider their risk tolerance, investment goals, and consult with financial advisors before making investment decisions. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.