A Junior Silver Miner in our Easter Basket

Actionable Market Insights from Tuttle Ventures

Welcome to the +12 new subscribers this week!

For all my new readers, I promise to share actionable market insights and portfolio updates so YOU can make better investment decisions and get an inside view of Tuttle Ventures.

Today I’ll cover our newest portfolio position and a private equity deal available to accredited investors.

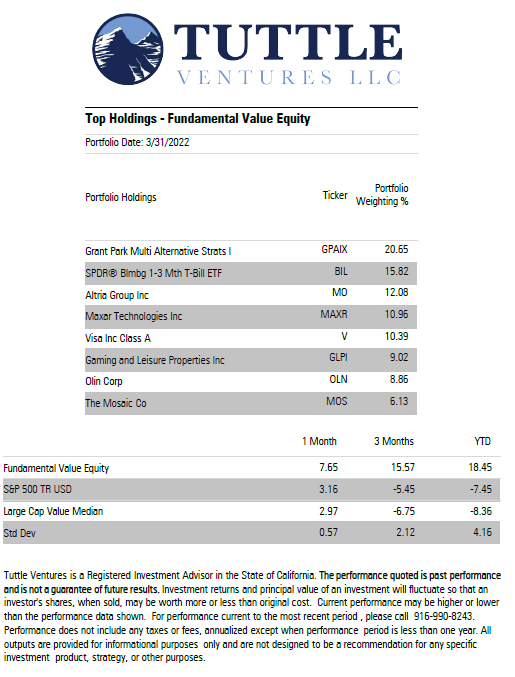

Quick check in on current portfolio holdings and performance as of 4/15/2022:

If you want to revisit any of my rationale of prior portfolio holdings click here.

Fortuna Silver Mines, Inc.

Fortuna Silver Mines Inc ($FSM) is engaged in precious and base metal mining across emerging market countries. We believe the company has the upside of an explorer with the low risk of a producer.

We came across the macro opportunities in Junior Miners as a relative play against the larger Senior Miners from recent popular Twitter threads:

Size could be an advantage here if the correlation mean reverts to current trends.

While evaluating junior miners, fundamental screens are crucial.

We zeroed in on $FSM fairly quickly based on their latest fundamental earnings and positive news.

Upside of an explorer with the low risk of a producer

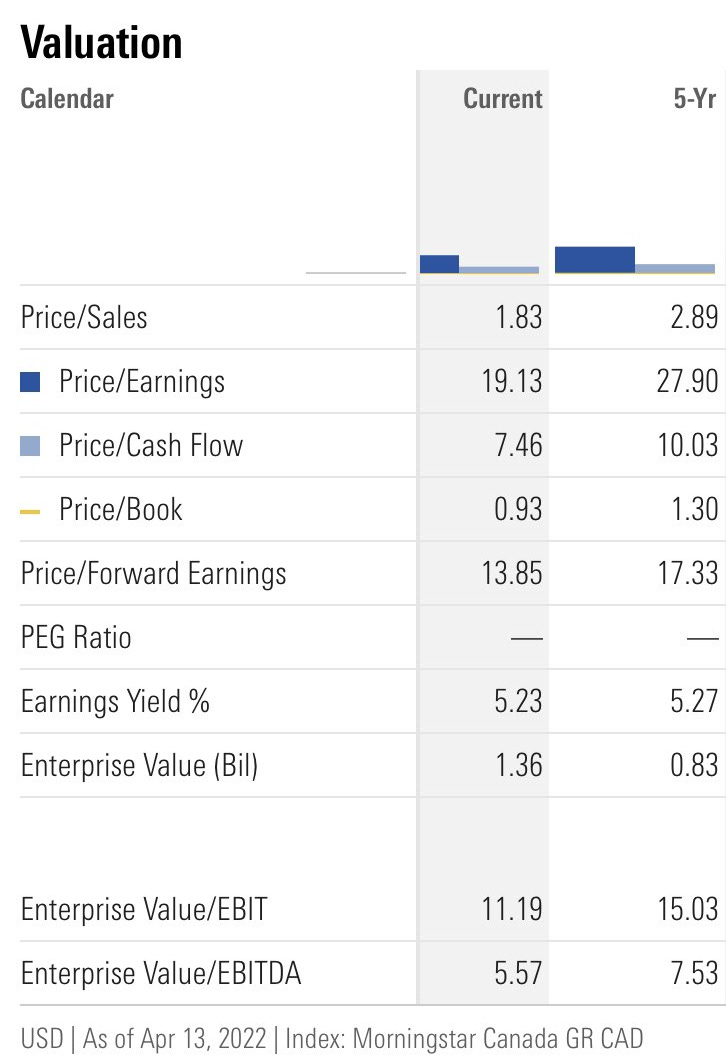

On paper, Fortuna Silver Mines Inc ($FSM) stays within our core value thesis.

Buying a stock with a P/B of 0.93 is like buying $1.00 for 93 cents.

We also like the comparison in P/CF as a 7x multiple in range with industry average.

Every value stock is long a call option on positive news.

In a conversation with Nate Fisher, author of renaissancemen.org I gained a greater appreciation for his conviction in the stock and company history.

In our opinion, Fortuna Silver Mines suffered from 2 things that crushed the stock price:

Roxgold Combination which diluted early shareholders

The Mexico San Jose Mine red tape political games. The company was granted a 12 year extension to mine in the area, but Semarnat (the Mexican equivalent of the EPA) then came out and said it was ‘2 years’ instead of 12 years due to a clerical error.

We now believe both issues have been handled in a responsible way and opens the door for future growth.

The Roxgold Combination will not longer dilute future shareholders. With only half a year track record, the combination is complete and growth from the combination has exceeded expectations. The company has doubled revenues of 2021. Gold production has jumped 93% on a YoY basis. Goodwill is reasonably in line with the acquisition price.

As for the San Jose Mine, we think this has more to do with a “pay to play” political game vs. actual risk to business operations. Per the company’s quarterly earnings a few weeks back, $FSM has high enough confidence in Mexico on a further extension to be investing around $10M into expanding reserves at San Jose this year.

The mine never stopped mining throughout the permit process and the company recently reported that Compañía Minera Cuzcatlán (the Mexican Subsidiary) recently made a payment of 764 million pesos in federal contributions and royalties in favor of the shared development in Oaxaca. The company also employs over 1,200 workers in the area. As the company continues to grow and expand production we anticipate paying back the local area as simply a cost of doing business.

I love a good misfit

Companies that are mislabeled or in the wrong category are often overlooked by bigger fund managers. While the name Fortuna Silver Mines, Inc. literally has “Silver Mines” in it, since the company acquired Roxgold, revenues are now 70% gold and 27% silver.

The traditional gold bugs don’t count the company as a gold play yet. In addition the Landero mine just started gold production. By next summer, with the new mine coming online, FSM may only be a 15-20% silver producer by revenue. If you see how the stock is performing, they are acting like a poor silver company who the market has never digested they have a gold mine for free in their market cap.

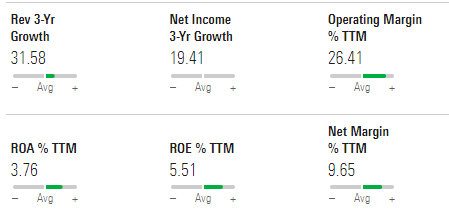

Growth metrics over a 3-year timeline demonstrate strong management.

Overall, we believe that Fortuna Silver Mines Inc ($FSM) will be quite the story in the next few months.

Accredited Investors for Arizona Apartment Real Estate

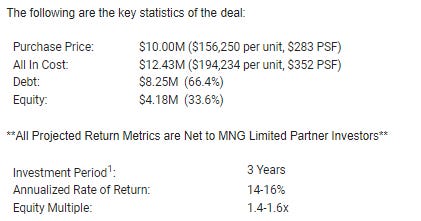

As a reader of the newsletter, we are reaching out to you to give you the first opportunity to invest in the acquisition and repositioning of Youngtown House Apartments.

The 64-unit apartment community is located in close proximity to a recent Sun Valley Apartment investment with a strategic partner. The business plan involves a similar approach of acquiring the asset at a compelling price and driving rents to market through renovations and bringing a sophisticated property management team.

This is being completed as an off-market opportunity which has been in negotiations for over a year.

We believe in the business plan for this new opportunity given the continued success we see at Sun Valley Apartments (now known as “North Edge”).

We also believe that in an inflationary environment, this business plan and product type provides one of the most compelling risk adjusted returns in private markets.

Apartment rents can be marked to market annually, and a value add opportunity vs. new construction has limited exposure to meaningful cost increases.

Our strategic partner Midtown National Group (MNG) has committed approximately three-quarters of the equity required and is offering investors the opportunity to invest up to $2,500,000 through a limited liability company MNG will create for this investment.

We are offering investors a 6% preferred return over which MNG will earn 20% of the profits thereafter.

Closing is anticipated in early May 2022, so we kindly ask for expressions of interest by April 18, 2022. After this, we will be sending the opportunity out to a much broader pool of investors.

Please let us know if we can help with any questions or if you would like to schedule a call or meeting to talk about this opportunity in more detail.

Thank you for reading and I am grateful and humbled to be able to learn, grow and invest alongside you at Tuttle Ventures.

Don’t forget to follow Tuttle Ventures on Twitter, LinkedIn or Instagram.

Check out the website or some other work here.

Best,

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Unless there is a signed Investment Management or Financial Planning Agreement by both parties, Tuttle Ventures is not acting as your financial advisor or in any fiduciary capacity.