Be Kind Please Rewind

No Narratives, Just the Facts with Tuttle Ventures

Welcome to +71 new subscribers this week, +167 over the last 30 days, & +388 over the last 90 days!

If this is your first time, know that our core values are: collaboration, excellence, and intellectual curiosity.

We believe our incredible growth is because of smart investors like you, who are willing to challenge false narratives and follow the facts which leads toward successful long term investing.

If you are looking for unique ideas backed by interesting research, you have come to the right place.

I highly encourage newcomers to go back and read through our past 62+ newsletters since we launched Tuttle Ventures.

I am writing this week after a quick trip to Park City, Utah.

We got some facetime with The Sandlot Partners. For those interested in private equity, we wrote about the group a few weeks back in Playing in the Sandlot.

Newsletter rundown:

Portfolio Updates

Be Kind Please Rewind

No Narratives, Just the Facts

What if there's another way to look at this?

Final Word

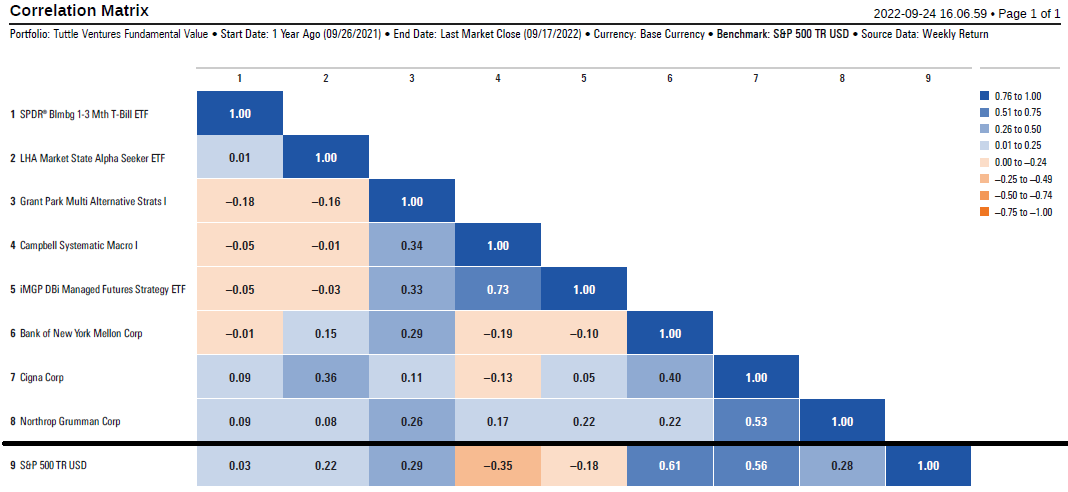

Portfolio Updates

The best money you will ever make is the money you DON’T LOSE in a bear market.

We do not anticipate making any changes in the near future and continue to stay positioned to gain while the broader market sells off.

Our diversifiers are beginning to shine through.

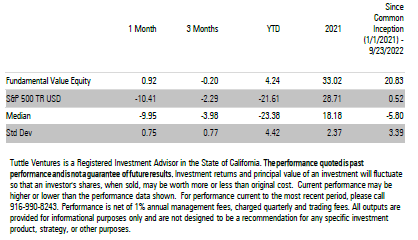

I think what continues to stand out is how low the portfolio is correlated to broader market returns.

Below is a correlation matrix of current portfolio holdings, based on net weekly returns benchmarked to the S&P 500 TR index over the past year.

What should stand out is the final row.

Here you can see a low or negative correlation across portfolio holdings.

Diversification is not what it used to be. Accelerated events to the downside are not unique and is the time when most correlations go to 1.

While correlations can and do change over time, we believe our diversifiers may continue to provide a ballast against market turmoil heading into the end of the year.

We have been preparing for this.

At Tuttle Ventures, we are not afraid to stand out from the crowd.

There maybe more bear rallies to come that will test the portfolio before the end of the year.

Paying subscribers can get access to the portfolio weightings, here.

Be Kind Please Rewind

Sometimes we feel like a broken record.

Does anyone remember the old VHS tapes with the slogan, “Be Kind Please Rewind”?

Way back when, VHS tapes had to be rewound before you could play the movie from the beginning.

After renting a video, some people would think about the next person and rewind the videotape for the next renter’s benefit.

Today we are going back and rewinding our investment rationale, for your benefit…

As we have said before, we believe we are in a position to profit as the market sells off due to the following reasons:

A higher allocation to cash

A blended allocation to 3 distinct managed futures strategies- Broadly diversified long/short positioning across commodities, interest rates, currencies, equities, and rates.

A tactical volatility fund that profits from the mean reverting qualities which volatility has historically demonstrated.

The strategy that I outline can have tax consequences for taxable accounts with capital gains and may not be appropriate for all individual investors.

This is why readers should not confuse portfolio positioning with individual investment advice. Readers should consult with a qualified financial advisor before making any changes to their investment accounts.

No Narratives, Simply the Facts

The world is a confusing place.

We're allured by narratives - explanations for what's going on in society, and then we get caught up into them because they make sense at first glance, adhere to our prior assumptions, or sound good enough to believe without question. In reality most investors have no idea if those things being talked about are true whatsoever; but yet people continue believing everything as though it were gospel.

What should you do if the market takes a turn for the worse?

My experience managing investment portfolios has been that understanding long-term economic and stock market cycles is key to risk management.

The Facts

If you remember, we continue to use two indicators to guide our positioning:

ECRI US Weekly Leading Index

Adjusted National Financial Conditions Index (ANFCI)

Leading economic indicators are the “early warning signals” of a recession.

The Economic Cycle Research Institute (ECRI) maintains a proprietary composite of leading economic indicators.

Here is a chart of the current ECRI US Weekly Leading Index:

As you can see, the Weekly Leading Index has broken in a downtrend below the red line at the zero level.

Historically, this has predicted recessions six to nine months before the recession starts. That would place the next recession sometime between October 2022 to January 2023.

The Adjusted National Financial Conditions Index (ANFCI) is a comprehensive weekly update on U.S. financial conditions three categories of financial indicators (risk, credit, and leverage).

We like this measure because adjustments are made to remove the variation in the individual indicators attributable to inflation.

Billionaire hedge fund manager Paul Tudor Jones uses this measure as his base case for an allocation to managed futures.

The index is designed to have an average value of 0 and a standard deviation of 1 over a sample period extending back to 1971.

Positive values have been historically associated with tighter-than-average financial conditions.

Negative values have been historically associated with looser-than-average financial conditions.

Here, you can clearly see we have broken into positive territory signaling tighter financial conditions ahead.

We expect a recession, with a lag, after monetary policy continues to get tighter.

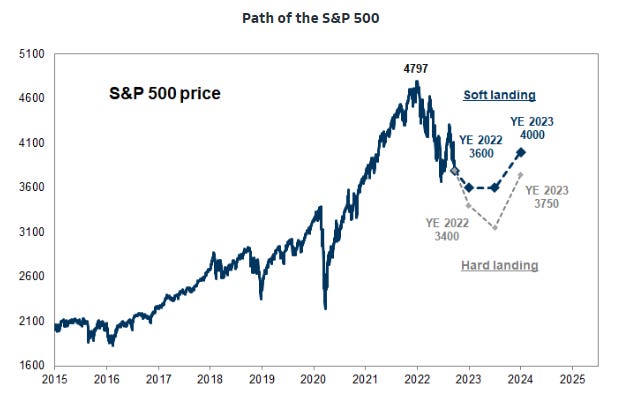

What if there's another way to look at this?

What if I'm wrong?

Let’s wave a magic wand and get inflation back down to 2%.

Erik Norland, executive director and senior economist of CME Group, does a great job outlining simple tradeoffs under the current market environment.

Erik explained possible scenarios to end 2022:

Option 1, we stay on the path of hiking rates to fight inflation — at the risk of upsetting equity markets.

On the other hand, the Fed could stop hiking rates to support financial markets — at the risk of failing to contain inflation.

I’m not trying to complicate investment decisions beyond this narrow view.

Currently our portfolio is positioned to profit under the first scenario.

If we are wrong, we will miss out on another potential positive equity rally.

We estimate, on the high side, this could be another +15% missed opportunity to the upside from current S&P 500 level to 4,245 before the end of the year.

On the downside, some sell side analysts forecast, under a "hard landing" scenario, the index to decline to 3,150 (-17%).

These are valid questions to ask, and its impossible to correctly time the market.

If you're not questioning your own point of view, you are most likely not looking at the full picture. Asking yourself "what if I'm wrong?" is a great way to keep yourself humble and reconsider your beliefs.

Final Word

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Vision, Courage and Patience leads to successful investing.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn or Instagram.

Check out the website or some other work here.

Best,

Darin Tuttle, CFA

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.