A New Era in Global Investing: National Security

A first-of-its-kind thematic approach for investors.

Many Americans are unaware that investing with Blackrock or Vanguard could unintentionally support companies that oppose U.S. national interests.

Human rights violators, cybersecurity threats and defense contractors in China are open for business, guided by index approval.

Some are beginning to wake up.

We are entering the cusp of a transformational shift.

A new era of impact investing where national security is a top consideration.

Quick Rundown

How did we get here?

National Security Impact Investing —a first of its kind

Why should investors care?

Why hasn’t anyone done this before?

What makes “Free Markets” Free?

Final Word

How did we get here?

In just 30 seconds: When a financial crisis occurs, it reveals unexpected power shifts. Since 2008, there's been a massive shift from active to passive investment strategies.

Crucially, this large and growing industry is dominated by just three asset management firms: BlackRock, Vanguard, and State Street. Source.

The recent Russian invasion of Ukraine brought geopolitical risk to the forefront for most investors. War is expensive and U.S. investors could no longer afford the luxury of funding both sides.

Companies that violated U.S. sanctions had to be divested, markets were shut down, products delisted.

This is a conflict of interest for global asset gathers.

The issue stems from a prosperous nation, exacerbated by entrusting enormous power to the “passive priests” of multinational corporations who allocate investment capital.

Some critics even argued that Vanguard and Blackrock, amid the Ukraine crisis, failed to address the geopolitical risk in a timely and direct way. Source.

In fact, the index provider MSCI fails to acknowledge there is any conflict at all.

“MSCI does not have any stock exchange, asset manager, broker dealer, bank, or trading/clearing facility in its corporate group. MSCI does not issue, market, trade or clear securities or financial products (excluding MSCI company stock). For these reasons, MSCI believes that there are no inherent conflicts of interest arising from its corporate structure in connection with benchmark administration.” Source.

And therein lies the problem.

Larry Fink and Tim Buckley as CEOs in the "passive priesthood" have been the accidental patron saints amid the popular rise of index investing.

These men sit in their ivory towers. They are surrounded by walls built from billions of dollars, sourced from pension funds and the savings of Americans.

Their objective is to appease global demands, which span an investment universe without borders.

Their primary allegiance lies not with any nation, but to the constant flow of investment.

Bottom Line: Sending substantial amounts of American funds to businesses associated with the Chinese military and human rights violations intensifies an existing national security risk and undermines American values.

National Security Impact Investing

National Security Index, in partnership with Tuttle Capital Management, announced the launch of the National Security Emerging Markets Index ETF on the Nasdaq stock exchange under ticker NSI 0.00%↑

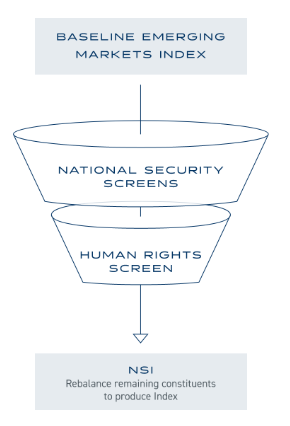

NSI is the first index fund to systematically vet out companies that threaten the national security and human rights interests of the United States.

A copy of the fund materials is available here.

We were given exclusive access from fund management to go behind the scenes and assess the index history and hypothetical track record.

The National Security Index employs leading opensource intelligence tools, including resources in use by federal agencies, to track and assess entities of concern across global capital markets.

The Index is subject to a National Security Governance process that filters out companies that test positive for at least one of nine investment screens.

Subject to U.S. Government sanctions

Defense contractor in a country of concern

Provider of militarily useful items to hostile forces

Participant in state-sponsored influence operations against the U.S. or its allies

Strategic threat

Cybersecurity threat

Espionage threat

Human rights violator

Operator in disputed areas of the South China Sea or East China Sea

In support of an objective standard, the Director of External Affairs solicits nonmaterial information and advice from national security professionals in the fields of defense, intelligence, export controls, foreign affairs, and human rights.

Keep in mind this fund is focused on emerging markets. Emerging markets are characterized by a combination of investment barriers, low market liquidity, low accounting standards, and weak investor protection.

The NSI uses the S-Network Emerging Markets Liquid 500 Index as a baseline but applies its own screening and sector weighting processes.

Exclusive Insights

As this product is new, certain aspects of the ETF remain untested.

However, our initial research reveals key insights.

Contrary to expectations, the 'national security screens' were not the main determinants of past performance attribution.

First, the fund is focused on emerging markets but includes specific country inclusions of South Korea and Taiwan. These particular countries of focus would not be typically found in other emerging market funds, and were a overall net positive contributor.

Second, the ETF current holdings are solely in ADRs (American Depository Receipts). This significantly reduced the investment universe from about 500 to just over 200 entities.

Empirical Research is mixed on whether ADRs positively contribute to performance over time. Source.

Most of the literature does agree in principle that the seasonality of U.S. markets plays a factor in ADR positive or negative performance. For example, the subsequent operating and stock performance of ADR firms listed in hot years is significantly worse than those of ADR firms listed in cold years. Source.

Some suggest the trend will be a positive season for ADRs given the current U.S. market.

The fund can invest in ordinary shares, but for the initial launch and operational constraints, ADRs were selected.

Third, the reallocation of sector weightings is significant.

Under the smaller universe, the overweight to Technology (23%) and Financials (23%) stands out.

Of the 105 diversified emerging market ETFs about 2/3 of the universe has less Technology exposure.

Year to date, the overweight to Technology has been a positive contributor.

Moving forward, we will continuously monitor these and other market dynamics, ensuring that the strategy adheres to its unique approach.

Why should investors care?

How much money is spent every year by corporate boards to understand what the heck is actually going on in Washington?

My guess is no small dollar amount.

But what about investors outside the U.S?

We believe a global investor faces losses in a diversified portfolio if a trade war with China occurs.

When a financial advisor looks at what they could do when Russia evades Ukraine, there was no good answer.

Now, we have a tool to be able to pick a side.

Here are key problems that the new National Security Index will solve for global investors.

A shift in power away from traditional index providers: Investors now have an option outside of the “all or nothing” approach. When allocations to China because to steadily rise in 2017 and 2018 in emerging market products, it was subverting the rhetoric coming from Washington at the time due to the trade war.

Defined alignment with US national Security interests: Clearly defining national interests is by far the biggest benefit of this index. For the reasons I mentioned above, those screens have not been critical in performance. However over time and as rebalances occur, this may become more important. Understanding that these screens come from the top down provides context to why and how companies can be excluded in the future.

A risk aware approach to investing oversees: Geopolitical risk can seemingly come out of nowhere. For years, Meb Faber of Cambria Investment Management, was always talking about the value premium in Russia.

The geopolitical discount was priced in, but not supported by fundamentals. At the time a P/E of 6, the potential upside to revert back to long term averages was high, as earnings were growing and stable. However, Meb, as many other portfolio managers have fallen victim, the geopolitical risk associated with an allocation was not readily apparent. By all accounts, the traditional index providers had given the stamp of approval and assets flowed in only to be rig pulled and the onset of war.

It is our hope that by closely following companies that fall out of favor of U.S. national interests it maybe a warning sign of trouble on the horizon.

Why hasn’t anyone done this before?

Addressing why this approach hasn't been adopted previously sheds light on the complexity and novelty of the strategy. Defining and quantifying national security interests is an intricate task, often clouded by broad and ambiguous interpretations. The National Security Index (NSI), however, has pioneered a method to navigate this complexity by establishing clear, actionable criteria. It is incredibly difficult to define and measure national security interest.

This can be a broad sweeping topic that is nebulous to many.

This framework not only reflects the evolving nature of global geopolitics but also marks a departure from traditional index strategies that lacked this nuanced understanding. The reluctance or inability of others to delve into such specific and sensitive territories is what sets the NSI apart.

It also opens up the potential for government overreach into free markets.

What makes “Free Markets” Free?

The term 'free markets' often conjures images of unfettered capitalism, yet in reality, these markets operate within a nuanced blend of autonomy and regulation. True free markets are underpinned by principles of voluntary exchange, competitive dynamics, and minimal government intervention. However, they also exist within frameworks that protect property rights and ensure fair play. This balance is crucial for fostering innovation and growth while safeguarding against monopolistic practices and unethical behaviors.

In the context of the NSI, I believe the freedom to support your own national interest is important.

Final Word

The National Security Index marks a significant shift in global investing, providing a framework that aligns financial decisions with national security interests. While it's not without its challenges and criticisms, it offers a new perspective for investors looking to navigate the complex interplay of geopolitics and finance.

As we witness the rise of multinational corporations and shifting geopolitical alliances, tools like the NSI become crucial in making informed investment choices that are both profitable and aligned with national values.

Best,

Darin Tuttle, CFA

This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved.

Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.