Beyond a Shadow of Doubt

Is now the time to sell out of the market and run for the hills?

Welcome to +13 new followers over the last 30 days and +17 Substack authors who recommend our newsletter.

For newcomers, we focus on unique investment ideas supported by novel research.

Discover more in our subscriber archive with over +150 newsletters.

Sometimes, I get a call or email from a worried investor who's been online or glued to the news. They've seen a story that convinced them the market is about to crash for good.

As an advisor to other financial advisors, you would be surprised to learn this happens to the best of them, even other advisors.

It's a reminder of how powerful the media is in spreading fear, regardless of the actual probability of an event happening.

The truth is, Bear markets are as common as dirt.

On average, they happen about once every six years.

So, is now the time to sell out of the market and run for the hills?

We don’t think so. Here are two reasons why:

Strong Economic Indicators

Sufficient liquidity reserves

Strong Economic Indicators

Key indicators like employment rates, consumer spending, and corporate earnings are still robust.

The Fed's preferred measure of inflation (Core PCE) held steady at 2.6% in June which is right on target.

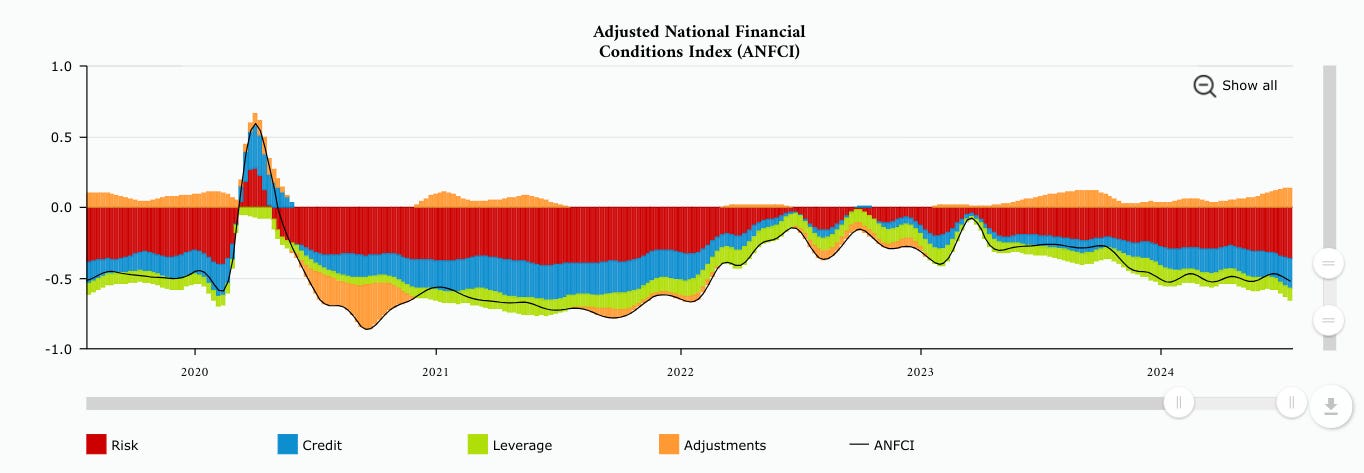

Frequent readers should know I also like using the Adjusted National Financial Conditions Index.

The Adjusted National Financial Conditions Index (ANFCI) is a comprehensive weekly update of 105 U.S. financial conditions across three categories of financial indicators (risk, credit, and leverage).

We prefer this measure due to adjustments for inflation.

The weekly data goes back to the 1970’s, includes “shadow banking” metrics, and is a key input in our investment outlook.

Positive values have historically been associated with tighter-than-average financial conditions. (Bad for risk assets)

Negative values have historically been associated with looser-than-average financial conditions. (Good for risk assets)

We are currently in a negative position, which is good for risk assets.

In fact, 99 of the 105 indicators are looser than the long term average.

Don’t believe the hype of restrictive monetary policy, we still are in a Goldilocks period.

Sufficient Liquidity Reserves

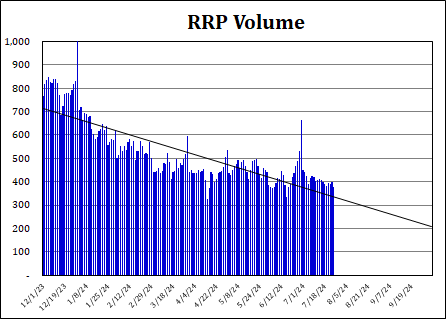

Since last year, we have seen a sustained and methodical release of funds from reverse repo, serving as an intraday relief valve for liquidity into the financial system.

We have looked at reverse repo levels to measure temporary general net liquidity conditions.

When you reduce RRP, you now have treasuries free and clear of the overnight sweep.

Banks get to extend duration by purchasing treasuries which are then used as collateral to take risk beyond one day.

The free treasuries are also leveraged into risk assets and held for longer terms in money market fund deposits.

It appears there has been a leveling off around in the range of $400B - $500B.

This leveling off was against the previous trend and has held steady since mid April.

We believe this could mean two things:

The Federal Reserve is confident in favorable financial conditions and is willing to maintain slightly tighter liquidity as a result. Powell understands the importance of reverse repo in daily market activity. We believe it's possible that Powell wants to preserve the final $400B - $500B to be held back to be prepared if/when an unexpected market event arises. This creates an instant safety net.

The Treasury General Account (TGA) has enough funds to support current government operations. If RRP remains stable, the TGA becomes the next release valve in measuring net intraday liquidity. This is the most logical reason, given the percent makeup of liabilities on the balance sheet.

In summary, despite the fear-driven narratives, strong economic indicators and sufficient liquidity reserves suggest the market is in a stable condition. It's crucial to look beyond the headlines and focus on the underlying data, which points to a favorable environment for risk assets.

Final Word

Thank you for reading and I am grateful and humbled to be able to learn, grow, and invest alongside you at Tuttle Ventures.

Vision, courage, and patience leads to successful investing.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn, or Instagram.

Check out the website or some other work here.

Best,

Darin Tuttle, CFA

This is not investment advice. Do your own due diligence. Past performance is no guarantee of future results. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Investors are encouraged to perform due diligence, consider their risk tolerance, investment goals, and consult with financial advisors before making investment decisions. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.