Big Moves in Bonds and Taxes

Actionable Market Insights from Tuttle Ventures

Newsletter rundown:

What we are watching in Markets

Tax Referral Partner

Employee Retention Credits (ERC)

Final Word

What we are watching in Markets

The month of March has been eventful. Bank equity is being repriced, with larger globally systemic important banks accepting a large share of new deposits and customers.

We believe this shift will continue to strengthen the competitive advantage of larger banks. The access and confidence advantages will allow the largest banks to pay higher interest to depositors and collect revenues from diversified banking activities.

Outside of the financial sector, outsized moves in U.S. treasury bonds and gold caught our attention.

While equities have relatively held up for the month, the price action in bonds has been significant.

U.S. treasury bonds are typically a “safe haven” asset and are bought during risk off periods.

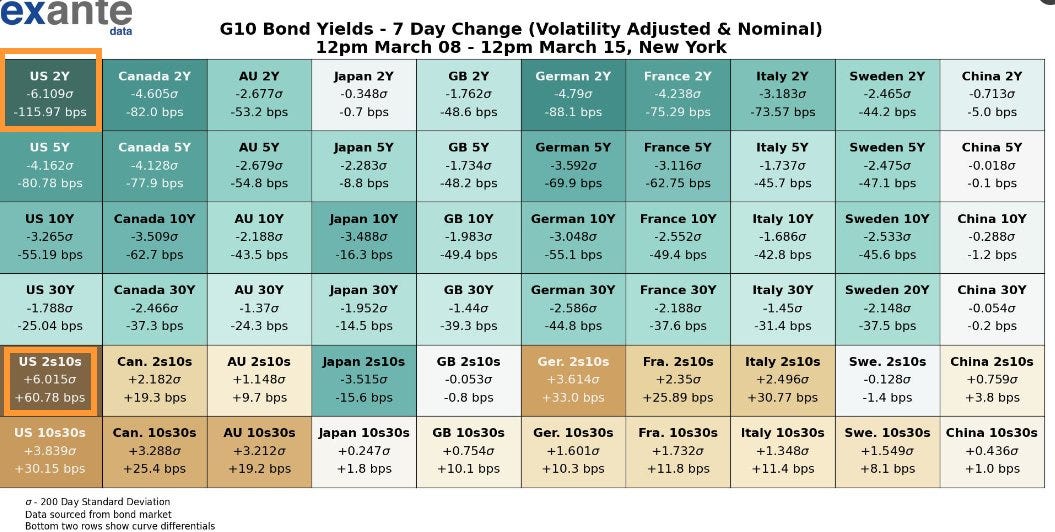

The six sigma event in the U.S. 2Yr Yield corresponds to a move so great it should occur once every *1.4 million years*.

The quite rare move suggests that a substantial number of investors are willing to buy U.S. treasury bonds and collect a yield of around 3.76% for the next 2 years. (As of March 23, 2023) TUA 0.00%↑

The largest changes are highlighted in boxed orange squares below:

Large shifts like this definitely catch our attention.

From my experience, this implies that bonds are back in favor, despite the fear of inflation.

The trend of shorting U.S. treasury bonds as the Fed continues to hike interest rates has been abruptly called to an end.

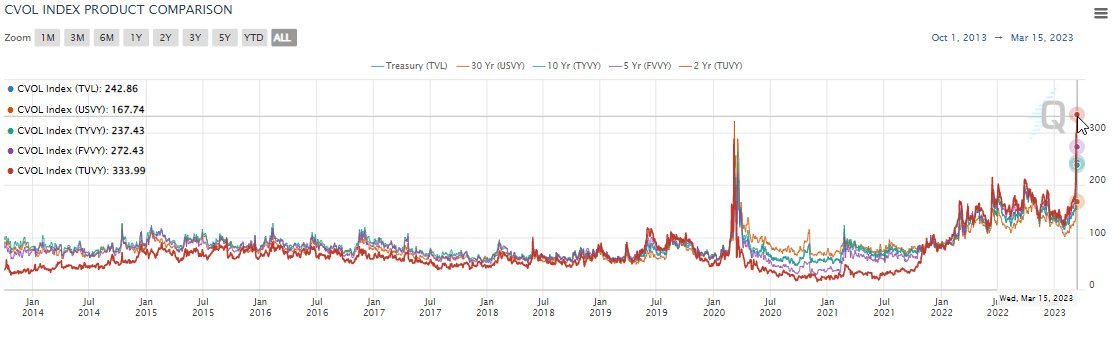

Volatility on the 2Yr defies history, now beating the 30-Yr in terms of elevated volatility levels back on March 9th, 2020

Gold has also been a big mover.

The iShares Gold Trust IAU 0.00%↑ is up 8.3% YTD on a total return basis and recently hit a new 52-week high.

Gold is often hailed as a hedge against inflation—increasing in value as the purchasing power of the dollar declines and investors are looking to protect against downside risk.

Holding gold does not pay a dividend. Its important to understand the price appreciation of gold will determine the total return over the long term and for that reason gold is not a default buy and hold asset in most portfolios.

The LBMA gold price continues to be set twice daily (at 10:30 and 15:00 UK time) in US dollars. The price of gold is ultimately tied to the US dollar. This has an negative impact for auction prices of central banks who want to purchase gold with other currencies but are tied to settlement prices in US dollars.

The strength of the US dollar, has historically been a cap on gold demand from foreign central banks.

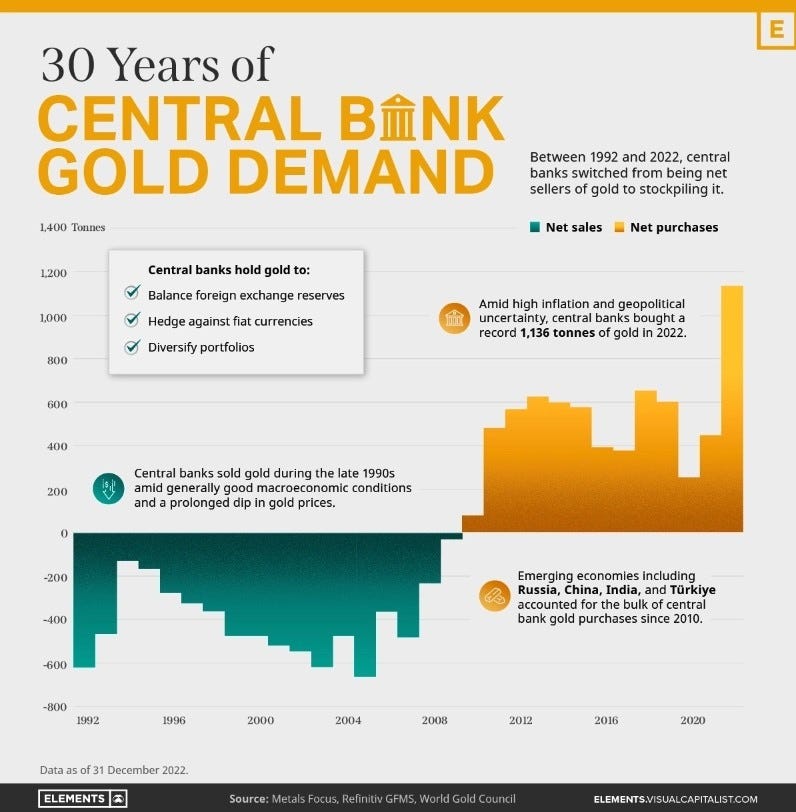

In 2022, central banks bought a record 1,136 tonnes of gold, worth around $70 billion. At the same time, the US dollar surged to some of the highest levels we have seen in a decade.

A recent article published on the World Economic Forum website highlights that central banks have switched from being net sellers to net buyers.

We will continue to watch the gold market, its relationship with the US dollar, and opportunities to hedge downside risk.

Tax Referral Partner

Taxes are likely the biggest expense you will have throughout your entire life, and the key to properly managing them is to align your income and investments to your long term goals.

We have been getting a lot of questions lately about who we typically refer for tax preparation.

We have been pleased with the work by www.yourtaxgeeks.com based here in Corona, CA.

Christopher is trustworthy, an expert in his field, and easy to work with.

ERC Payouts

We have also been helping our clients receive the Employee Retention Credit (ERC).

We are a preferred advisor with BottomLine Concepts who have processed over 35,000 claims, including many Fortune 100 companies like Citibank and Rolex.

Jeff left his cushy investment career in New York to help business owners impacted by Covid-19 who have more than 5 W-2 employees during the 2021 and 2022 tax year.

The rules have been updated and its definitely worth your time. If you have not received your ERC money, I would encourage you to book a time with Jeff before the tax filing deadline.

Final Word

I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

We believe that Vision, Courage and Patience leads to successful investing.

Best,

Darin Tuttle, CFA

This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.